Former banker behind chipmaker Renesas aims for value of 100 billion dollars

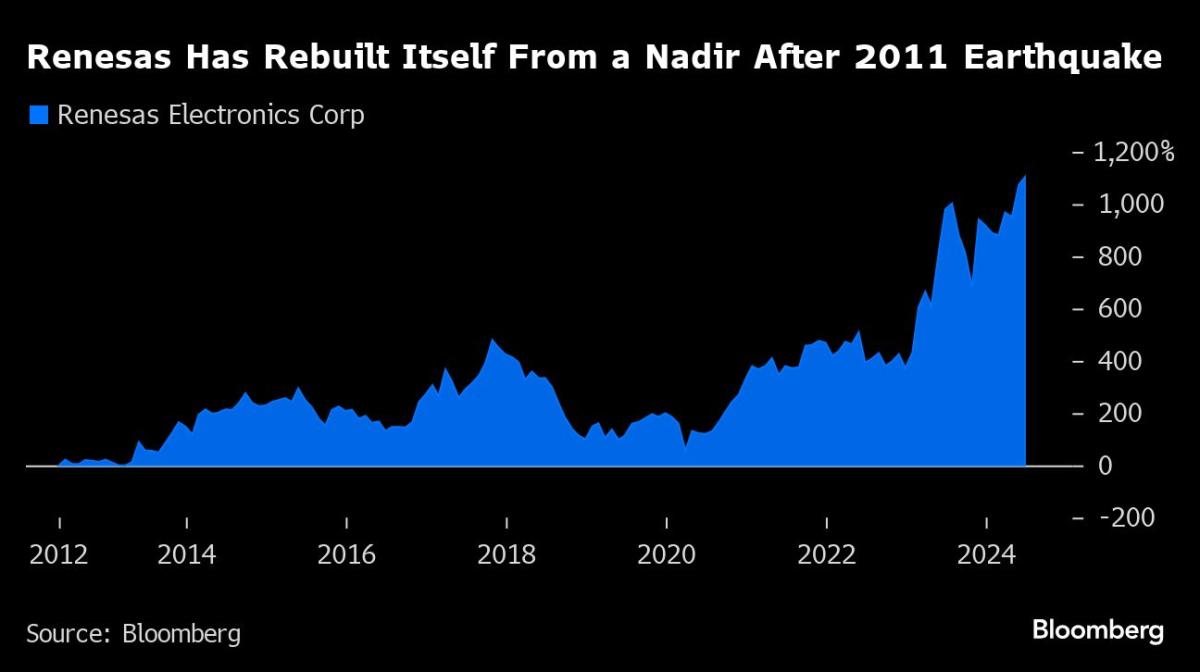

(Bloomberg) — Ten years ago, Renesas Electronics Corp. was under government control and losing money. The Japanese chipmaker is now worth $35 billion and is aiming for a market value of about $100 billion by 2030 thanks to a series of overseas acquisitions.

Most read by Bloomberg

Behind the deals is former Merrill Lynch banker Hidetoshi Shibata, who has been CEO for five years and expects new businesses in India and AI-enabled microcontrollers to help the company double its annual sales to a record $20 billion by the end of the decade. His goal of tripling the company’s valuation to 16-17 trillion yen comes as a new wave of enthusiasm for AI is driving the chipmaker’s shares behind Toyota Motor Corp., Honda Motor Co. and Nissan Motor Co. to their highest since the global financial crisis.

Renesas, which was formed from the chip divisions of NEC Corp., Hitachi Ltd. and Mitsubishi Electric Corp., was the world’s third-largest chipmaker in 2009 after Intel Corp. and Samsung Electronics Co. But its fortunes faded along with its Japanese customers. Damage to a key factory in the March 2011 earthquake in Japan prompted automakers to reduce their dependence on a single supplier, and Renesas soon had to give way to rival NXP Semiconductors NV.

Since joining the company as chief financial officer in 2013, Shibata has orchestrated a series of acquisitions. This year, Renesas announced a $6 billion deal to acquire Australian-listed software company Altium Ltd. as it looks to expand into product development and electronics design.

In 2021, the company acquired U.K.-based Dialog Semiconductor Plc for $6 billion and previously bought San Jose-based Integrated Device Technology Inc. and Milpitas, Calif.-based Intersil Corp., in part to expand beyond the automotive sector into data centers and consumer devices. Shibata has also expressed interest in compound semiconductors, which remain popular with electric vehicle makers.

“We have to be a real global player,” Shibata said in an interview last month. “It is meaningless to be a big player in Japan. We have to be at the top of the world. That is what I want to achieve.”

Its buying spree has helped Renesas reduce its domestic dependence and expand overseas. Japan accounted for 26 percent of total sales last year, compared with 44 percent in 2016. Sales to other Asian countries, as well as Europe and North America, have increased over the same period.

India, which currently accounts for only a fraction of Renesas’ revenue, will be important for future growth, according to Shibata. The company aims to generate at least 10% of its revenue in the South Asian country by the end of this decade, banking on that market’s rapidly growing demand for electronics. Renesas plans to increase its workforce in India twenty-fold to 1,000 employees by 2025.

“For about 10 years, Renesas has been steadily losing market share,” said Masaya Yamasaki, senior analyst at Nomura Securities Co. “Now they seem ready to be more aggressive – their product portfolio is quite balanced.”

Renesas’s push coincides with an aggressive campaign by Japan to turn the world’s fourth-largest economy into a chip stronghold. In less than three years, Tokyo has pledged to invest 4 trillion yen ($25 billion) in semiconductors and other advanced technologies, including 15.9 billion yen to cover a third of the cost of expanding capacity at a Renesas plant. The Tokyo government has also encouraged listed companies to take steps to improve shareholder value, with Shibata’s comments a rare example of a Japanese CEO laying out plans to boost the stock price.

According to TechInsights analyst Asif Anwar, Renesas was the second-largest automotive processor manufacturer in 2023 after NXP, followed by Infineon Technologies AG.

Renesas is integrating chiplets into its semiconductors, which lowers costs while allowing more customization, he said. The strategy is designed to help Renesas meet growing demand for chip architectures suitable for electric vehicles and self-driving and connected vehicles.

“Renesas will say they want to be number one, and so will NXP, Infineon and Qualcomm,” said Anwar. “We will see in the next three to four years how that changes over time and who emerges as the winner.”

Most read by Bloomberg Businessweek

©2024 Bloomberg L.P.

:quality(70):focal(1019x532:1029x542)/cloudfront-eu-central-1.images.arcpublishing.com/irishtimes/NMSZPPC4ERF5DAJHNJSCHO4PKY.jpg)