Adriatic Metals and two other ASX stocks are considered to be below estimated market value

The Australian stock market has shown a stable performance, rising 8.9% over the past year, with annual earnings growth forecast at 14%. In this context, identifying stocks trading below their estimated market value could provide potential opportunities for investors looking to capitalize on current market conditions.

The 10 most undervalued stocks in Australia based on cash flows

|

Surname |

Current price |

Fair value (estimated) |

Discount (estimated) |

|

Smart Parking (ASX:SPZ) |

0.485 A$ |

0,96 € |

49.2% |

|

COSOL (ASX:COS) |

1,24 € |

2,43 € |

49% |

|

Charter Hall Group (ASX:CHC) |

11,69 € |

22,35 € |

47.7% |

|

Number (ASX:CUP) |

0.555 A$ |

1.10 A$ |

49.7% |

|

ReadyTech Holdings (ASX:RDY) |

3,24 € |

5,97 € |

45.7% |

|

hipages Group Holdings (ASX:HPG) |

1,08 € |

1,94 € |

44.5% |

|

Regal Partners (ASX:RPL) |

3,21 € |

6,19 € |

48.1% |

|

IPH (ASX:IPH) |

6,30 € |

11,40 € |

44.7% |

|

Millennium Services Group (ASX:MIL) |

1,145 € |

2,24 € |

48.9% |

|

Treasury Wine Estates (ASX:TWE) |

12,48 € |

21,87 € |

42.9% |

Click here to see the full list of 47 stocks from our Undervalued ASX Stocks Based on Cash Flows screener.

Let’s take a closer look at some of our favorites from the reviewed companies

Overview: Adriatic Metals PLC is engaged in the exploration and development of precious and base metals and has a market capitalization of approximately A$1.28 billion.

Operations: The company focuses on the exploration and development of precious and base metals.

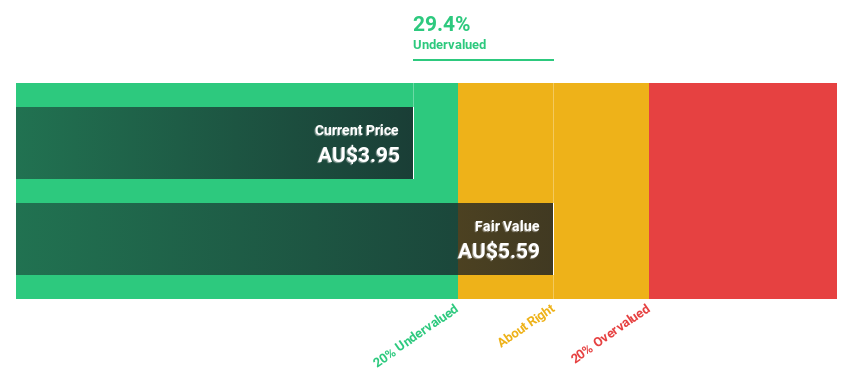

Estimated discount to fair value: 29.4%

Adriatic Metals currently trades at A$3.95 and is considered undervalued with an estimated fair value of A$5.59 based on discounted cash flow analysis, representing a significant discount of 29.4%. Although the company has less than US$1 million in revenue, the future of the company looks promising. Expected annual revenue growth is 36.6% and earnings forecasts suggest profitability within three years, significantly exceeding average market expectations. However, recent shareholder dilution and management changes may make achieving these financial targets more difficult.

Overview: Lotus Resources Limited focuses on the exploration, evaluation and development of uranium deposits in Australia and Africa and has a market capitalization of approximately A$595.15 million.

Operations: The company generates its revenue primarily through the exploration, evaluation and development of uranium deposits in Australia and Africa.

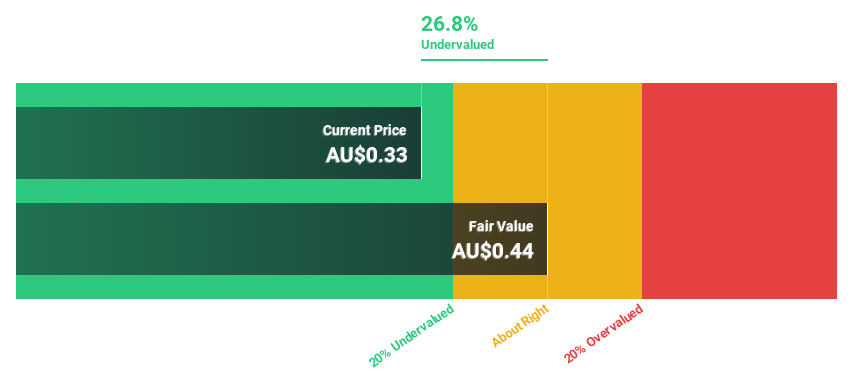

Estimated discount to fair value: 26.8%

Lotus Resources is considered undervalued at AUD 0.33, with a fair value estimate of AUD 0.44, which represents a significant discount. Despite minimal current revenues (AUD 102,000), the company is poised for significant financial improvement. Profitability is expected within three years and the expected return on equity will be very high. However, challenges such as recent shareholder dilution and no expected revenues next year could impact growth prospects.

Overview: Regal Partners Limited is a privately held hedge fund sponsor and has a market capitalization of approximately A$818.05 million.

Operations: The Company generates revenue primarily from the provision of investment management services, with total revenues of approximately A$105.28 million.

Estimated discount to fair value: 48.1%

Regal Partners Limited is currently valued at A$3.21, significantly undervalued with an estimated fair value of A$6.19. Analysts are forecasting a potential price upside of 43%, supported by expected annual earnings growth of 32.93% and revenue growth that outpaces the Australian market at 21.6% per year. Recent strategic moves include seeking acquisitions to expand scale and expertise, and a change of auditor to KPMG to gain new insights. However, current dividend coverage by earnings and cash flow is weak and profit margins have declined year-on-year.

Where to now?

Interested in other options?

This Simply Wall St article is of a general nature. We provide commentary based solely on historical data and analyst forecasts, using an unbiased methodology. Our articles are not intended as financial advice. They do not constitute a recommendation to buy or sell stocks, and do not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.

Companies discussed in this article include ASX:ADT, ASX:LOT and ASX:RPL.

Do you have feedback on this article? Are you interested in the content? Contact us directly. Alternatively, send an email to [email protected]