Codan and two other ASX stocks are below estimated value

The Australian share market has shown modest activity recently, remaining flat last week but gaining 6.2% over the past year, with earnings expected to grow 14% annually. In this context, identifying stocks trading below their estimated value could present attractive opportunities for investors looking for potential growth in an ever-growing market.

The 10 most undervalued stocks in Australia based on cash flows

|

Surname |

Current price |

Fair value (estimated) |

Discount (estimated) |

|

LaserBond (ASX:LBL) |

0.695 € |

1.21 A$ |

42.4% |

|

Smart Parking (ASX:SPZ) |

0,48 € |

0,96 € |

49.9% |

|

COSOL (ASX:COS) |

1.25 A$ |

2,43 € |

48.6% |

|

MaxiPARTS (ASX:MXI) |

1,88 € |

3,13 € |

40% |

|

Charter Hall Group (ASX:CHC) |

12,44 € |

22,79 € |

45.4% |

|

ReadyTech Holdings (ASX:RDY) |

3,22 € |

5,96 € |

45.9% |

|

Mader Group (ASX:MAD) |

6,51 € |

12,62 € |

48.4% |

|

hipages Group Holdings (ASX:HPG) |

1,035 € |

1,94 € |

46.7% |

|

IPH (ASX:IPH) |

6,16 € |

11,35 € |

45.7% |

|

Millennium Services Group (ASX:MIL) |

1,145 € |

2,24 € |

48.9% |

Click here to see the full list of 49 stocks from our Undervalued ASX Stocks Based on Cash Flows screener.

Let’s take a closer look at some of our favorites from the reviewed companies

Overview: Codan Limited specialises in developing technology solutions for a broad range of clients, including United Nations organisations, mining companies and security forces, and has a market capitalisation of approximately A$2.07 billion.

Operations: The company generates its revenue primarily from the communications and metal detection sectors, generating A$291.50 million and A$212.20 million respectively.

Estimated discount to fair value: 24.5%

Codan, currently trading at AUD$11.42, appears to be undervalued by over 20% compared to its estimated fair value of AUD$15.13 based on discounted cash flows. The company’s return on equity is expected to be a solid 21.5% over three years, beating the Australian market forecast of 5.4%. With forecast earnings growth of 16.2% annually, Codan’s growth curve exceeds the average market forecast of 13.7%, highlighting its potential, although not significantly above the 20% growth threshold.

Overview: Mader Group Limited is a contracting company providing specialised engineering services to the mining, energy and industrial sectors both in Australia and internationally and has a market capitalisation of approximately A$1.30 billion.

Operations: The company generates revenue of AUD 702.87 million primarily from staffing and outsourcing services.

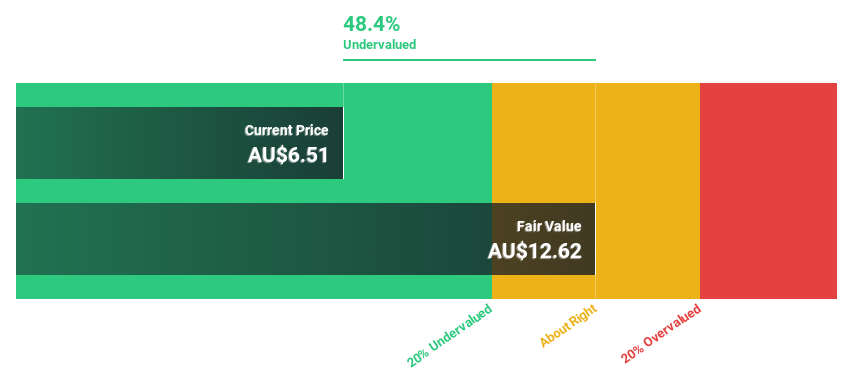

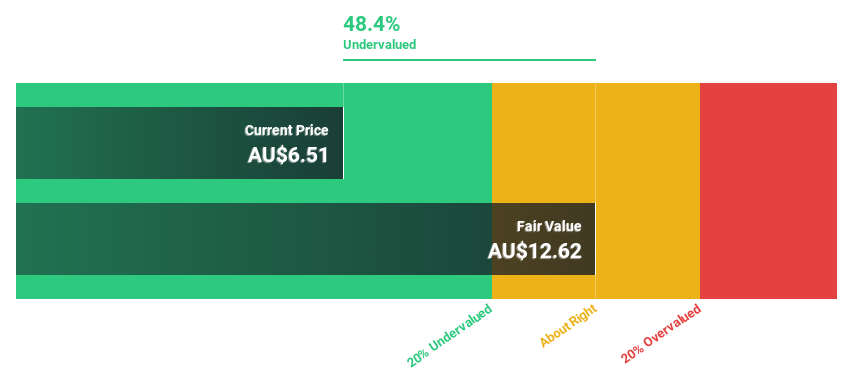

Estimated discount to fair value: 48.4%

Mader Group is significantly undervalued at AUD 6.51. The DCF-based fair value estimate is AUD 12.62, which represents an undervaluation of 48.4%. Earnings growth is expected to be robust at 17.56% annually, outperforming the Australian market average of 13.7%. In addition, Mader’s revenue growth forecast of 15.3% annually exceeds the general market forecast of 5.4%. This underlines the company’s potential in a competitive environment, despite not achieving extremely high growth rates.

Overview: South32 Limited is a diversified metals and mining company with operations in several countries including Australia, India and the United States and a market capitalization of approximately A$16.52 billion.

Operations: South32’s revenues mainly come from Hillside Aluminium with A$1.72 billion, followed by Illawarra Metallurgical Coal with A$1.36 billion, Worsley Alumina with A$1.36 billion and other segments including Mozal Aluminium (A$801 million), Sierra Gorda (A$649 million), Australia Manganese (A$651 million), Cannington (A$588 million), Cerro Matoso (A$541 million), South Africa Manganese (A$321 million), Brazil Alumina (A$443 million) and Brazil Aluminium (BA) with A$210 million.

Estimated discount to fair value: 40%

South32 currently trades at A$3.66, 40% below its estimated fair value of A$6.1, suggesting a significant undervaluation on a discounted cash flow basis. South32 is expected to be profitable within three years, and its forecast revenue growth rate of 7.5% per annum is above the Australian market average of 5.4%. However, its forecast return on equity over three years is relatively low at 10.9%, somewhat dampening optimism about future financial performance.

Turning ideas into action

Interested in other options?

This Simply Wall St article is of a general nature. We provide commentary based solely on historical data and analyst forecasts, using an unbiased methodology. Our articles are not intended as financial advice. They do not constitute a recommendation to buy or sell stocks, and do not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.

Companies discussed in this article include ASX:CDA, ASX:MAD and ASX:S32.

Do you have feedback on this article? Are you interested in the content? Contact us directly. Alternatively, send an email to [email protected]