Top 3 Value Stock Picks on the Japanese Stock Exchange in June 2024

Amid a mixed performance in Japanese markets, with the Nikkei 225 index posting modest gains while the broader TOPIX index posted slight declines, investors continue to navigate an environment marked by cautious optimism and strategic adjustments by the Bank of Japan. In this context, identifying undervalued stocks on the Japanese stock market could offer potential opportunities for those looking to capitalize on discrepancies between market price and intrinsic value in June 2024.

The 10 most undervalued stocks in Japan based on cash flows

| Surname | Current price | Fair value (estimated) | Discount (estimated) |

| Connection and Motivation (TSE:2170) | ¥471.00 | 896.26 ¥ | 47.4% |

| FP Partners (TSE:7388) | 2605.00 ¥ | ¥5067.34 | 48.6% |

| Hodogaya Chemical (TSE:4112) | ¥5930.00 | ¥11,521.06 | 48.5% |

| Plus Alpha Consulting Ltd (TSE:4071) | ¥1842.00 | ¥3562.58 | 48.3% |

| Cyber Security Cloud (TSE:4493) | 2092.00 ¥ | 4099.45 ¥ | 49% |

| NIHON CHOUZAIL Ltd (TSE:3341) | 1450.00 ¥ | 2789.24 ¥ | 48% |

| Members (TSE:2130) | 900.00 ¥ | 1717,73 ¥ | 47.6% |

| Macromill (TSE:3978) | 892.00 ¥ | 1692.39 ¥ | 47.3% |

| Kanto Denka Kogyo (TSE:4047) | 977.00 ¥ | 1950.27 ¥ | 49.9% |

| free KK (TSE:4478) | 2297,00 ¥ | ¥4454.95 | 48.4% |

Click here to see the full list of 103 stocks from our Undervalued Japanese Stocks Based on Cash Flows screener.

Let’s dive into some of the best options from the screener

Overview: UT Group Co., Ltd. operates in Japan and focuses on the deployment and outsourcing of permanent employees in various industries, including manufacturing and construction. Its market capitalization is approximately 119.30 billion yen.

Operations: The company generates revenue from several key segments: area business (63.52 billion yen), overseas business (10.91 billion yen), solution business (17.89 billion yen), engineering business (9.30 billion yen), and manufacturing business excluding solution business (65.46 billion yen).

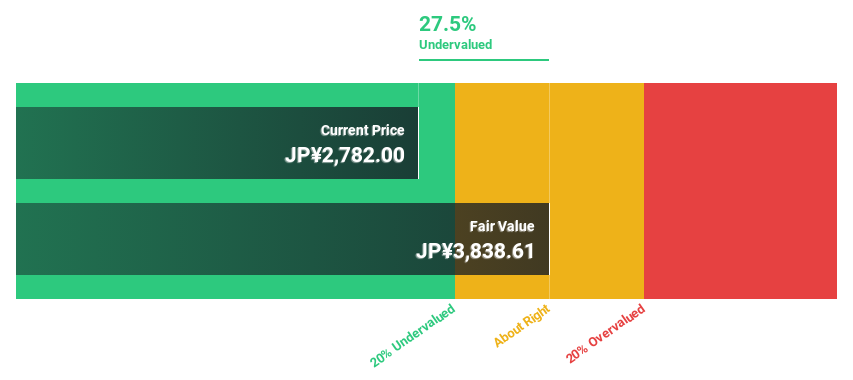

Estimated discount to fair value: 13%

UT Group Ltd. is trading below its estimated fair value of 3,005 yen (compared to fair value of 3,452.1 yen) and has potential as an undervalued stock based on cash flow analysis. Although a dividend yield of 5.48% is not well covered by cash flows, the company’s earnings have grown 66% over the past year and are expected to grow 23.94% annually. Recent initiatives such as the launch of a new career support service through JOBPAL indicate strategic moves to improve the business model amid management changes, including a shift in director roles and changes to the company’s charter to improve decision-making processes.

Overview: Kotobuki Spirits Co., Ltd. is a Japanese company that manufactures and sells candy. Its market capitalization is around 286.37 billion yen.

Operations: The company generates its revenue primarily through the production and sale of sweets in Japan.

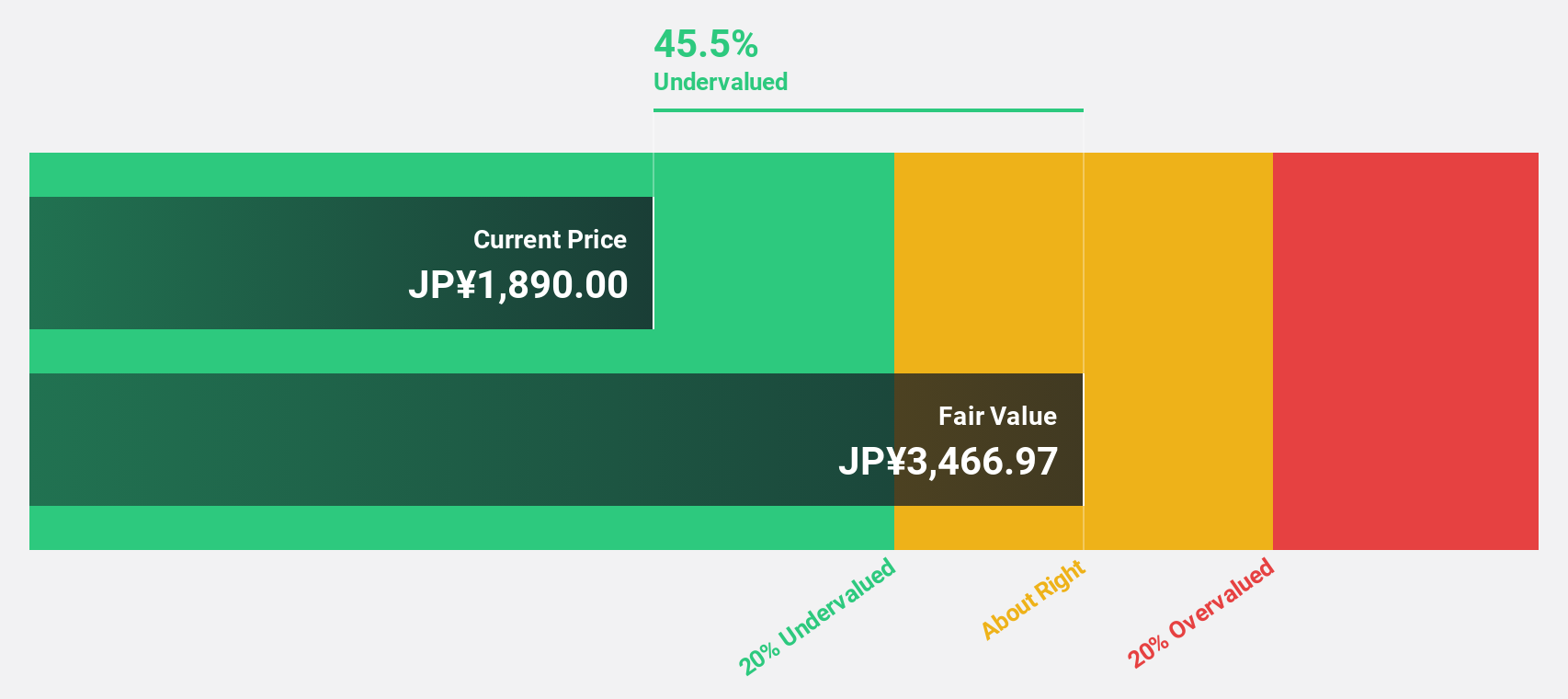

Estimated discount to fair value: 11.4%

Kotobuki Spirits Co., Ltd. is trading below its estimated fair value of ¥1840.5, with the calculated fair value being ¥2078.16, indicating a potential undervaluation based on cash flows. The company’s earnings have shown a strong increase of 54.3% over the past year and are expected to grow at an annual rate of 13.75%, outpacing the average growth rate of the Japanese market. Analysts forecast that the share price could increase by 49.8%, supported by consistent dividend payments and a solid financial forecast for the coming fiscal years, including expected net sales of JPY70 billion and profit attributable to owners of JPY11.8 billion for the fiscal year ending March 2025.

Overview: Relo Group, Inc. operates in Japan and provides property management services with a market capitalization of approximately 262.28 billion yen.

Operations: The company generates its revenue mainly in three segments: the moving business (92.67 billion yen), social services (25.32 billion yen) and tourism (14.16 billion yen).

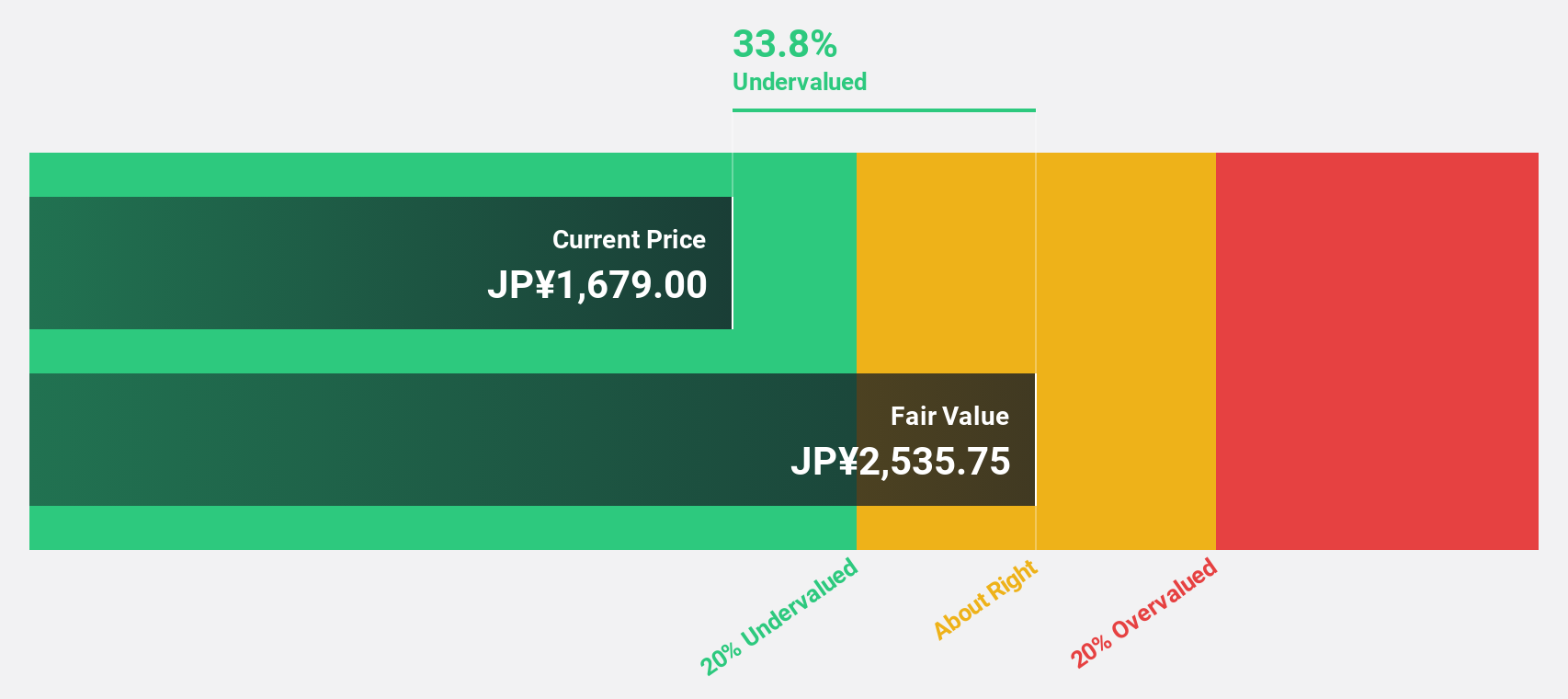

Estimated discount to fair value: 20.9%

Relo Group is considered undervalued at 1716 yen, its fair value is 2168.63 yen, which represents a significant discount. Despite the high debt and volatile share price, the company’s earnings are expected to grow 35.52% annually. Analysts forecast the share price to rise 20.9%. Recent improvements in corporate governance are aimed at strengthening oversight and attracting qualified executives, which could boost investor confidence and corporate performance in the long term.

Take advantage

Interested in other options?

This Simply Wall St article is of a general nature. We provide commentary based solely on historical data and analyst forecasts, using an unbiased methodology. Our articles are not intended as financial advice. They do not constitute a recommendation to buy or sell stocks, and do not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.

Valuation is complex, but we help simplify it.

Find out if Relo Group may be over- or undervalued by checking our comprehensive analysis which includes Fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View free analysis

Do you have feedback on this article? Are you interested in the content? Contact us directly. Alternatively, send an email to [email protected]