Amazon stock (AMZN) hits all-time high and enters the $2 trillion club

Amazon (NASDAQ:AMZN) shares hit an all-time high of $194.8 on June 26, pushing its market value above $2 trillion. AMZN shares traded at $193.61 yesterday, up 3.91% and giving it a market cap of around $2.02 trillion.

Overall, Amazon shares have risen by over 27% since the beginning of the year, outperforming the S&P 500 (SPX) an increase of almost 15%. In addition, it joins the ranks of technology giants such as Alphabet (NASDAQ: GOOGL), Apple (NASDAQ:AAPL), Nvidia (NASDAQ: NVDA) and Microsoft (NASDAQ:MSFT) in the $2 trillion club.

This has pushed up the AMZN share price

Amazon shares benefited from the rally in shares of electric car manufacturer Rivian Automotive (NASDAQ:RIVN). Rivian shares closed more than 23% higher on June 26 after announcing a joint venture with Volkswagen (VWAG)(EN:VOW3). It is worth noting that Amazon owns a significant stake of over 16% in Rivian, so a rise in Rivian stock had a positive impact on Amazon’s valuation.

Adding to the positive aspects, Justin Post, an analyst at Bank of America Securities, reiterated his buy rating on AMZN stock. On June 26, the analyst increased the price target from $210 to $220. Justin Post is a 5-star analyst who ranks in the top 3% of Wall Street equity professionals.

Although Amazon has already implemented several initiatives to increase revenue, Post sees further room for improvement.

Amazon increases efficiency

Amazon has streamlined its infrastructure to increase efficiency. The company has set up eight regional hubs that have reduced travel distances and operating costs. The company managed to reduce its global service cost per unit in 2023, which is the first decline since 2018. The cost savings will enable Amazon to improve delivery speed, keep prices low, and expand its product offerings.

Looking ahead to 2024 and beyond, Amazon plans to improve its inventory management to achieve further cost savings.

Is Amazon currently a buy or sell argument?

Amazon’s stock uptrend reflects improved efficiency, growth in its cloud business and investments in AI. Although the stock is up about 50% in a year, Wall Street remains optimistic.

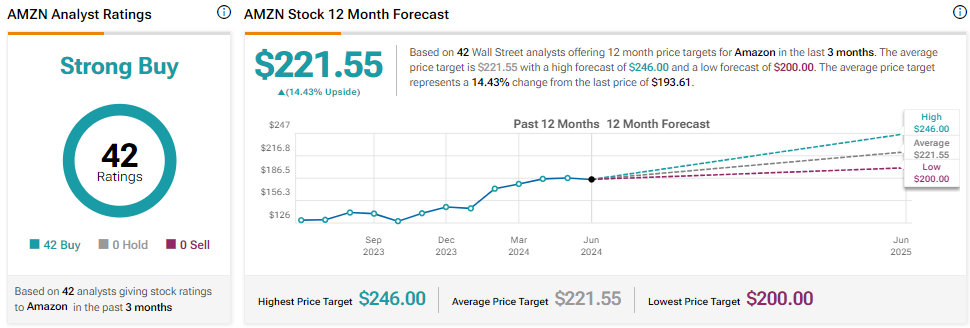

42 analysts rate AMZN stock and all recommend buying it. AMZN stock has a consensus rating of Strong Buy. The average analyst price target for AMZN stock is $221.55, which represents an upside potential of 14.43% from current levels.

Notice