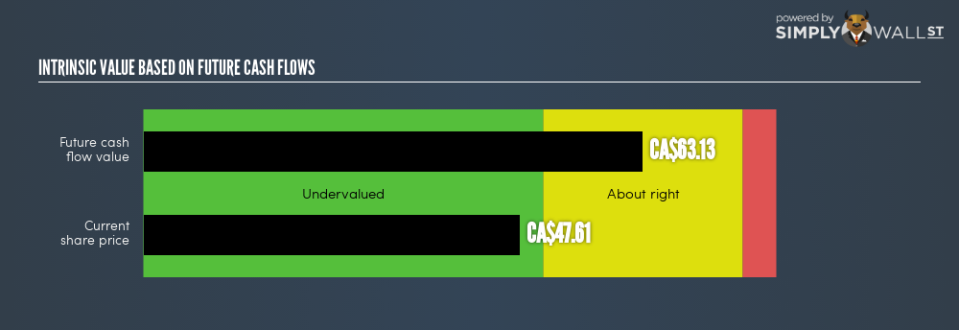

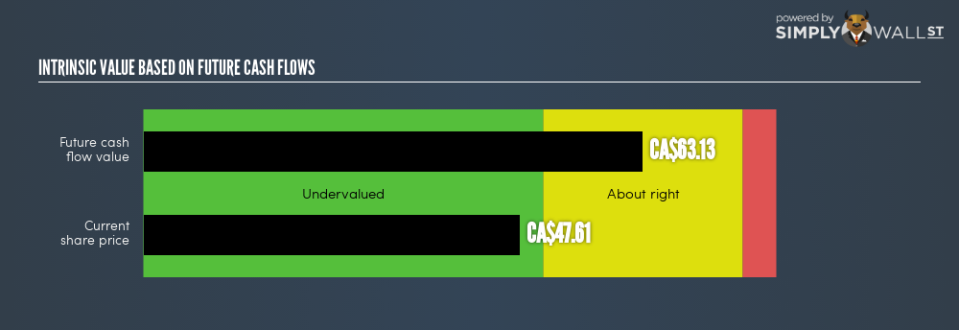

Investors undervalue Laurentian Bank of Canada (TSE:LB) by 24.58%

Valuing bank stocks like LB is particularly challenging. Since these companies are subject to different rules compared to other companies, their cash flows must also be valued differently. For example, banks must hold certain amounts of capital in order to have a safe cash cushion. To determine the true value of LB, it can be useful to look at factors such as book value in combination with the return and cost of equity. Today I’ll show you how to value LB in a reasonably accurate and straightforward way.

Check out our latest analysis on Laurentian Bank of Canada

Why the excess return model?

We should keep two things in mind – regulation and type of assets. The regulatory environment in Canada is quite strict. In addition, banks typically do not hold significant amounts of physical assets compared to their total assets. Therefore, the excess returns model is better suited to determine LB’s intrinsic value than the traditional discounted cash flow model, which emphasizes factors such as depreciation and capital expenditures.

Derivation of the intrinsic value of LB

The central idea behind excess returns is that the equity value is the amount the company can earn over and above its cost of equity, given the current amount of equity. The returns that exceed the cost of equity are called excess returns:

Excess return per share = (Stable return on equity – cost of equity) (Book value of equity per share)

= (10.83% – 10.00%) x CA$56.94 = CA$0.47

We use this value to calculate the company’s terminal value, which is the amount we expect the company to earn each year forever. This is a common component of discounted cash flow models:

Final value per share = excess return per share / (cost of equity – expected growth rate)

= CA$0.47 / (10.00% – 2.34%) = CA$6.18

The combination of these components results in LB’s intrinsic value per share:

Value per share = book value of equity per share + terminal value per share

= CA$56.94 + CA$6.18 = CA$63.13

This results in an intrinsic value of CA$63.13. Compared to today’s price of CA$47.61, LB’s price is currently below its true value. So if you bought LB at CA$63.13, there is an opportunity to profit from a mispricing. Valuation is only one part of your investment analysis to decide whether to buy or sell LB. There are other important factors to consider when assessing whether LB is the right investment for your portfolio.

Next Steps:

For banks, there are three important aspects to consider:

-

Financial health: Is the balance sheet healthy? Take a look at our free bank analysis with six simple checks on things like non-performing loans and customer deposits.

-

Future earnings: What does the market think about the future of LB? Our chart with analyst growth expectations helps visualize LB’s growth potential in the coming years.

-

Dividends: Most people buy financial stocks for their healthy and stable dividends. Find out if LB is a dividend rockstar with our historical and future dividend analysis.

For more details and sources, see our full LB calculation here.

To help our readers look beyond the short-term volatility of the financial market, we aim to provide you with long-term focused research analysis based solely on fundamental data. Please note that our analysis does not take into account the latest price-sensitive company announcements.

The author is an independent writer and had no ownership interest in any stocks mentioned at the time of publication. If you find any errors that need to be corrected, please contact the editor at [email protected].