McDonald’s needs consistency in promoting cheap meals, says analyst

First there was the chicken sandwich war, now fast-food chains are going all-in on competing value meals. Citi director and restaurant analyst Jon Tower joins Market Domination to discuss how he envisions these value meal strategies succeeding for the competing brands, which now include McDonald’s (MCD), Wendy’s (WEN), Restaurant Brands International’s (QSR) Burger King and Yum! Brands’ (YUM) Taco Bell.

“Many of them have now reached reasonable goals in terms of advertising, timing and type of advertising. And I think that should drive traffic,” Tower says of the relationship between franchisees and franchisors.

Click here to watch the full episode of Market Domination for more expert insights and information on current market events.

This article was written by Luke Carberry Mogan.

Read more of Yahoo Finance’s coverage of the latest fast-food meals:

Are consumers responding to the new low-cost fast food options?

Fast-food chains are betting on value this summer. Will it be enough to boost their flagging stocks?

McDonald’s offers $5 meals on menus as Golden Arches tries to win back customers

Taco Bell joins the trend of inexpensive fast food meals

McDonald’s officially adds a $5 meal to its menu

UBS maintains McDonald’s “Buy” rating and points to the increase in Value Meals

The key to quality meals: Don’t sacrifice quality for price

Fast food companies compete for the cheapest meal

Video transcript

KFC, McDonald’s and now Taco Bell – guests looking for a bargain are in luck.

But what does the revival of the meal deal mean for value-oriented investors?

We’ll look at how to stay on top of things with the Yahoo Finance Playbook.

And now we’re joined by John Tower, the city’s director and restaurant analyst.

Good to see you.

And you’re the perfect person to talk to, John. You know the industry, you know these names.

Um, I think we have to start with the bigger picture there, John. Do you think it’s going to work with all these inexpensive meals that are being introduced here?

Do you think this will result in more people coming through the door?

That will boost traffic, John.

Yes, look, I think there’s a very good chance that it will work, at least to stop the bleeding, as far as traffic is concerned.

That was the bigger problem.

This trend has been declining for some time now, mainly because prices are significantly higher than domestic food inflation.

I think there’s been about a 700 basis point gap between the two since pre-COVID, and restaurants have been on the wrong side of that.

This will at least help to reduce the loss of traffic somewhat.

And, most importantly, restaurant brands will have a marketing budget to make this clear to every consumer.

Wherever they consume media, be it on television or on their mobile devices, consumers are increasingly being bombarded with attractively priced offers.

But John, this means sacrificing margins.

And if so, are there strategies that some of these companies can implement to protect their margins?

Yes, many of these operators have become much better at protecting their profits when it comes to focusing on value.

They are therefore more likely to resort to bundled meals at special prices.

Therefore, there are 3,456 starting prices starting at $7 or package deals instead of simply discounting individual menu items.

So I think there won’t necessarily be a drastic decline in profits as the value mix of these menus continues to increase.

Um, well, you know, I’m not that worried about the profit aspect, and you should keep that in mind as well.

Many of these operators are franchises and therefore do not see it directly on their own profit and loss statements.

Ultimately, franchisees will feel the impact more strongly at the branch level.

And that’s where, frankly, a lot of the tension comes from around not launching these value platforms sooner.

Let’s say there is friction between the franchisee and the franchisor in late 2023 about where and with what discounts to promote their products and at what price to bring customers back to the stores.

However, I think many of them have now reached reasonable standards in terms of what they promote, when they promote it and how they do it.

And I believe that this should lead to an increase in traffic.

Let’s take some pictures, John.

That is interesting.

They cover many names.

They have a large coverage universe.

Here’s McDonald’s and there, John, you, you, it looks like your rating is still neutral.

You stand on the sidelines.

How come, John, and what would you need to see before you become more optimistic about this name?

Yes, some things happened.

Um, we were a little more conservative in terms of our expectations for domestic and global revenue going into 2024, and so far that’s held true.

Um, I think, you know, you shouldn’t necessarily bet completely against McDonald’s in terms of value because that’s core to their ethos as a brand.

But I think we need to see some consistent value for money across the menu even beyond this five-week period.

And I know that some of the franchisees have committed to this $5 meal for more than the advertised five-week period.

I think there will be more on the topic of value messaging as we move forward in ’24, and probably even more in ’25.

But we need a unified message there.

I think so that we feel comfortable, also internationally.

You know, the softness we saw here has traveled all over the world, hasn’t it?

Whether in Asia or Europe, if we have the certainty that these markets are not going to shrink or their growth is not going to slow down any further, I think we can familiarize ourselves with the assessments and become more open to the stock.

And John, when you think about loyalty memberships and digital rewards, which companies are best positioned in that regard, because that also impacts the whole idea of value for the consumer.

Yes, look, I would say the pizza category has been a leader in the digital space for a long time.

Then the drink did a phenomenal job.

Only recently have many other fast food concepts become better at loyalty programs and digital ordering.

I believe Taco Bell, which is owned by Yum, is currently revamping its program.

You’ll see it arrive in the third quarter of this year. It’ll reduce some friction in the drive-thru window, where I think it’s been a sore spot for consumers in terms of usage.

Uh, and, and, uh, you know, honestly the desire to use the platform regularly and increase the frequency.

Um, I think the overhaul will help the current programs themselves.

They served more as a discount mechanism.

Um, it’s a way to communicate directly with the consumer, but you know, it’s still uncertain who’s going to win here in the long run.

I like the redesign of Taco Bell.

I think they will make a difference in the short term if the program is revised.

John.

Thank you for your time and stock selection.

Thank you for joining us today.

Thank you very much.

Have fun.

Related Posts

Kansas City Royals vs Tampa Bay Rays (Game 1)

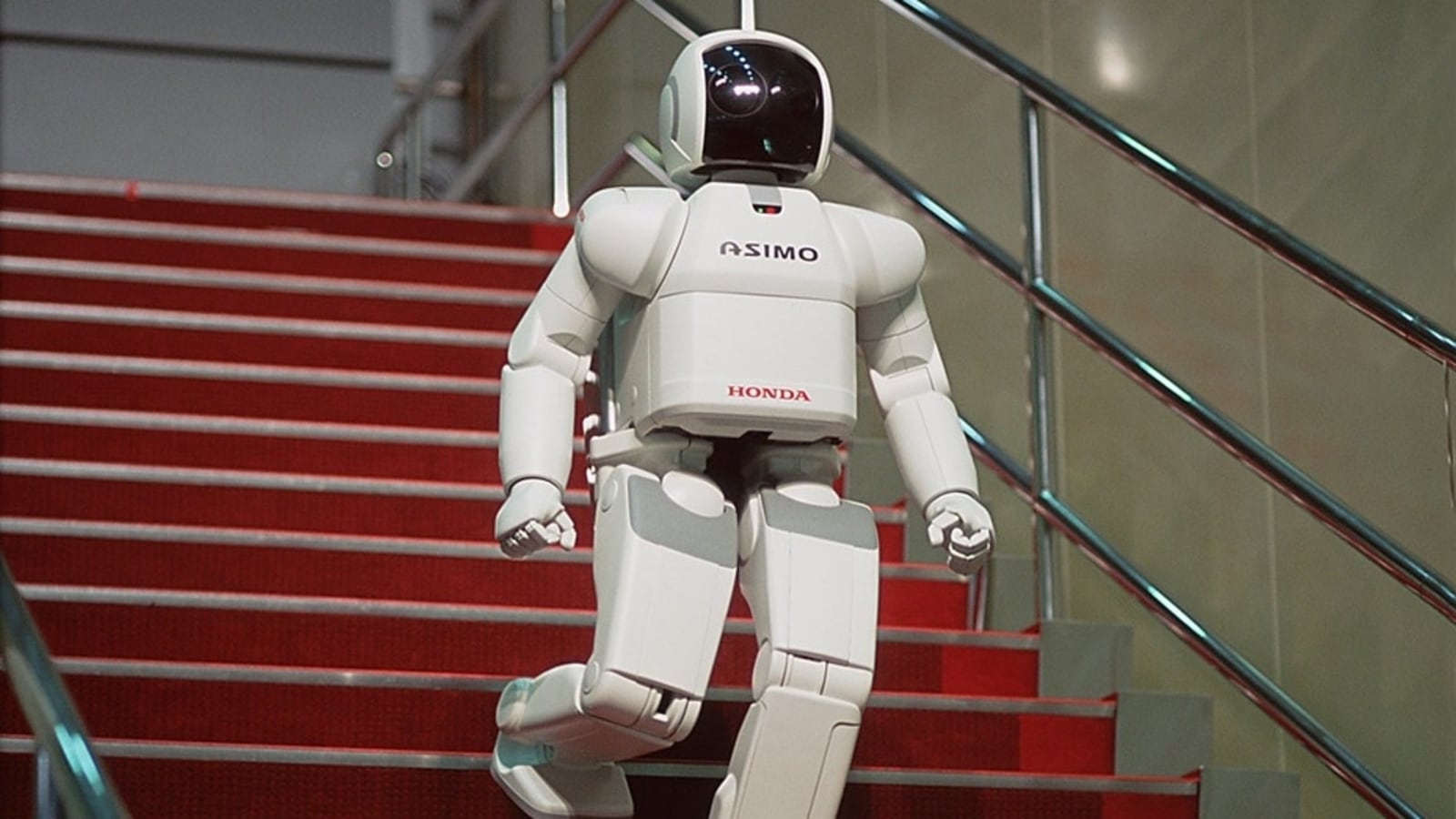

‘Robot suicide’ shocks South Korea, authorities investigate sudden ‘death’ of ‘depressed’ cyborg | World news