July 2024 Insight into Indian stocks that are valued below their value

The Indian stock market has shown robust growth, rising 44% in the last 12 months and gaining 1.1% in the last week alone. Earnings are expected to grow at 16% annually. In such a thriving market, identifying potentially undervalued stocks could provide investors with a unique opportunity for value investing.

Top 10 undervalued stocks in India based on cash flows

|

Surname |

Current price |

Fair value (estimated) |

Discount (estimated) |

|

Updater Services (NSEI:UDS) |

297,25 € |

477,81 € |

37.8% |

|

IOL Chemicals and Pharmaceuticals (BSE:524164) |

403,65 € |

574,52 € |

29.7% |

|

Vedanta (NSEI:VEDL) |

€ 454,00 |

635,30 € |

28.5% |

|

Strides Pharma Science (NSEI:STAR) |

948,85 € |

1,520.38 € |

37.6% |

|

Mahindra Logistics (NSEI:MAHLOG) |

525,05 € |

800,49 € |

34.4% |

|

TV18 broadcast (NSEI:TV18BRDCST) |

41,18 € |

69,41 € |

40.7% |

|

PVR INOX (NSEI:PVRINOX) |

1,427.35 € |

2,229.08 € |

36% |

|

Delhivery (NSEI:DELHIVERY) |

400,15 € |

604,58 € |

33.8% |

|

Camlin Fine Sciences (BSE:532834) |

103,22 € |

155,05 € |

33.4% |

|

Godrej Properties (NSEI:GODREJPROP) |

3207,90 € |

4589,46 € |

30.1% |

Click here to see the full list of 16 stocks from our Undervalued Indian Stocks Based on Cash Flows screener.

We will look at some of the best tips from our screener tool

Overview: Fusion Micro Finance Limited is a non-banking finance company in India that provides microfinance loans to women entrepreneurs in rural and suburban areas. Its market capitalization is around Rs 45.15 billion.

Operations: The company generates revenue primarily from microfinance activities totaling approximately Rs 12,570 crore.

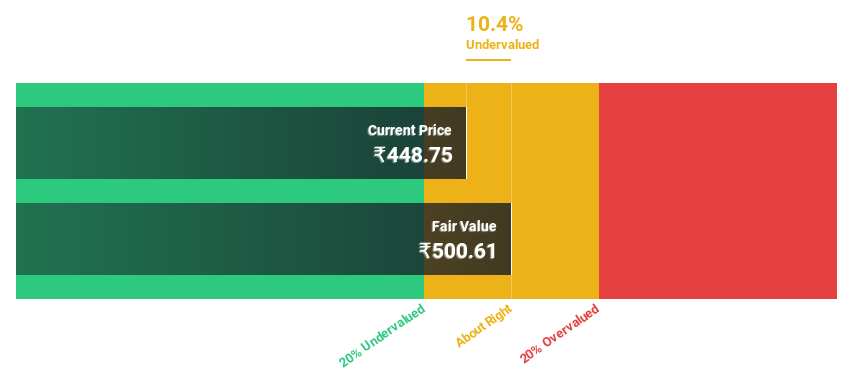

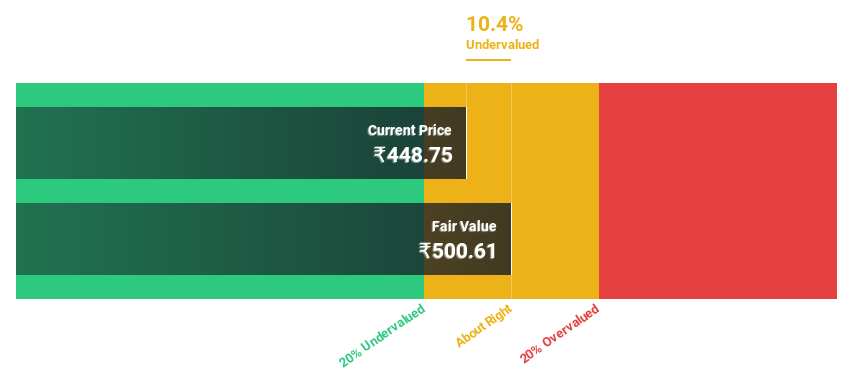

Estimated discount to fair value: 10.4%

Fusion Micro Finance, now Fusion Finance Limited, trades at ₹448.75 per cent, below its estimated fair value of ₹500.61 per cent, which represents an undervaluation of 10.4% based on a discounted cash flow analysis. Despite robust revenue growth forecasts of 24.9% annually – outperforming the Indian market at 9.6% – the company’s debt is barely covered by operating cash flow and return on equity is expected to be modest at 19.3%. Recent regulatory challenges and significant insider selling could pose risks, although the company has shown strong earnings growth over the past five years.

Overview: Godrej Properties Limited is primarily engaged in real estate construction and development in India and has a market capitalization of approximately Rs 891.98 billion.

Operations: The company’s revenues are mainly derived from real estate construction and development, totaling approximately Rs 29.95 billion, with a smaller contribution of Rs 0.41 billion coming from the hospitality sector.

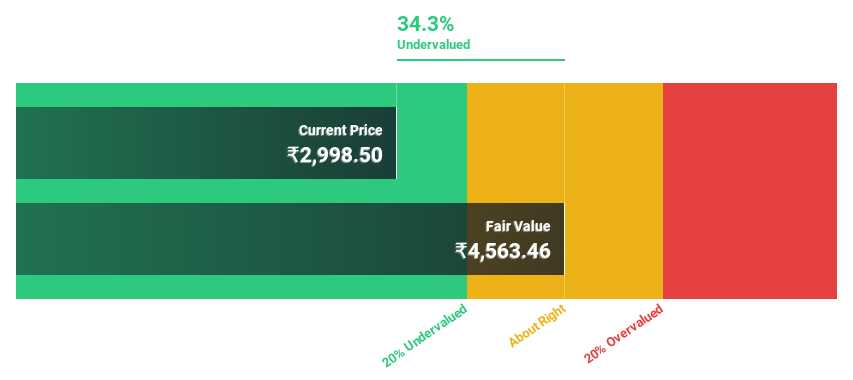

Estimated discount to fair value: 30.1%

Godrej Properties Limited is undervalued by more than 20% at ₹3207.9 compared to a fair value of ₹4589.46 based on cash flow analysis. Despite challenges such as debt that is not well covered by operating cash flow, the company is showing promising results with a projected annual earnings growth of 35.7%, easily beating the Indian market forecast of 15.8%. Recent financials indicate robust year-on-year growth in net profit and sales volumes, underscoring its potential despite competitive pressures.

Overview: Mahindra Logistics Limited is an integrated logistics and mobility solutions provider in India and internationally and has a market capitalization of approximately Rs 37,830 crore.

Operations: The company’s revenue is mainly generated from two segments: Supply Chain Management at ₹51.78 billion and Enterprise Mobility Services at ₹3.28 billion.

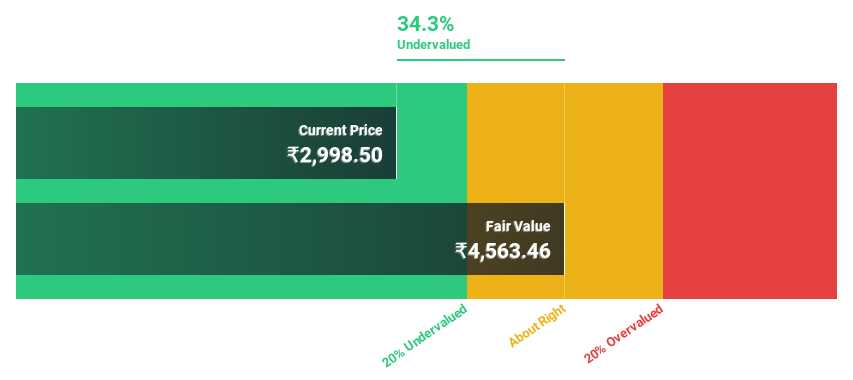

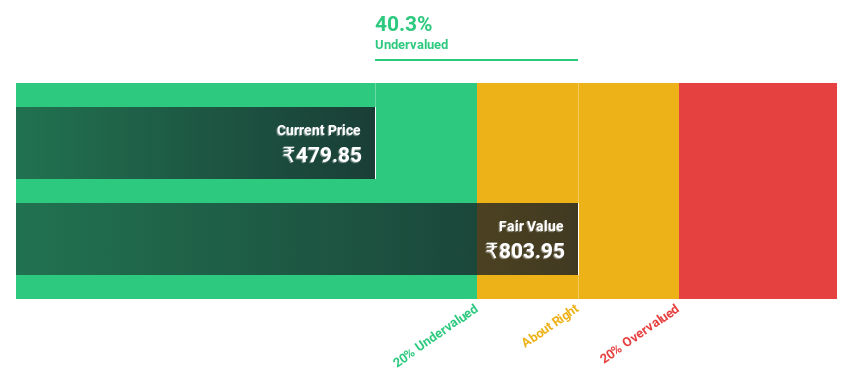

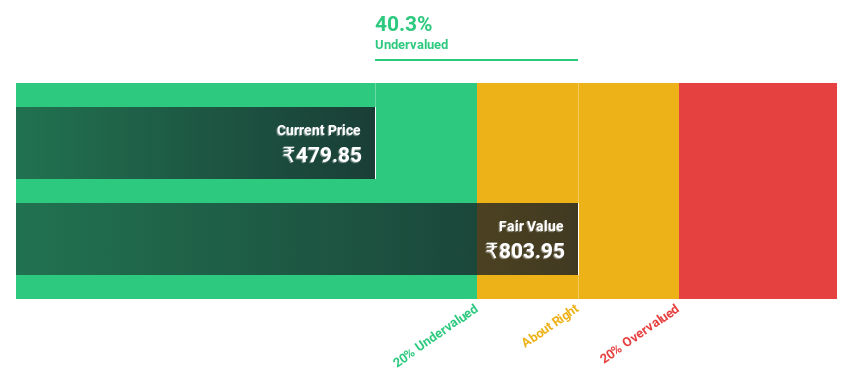

Estimated discount to fair value: 34.4%

Mahindra Logistics is significantly undervalued at ₹525.05, with an estimated fair value of ₹800.49, by more than 20%. Despite a difficult financial year marked by a net loss of INR547.4 million and weak profit coverage for dividends, the company’s strategic joint venture to enhance warehousing and transportation services shows potential for market expansion in India. Analysts forecast improving profitability and revenue growth faster than the Indian market average, indicating recovery prospects.

The central theses

Looking for other investments?

This Simply Wall St article is of a general nature. We provide commentary based solely on historical data and analyst forecasts, using an unbiased methodology. Our articles are not intended as financial advice. They do not constitute a recommendation to buy or sell stocks, and do not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.

Companies discussed in this article include NSEI:FUSION, NSEI:GODREJPROP and NSEI:MAHLOG.

Do you have feedback on this article? Are you interested in the content? Contact us directly. Alternatively, send an email to [email protected]