The three largest TSX stocks are expected to trade below value in June 2024

In an environment where the Canadian market is showing resilience with steady economic growth and rising equity values, consumer sentiment remains subdued, reflecting a complex interplay of economic factors. In such an environment, identifying potentially undervalued stocks is particularly rewarding as they can offer opportunities to investors seeking value in a market where broader indices are showing robust performance.

The 10 most undervalued stocks in Canada based on cash flow

|

Surname |

Current price |

Fair value (estimated) |

Discount (estimated) |

|

Caliber Mining (TSX:CXB) |

1.75 CA$ |

3.22 CA$ |

45.7% |

|

Calian Group (TSX:CGY) |

CA$56.00 |

110.49 CA$ |

49.3% |

|

Trisura Group (TSX:TSU) |

39,98 € |

80.18 CA$ |

48.9% |

|

Aura Minerals (TSX:ORA) |

11,90 € |

21.08 CA$ |

43.5% |

|

Kinaxis (TSX:KXS) |

150.84 CA$ |

$249.64 |

39.6% |

|

Viemed Healthcare (TSX:VMD) |

10.45 CA$ |

20.08 CA$ |

48% |

|

Endeavour Mining (TSX:EDV) |

28.55 CA$ |

53.83 CA$ |

47% |

|

Jamieson Wellness (TSX:JWEL) |

$28.00 |

46.68 CA$ |

40% |

|

Kits Eyecare (TSX:KITS) |

8.35 CA$ |

14.29 CA$ |

41.6% |

|

Capstone Copper (TSX:CS) |

9.33 CA$ |

16.47 CA$ |

43.3% |

Click here to see the full list of 24 stocks from our Undervalued TSX Stocks Based on Cash Flows screener.

Let’s examine some outstanding options from the results in the screener

Overview: Green Thumb Industries Inc. operates in the United States and focuses on the manufacturing, distribution, marketing and sale of cannabis products for medical and recreational use. The company has a market capitalization of approximately $4.06 billion Canadian dollars.

Operations: The company generates its revenue primarily in two segments: Retail at $806.38 million and Consumer Goods at $583.78 million.

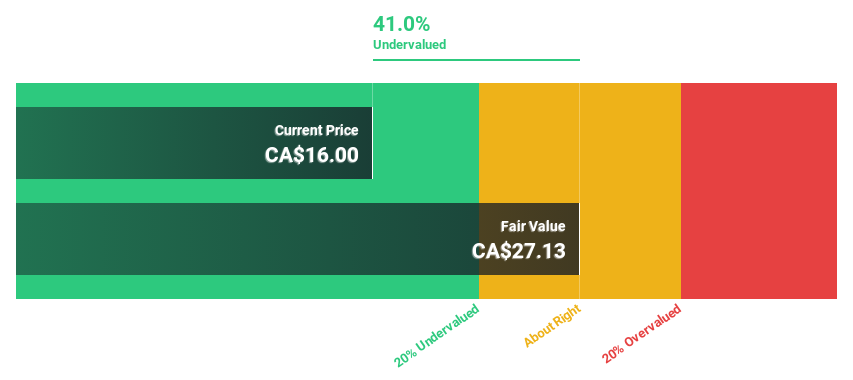

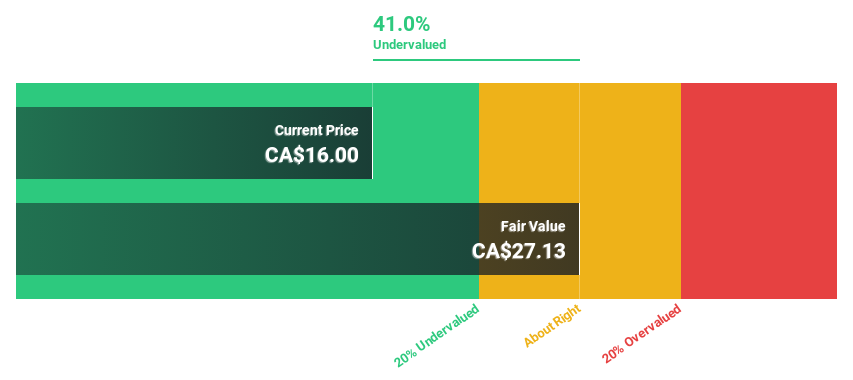

Estimated discount to fair value: 39.2%

Green Thumb Industries is undervalued by more than 20% at CA$16.46 compared to an estimated fair value of CA$27.07. Despite a low three-year return on equity forecast of 10.2%, the company’s earnings are expected to grow 27.26% annually, outperforming the Canadian market’s forecast of 14.7%. Recent expansions and potential M&A activity with Boston Beer Company underscore strategic growth efforts despite regulatory challenges in the US and underscore the company’s proactive approach in a competitive sector.

Overview: Brookfield Asset Management Ltd. is a real estate investment firm specializing in alternative asset management services with a market capitalization of approximately C$21.88 billion.

Operations: The company generates its revenue primarily from real estate investments and alternative asset management services.

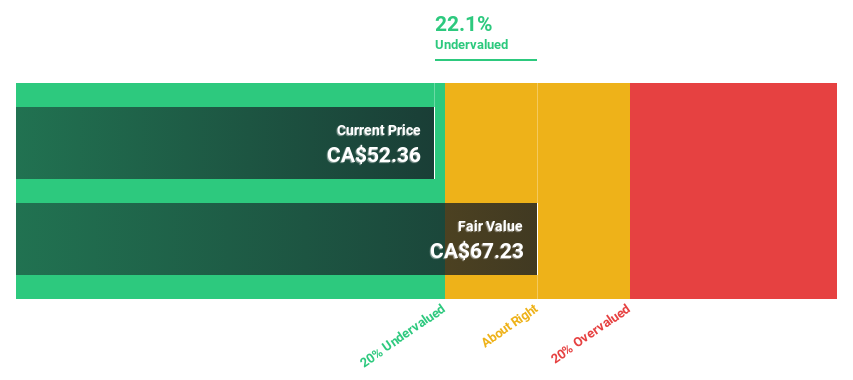

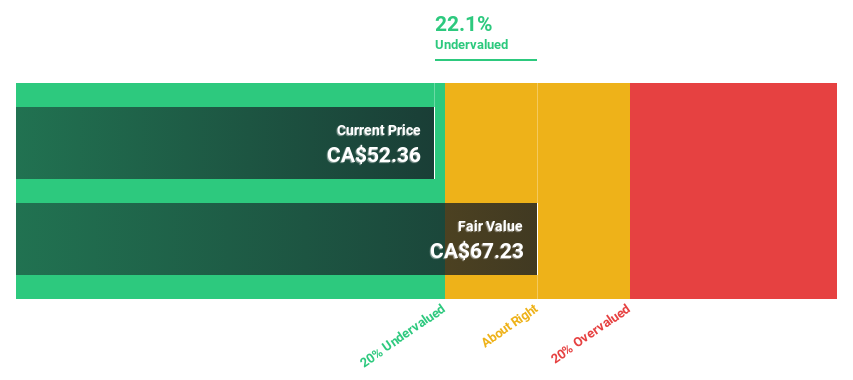

Estimated discount to fair value: 22.3%

Brookfield Asset Management is significantly undervalued at CA$52.38 and has an estimated fair value of CA$67.39, a discount of 22.3%. Despite shareholder dilution last year and dividends that are not well covered by earnings or cash flow, BAM has solid growth prospects. Revenue and earnings forecasts are for 61.8% and 74.57% annually, respectively, comfortably outperforming the Canadian market average of 7.2% revenue growth and 14.7% earnings growth. Recent M&A activity suggests strategic expansion efforts, but also brings uncertainty about outcomes.

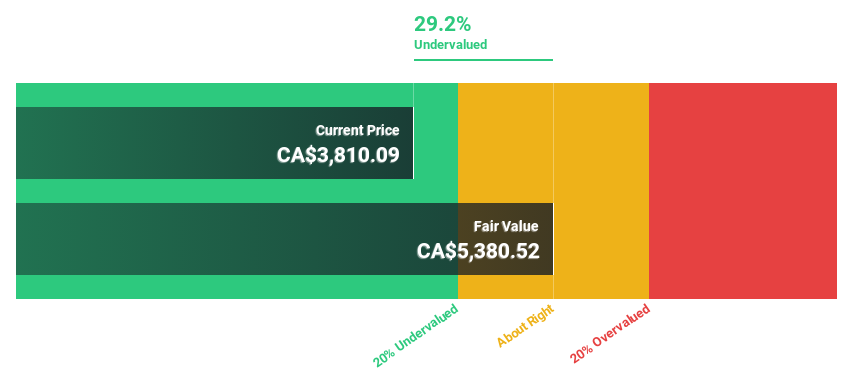

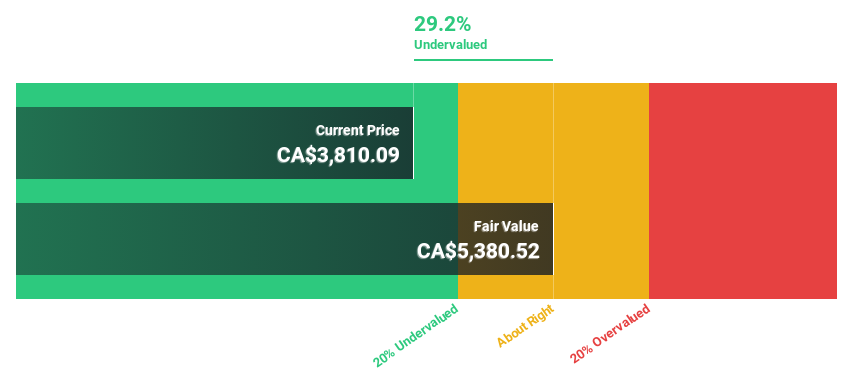

Overview: Constellation Software Inc. operates globally and focuses on acquiring, building and managing software companies for vertical markets, primarily in Canada, the United States and Europe. The company has a market capitalization of approximately $81.55 billion Canadian dollars.

Operations: The company generates 8.84 billion Canadian dollars in the software and programming segment.

Estimated discount to fair value: 27.8%

Constellation Software trades at CA$3876.95, 27.8% below its estimated fair value of CA$5371.56, suggesting significant undervaluation on a discounted cash flow basis. Despite high debt and recent insider selling, the company is poised for robust growth, with earnings expected to grow 24.43% annually, significantly outperforming the Canadian market average. Recent strategic moves include the launch of Omegro and leadership changes within the Harris operating group, improving the company’s global software presence and management depth.

Summarize everything

Ready to venture into other investment styles?

This Simply Wall St article is of a general nature. We comment based solely on historical data and analyst forecasts, using an unbiased methodology. Our articles are not intended as financial advice. They do not constitute a recommendation to buy or sell stocks and do not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.

Companies discussed in this article include CNSX:GTII TSX:BAM and TSX:CSU.

Do you have feedback on this article? Are you interested in the content? Contact us directly. Alternatively, send an email to [email protected]