Adesso and two other German stocks are considered to be below the estimated value

Recent political uncertainty and economic data have led to a mixed performance in European equity markets, with the German stock index DAX down significantly. In such an environment, identifying stocks that appear undervalued relative to their fundamentals could provide potential opportunities for investors looking for value in a volatile market.

The 10 most undervalued stocks in Germany based on cash flow

|

Surname |

Current price |

Fair value (estimated) |

Discount (estimated) |

|

Kontron (XTRA:SANT) |

19,95 € |

31,54 € |

36.7% |

|

SAP (XTRA:SAP) |

176,28 € |

281,60 € |

37.4% |

|

MTU Aero Engines (XTRA:MTX) |

223,60 € |

396,68 € |

43.6% |

|

Stratec (XTRA:SBS) |

45,85 € |

79,84 € |

42.6% |

|

Verbio (XTRA:VBK) |

18,26 € |

28,74 € |

36.5% |

|

CHAPTERS Group (XTRA:CHG) |

23,80 € |

44,54 € |

46.6% |

|

SBF (DB:CY1K) |

2,84 € |

5,22 € |

45.6% |

|

Redcare Pharmacy (XTRA:RDC) |

115,60 € |

197,69 € |

41.5% |

|

Your family entertainment (DB:RTV) |

2,40 € |

4,08 € |

41.1% |

|

Dr. Hönle (XTRA:HNL) |

19,90 € |

33,17 € |

40% |

Click here to see the full list of 29 stocks from our Undervalued German Stocks Based on Cash Flows screener.

Here’s a look at some of the choices from the screener

Overview: adesso SE, an internationally active company focusing on IT services primarily in Germany, Austria and Switzerland, has a market capitalization of around EUR 588.78 million.

Operations: The company generates its revenue mainly in two segments: IT services with 1.31 billion euros and IT solutions with 119.88 million euros.

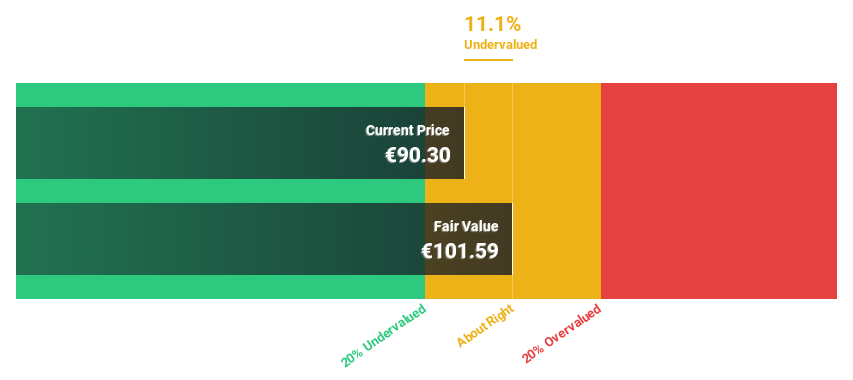

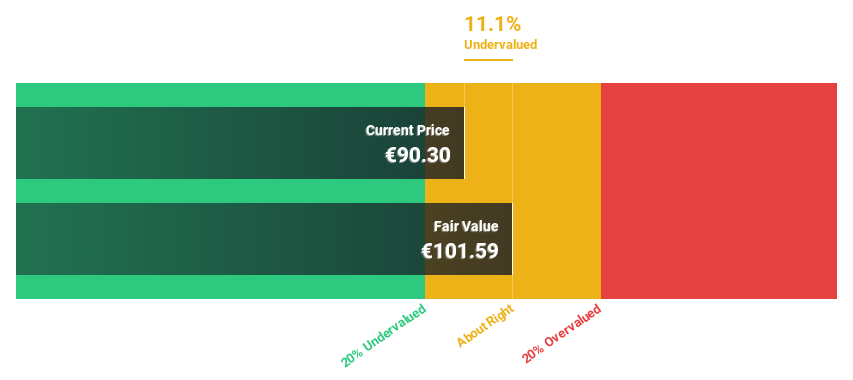

Estimated discount to fair value: 11.1%

Adesso SE, a German technology company, is currently trading at €90.3 million, which is 11.1% below our calculated fair value of €101.59. Despite a significant decline in net profit from €28.6 million to €3.21 million in the last financial year, adesso’s revenue growth prospects appear robust with an expected increase of 11.9% per year – beating the German market’s forecast of 5.1%. However, adesso’s ability to cover interest payments with profits remains weak, suggesting some financial vulnerabilities despite the favorable growth prospects and undervaluation based on cash flows.

Overview: MBB SE is primarily active in the technology and engineering sectors and focuses on the acquisition and management of medium-sized companies worldwide. The market capitalization is around 0.61 billion euros.

Operations: MBB SE generates sales revenues in three main segments: Consumer Goods (€94.23 million), Technical Applications (€378.50 million) and Service & Infrastructure (€487.10 million).

Estimated discount to fair value: 12.7%

MBB SE trades at €107.2 below our estimated fair value of €122.79, reflecting a slight undervaluation based on cash flows. The latest financials show a recovery, with net profit turning from a loss to €5.77 million in Q1 2024 and annual earnings growth reaching 63.9%. Despite these gains, MBB’s forecast return on equity remains low at 9.6% over three years. However, revenue and profit are expected to outperform the German market, with forecasts of 7.1% and 33.5% growth per year, respectively.

Overview: Redcare Pharmacy NV is an online pharmacy operating in the Netherlands, Germany, Italy, Belgium, Switzerland, Austria and France with a market capitalization of around EUR 2.35 billion.

Operations: The company generates 1.62 billion euros in the DACH region and 0.37 billion euros internationally.

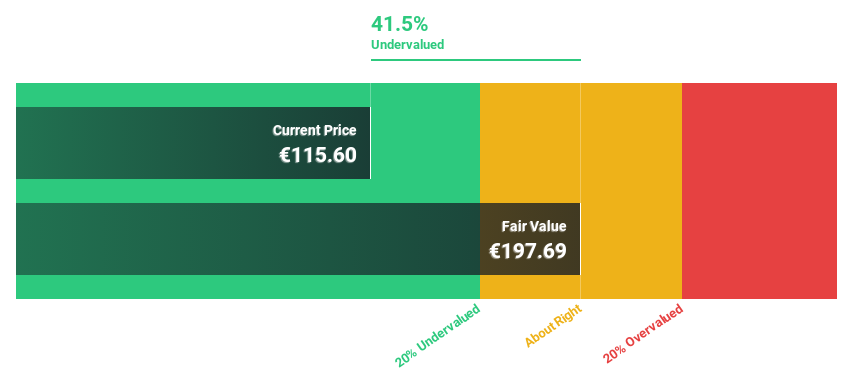

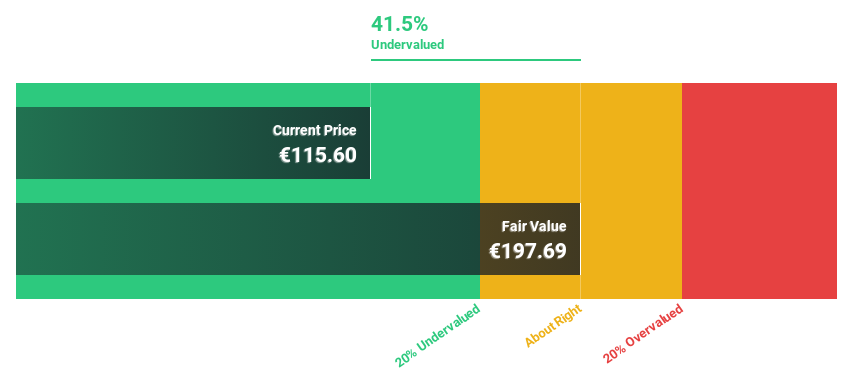

Estimated discount to fair value: 41.5%

Redcare Pharmacy is trading at a current price of €115.6, well below our fair value estimate of €197.69, suggesting severe undervaluation based on cash flows. Despite a reduction in net loss in Q1 2024 to €7.81 million from €10.22 million last year and an increase in revenues to €560.22 million, profitability is expected within three years, with earnings expected to grow at 46.89% annually. However, the forecast revenue growth of 17% per year falls short of the desired 20%, and shareholder dilution occurred last year.

Seize the opportunity

Are you looking for alternative options?

This Simply Wall St article is of a general nature. We provide commentary based solely on historical data and analyst forecasts, using an unbiased methodology. Our articles are not intended as financial advice. They do not constitute a recommendation to buy or sell stocks, and do not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.

Companies discussed in this article include XTRA:ADN1XTRA:MBB XTRA:RDC

Do you have feedback on this article? Are you interested in the content? Contact us directly. Alternatively, send an email to [email protected]