Kuaishou Technology and two other SEHK stocks potentially trading below their estimated true value

Against a backdrop of volatile global markets, the Hong Kong Stock Exchange reflected this volatility, recording significant declines in major indices such as the Hang Seng. In such an environment, it is particularly important to identify potentially undervalued stocks, as these could represent opportunities for investors looking for potential amid uncertainty.

Top 10 undervalued stocks in Hong Kong based on cash flows

|

Surname |

Current price |

Fair value (estimated) |

Discount (estimated) |

|

Plover Bay Technologies (SEHK:1523) |

HK$3.10 |

HK$5.72 |

45.8% |

|

Kuaishou Technology (SEHK:1024) |

HK$52.20 |

HK$98.81 |

47.2% |

|

Gaush Meditech (SEHK:2407) |

HK$14.00 |

HK$26.16 |

46.5% |

|

Zijin Mining Group (SEHK:2899) |

HK$16.54 |

HK$29.15 |

43.3% |

|

Innovent Biologics (SEHK:1801) |

HK$38.15 |

HK$67.13 |

43.2% |

|

Melco International Development (SEHK:200) |

HK$5.85 |

HK$11.38 |

48.6% |

|

REPT BATTERO Energy (SEHK:666) |

HK$14.40 |

HK$27.25 |

47.2% |

|

Zhaojin Mining Industry (SEHK:1818) |

13.64HK$ |

HK$25.11 |

45.7% |

|

Zylox-Tonbridge Medical Technology (SEHK:2190) |

HK$10.78 |

HK$19.06 |

43.5% |

|

CGN Mining (SEHK:1164) |

HK$2.71 |

HK$4.86 |

44.3% |

Click here to see the full list of 44 stocks from our Undervalued SEHK Stocks Based on Cash Flows screener.

Let’s dive into some of the best options from the screener

Overview: Kuaishou Technology is an investment holding company in China that provides services such as live streaming and online marketing and has a market capitalization of around HK$226.26 billion.

Operations: The company generates its revenue mainly from domestic sources, totaling CNY 114.72 billion, and a smaller portion from overseas activities, amounting to CNY 2.94 billion.

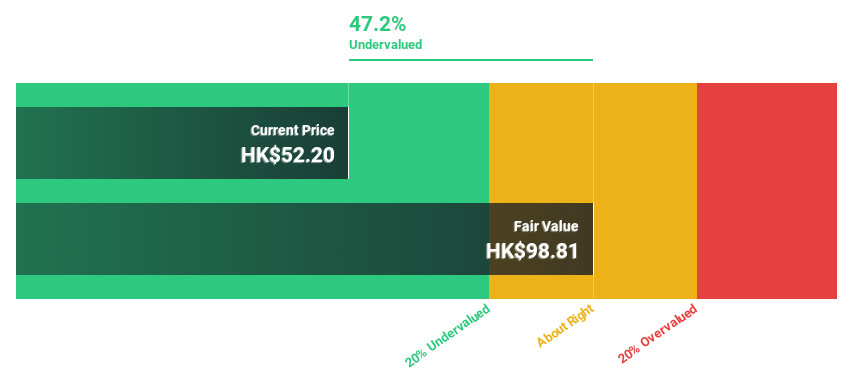

Estimated discount to fair value: 47.2%

Kuaishou Technology trades well below our estimated fair value of HK$98.81 at a current share price of HK$52.2, suggesting potential undervaluation based on cash flows. Recent corporate actions include a large-scale share buyback program valued at HK$16 billion and changes to the company’s charter to improve operational flexibility. Financially, Kuaishou has made the transition from a loss to a net profit of CNY4,119 million in the first quarter of 2024, with analysts forecasting strong earnings growth and favorable comparisons to industry peers.

Overview: China Resources Mixc Lifestyle Services Limited is an investment holding company that provides property management and commercial operation services throughout the People’s Republic of China and has a market capitalization of approximately HK$64.14 billion.

Operations: The company generates revenue from residential property management services totaling CNY 9.60 billion and from commercial operations and property management services totaling CNY 5.17 billion.

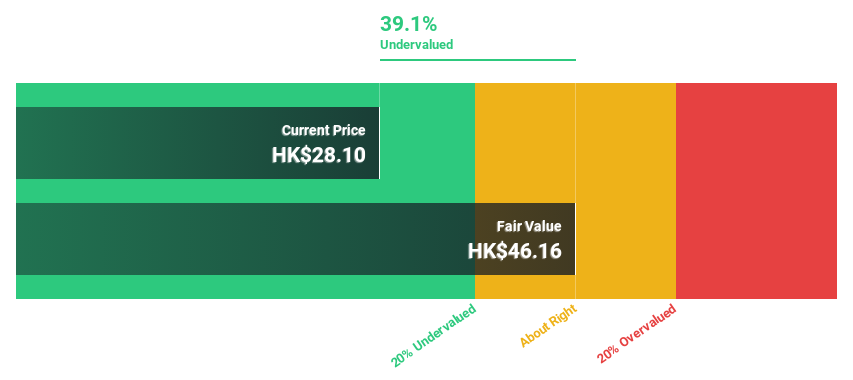

Estimated discount to fair value: 39.1%

China Resources Mixc Lifestyle Services appears undervalued at HK$28.1, with our fair value estimate at HK$46.16, a significant discount. The company’s earnings have grown 32.8% over the past year and are expected to grow 17.54% annually, outpacing the Hong Kong market at 11.7%. In addition, its revenue growth forecast of 16.9% also exceeds the local market average of 7.8%. Recent company developments include a dividend increase and leadership changes that could impact corporate governance and operational efficiency in the future.

Overview: Weimob Inc. is an investment holding company that provides digital commerce and marketing services in the People’s Republic of China and has a market capitalization of approximately HK$4.86 billion.

Operations: The company generates its revenue mainly in two segments: Merchant Solutions with CN¥878.28 million and Subscription Solutions with CN¥1.35 billion.

Estimated discount to fair value: 12.8%

Weimob trades at HK$1.58, below its calculated fair value of HK$1.81, suggesting a potential undervaluation based on cash flows. Despite a very volatile share price of late, its revenue growth forecast of 12.7% per annum exceeds the Hong Kong market average of 7.8%. However, shareholders have been diluted over the past year and return on equity is expected to remain low at 7.4% in three years. Recent activity includes a follow-on offering of HK$313.01 million and changes to the company’s charter to improve governance structures.

Take advantage

-

Click through to explore the remaining 41 SEHK stocks undervalued based on cash flows now.

-

Are you interested in these stocks? Improve your management by using the Simply Wall St portfolio, which offers intuitive tools to help you optimize your investment results.

-

Optimize your investment strategy for free with the Simply Wall St app and benefit from comprehensive research on stocks from all over the world.

Curious about other options?

This Simply Wall St article is of a general nature. We provide commentary based solely on historical data and analyst forecasts, using an unbiased methodology. Our articles are not intended as financial advice. They do not constitute a recommendation to buy or sell stocks, and do not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.

Companies discussed in this article include SEHK:1024SEHK:1209 and SEHK:2013.

Do you have feedback on this article? Are you interested in the content? Contact us directly. Alternatively, send an email to [email protected]

)