Global value stocks – The compelling argument at mid-year

With a solidly growing global economy, stable inflation and high employment, we believe the current environment for global value stocks remains favorable. When structural trends such as reshoring, infrastructure investment and electrification are taken into account, we believe the value outlook becomes even more attractive over the long term.

Economic strength, value strength

The global economy continues to boom. After concerns about a possible recession in late 2023 and early 2024, the economy is now growing again and even the pressure on lower-end US consumers may be gradually easing.

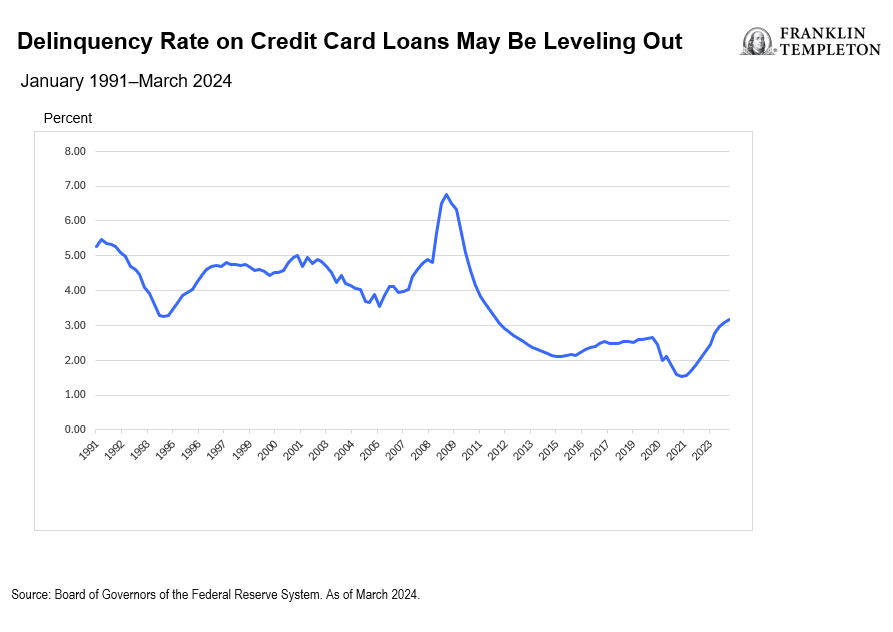

According to the US Federal Reserve1 For example, the increase in credit card delinquencies began to slow in the first quarter of 2024, as shown in Figure 1. Other industry data also indicate early signs of improvement.

Figure 1: Credit card default rates may stabilize (right click on the diagram to enlarge)

Meanwhile, global growth is expected to remain at around 3.2 percent this year and next, according to estimates by the International Monetary Fund.2 This solid expansion should keep labor markets tight and boost consumer spending. For retailers, we believe the challenge will be to keep the products consumers want in stock.

Inflation, while still high, is far from its worst levels. After years of inflation not even reaching 2%, we believe that the recent above-average inflation rate, while painful for some, may just be the stabilization of the long-term trend. In addition, rents, which have continued to rise and have led to higher inflation,3 could decrease if more residential buildings are completed4 and could thus reduce overall inflation over time.

As long as inflation is not too high, we are optimistic that it will continue to normalize. And after the European Central Bank cut interest rates in June, we believe that interest rates in the US could eventually come down a bit as well, which could be positive for value-oriented companies.

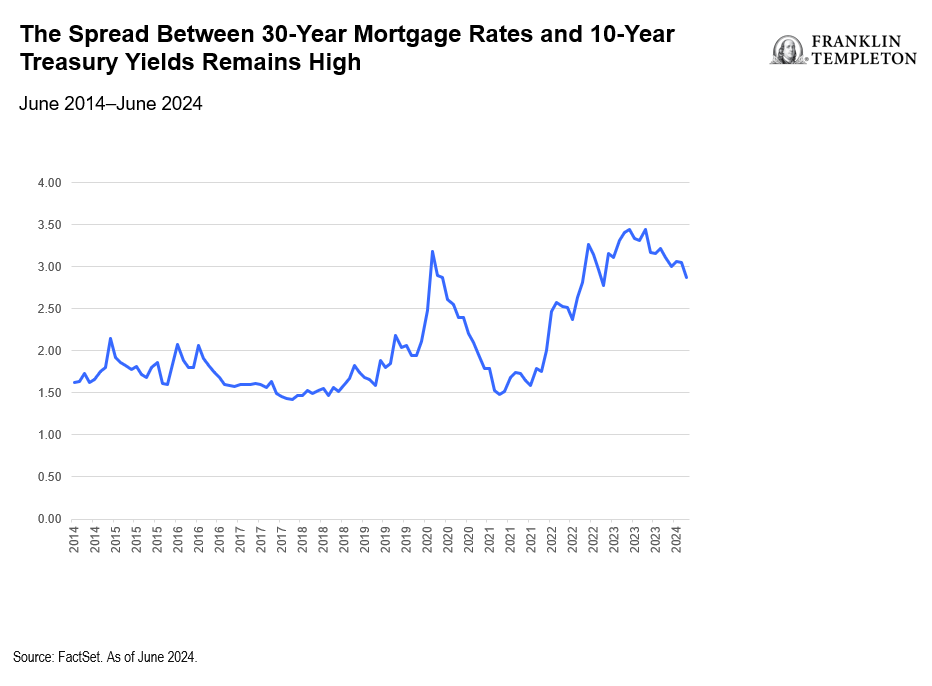

If rates do fall, we believe this should be positive for the U.S. housing market, where mortgage rates remain stubbornly high despite stable 10-year Treasury yields. (See Figure 2.) This discrepancy has dampened sales activity. According to the National Association of Realtors, 4.1 million existing homes were sold in April, compared to 4.22 million a year earlier.5 New home sales, as reported by the U.S. Department of Commerce,6 Economic development has also slowed in recent months. And this weakness is having a negative impact on the sectors that supply the housing construction and housing industry.

Figure 2: The spread between 30-year mortgage rates and 10-year Treasury yields remains high (right click on the diagram to enlarge)

Overall, we believe the economic environment remains favorable for value investors, even after the recent rally in the U.S. equity market has expanded beyond the Magnificent Seven technology stocks.7 And given attractive valuations, we believe solid long-term returns are achievable for value stocks. But knowing where to look and what long-term trends to watch will be key.

Value is international

We believe that European and Japanese equities are a good investment opportunity in the coming quarters. Europe, for example, is out of favor as investors continue to invest in US technology stocks. But there are some really innovative companies there, and the regional economy has largely overcome the energy market challenges brought about by Russia’s war in Ukraine by switching suppliers and increasing energy efficiency. Economic growth is stable and inflation appears to be moderating, in our view.

Japan is also slowly changing and is finally attracting international investors again. The return of wage and goods inflation, as well as important corporate governance reforms, have brightened the outlook for Japanese equities in our view. Not all companies are ready for change, but we believe that those that are can create value for investors over time.

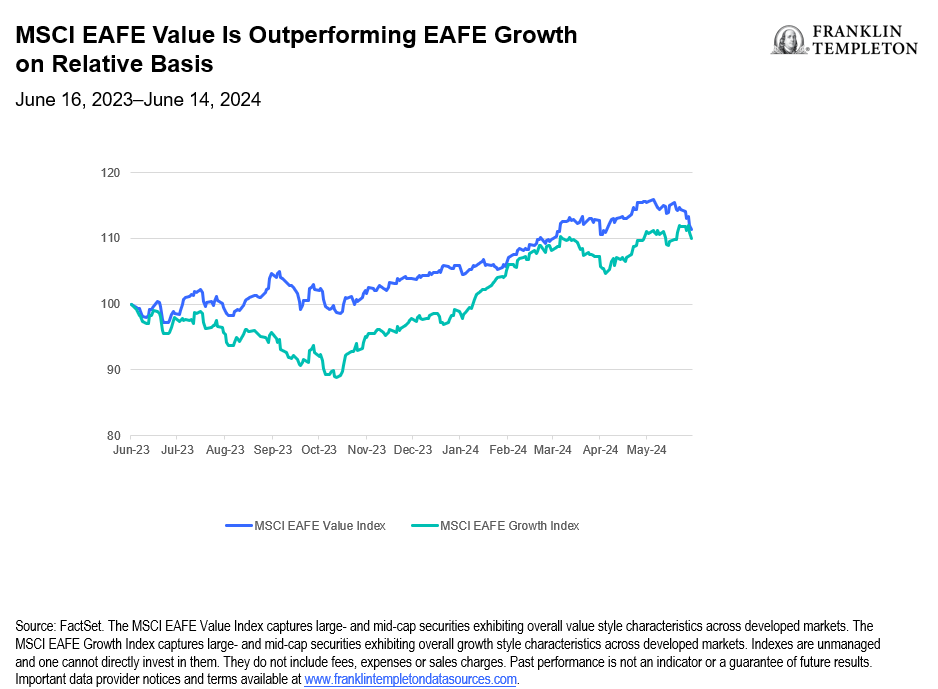

Non-US value stocks have largely outperformed non-US growth companies over the past year, as measured by the MSCI EAFE Growth and Value indices (see Figure 3), and we believe this trend could continue.

Figure 3: The MSCI EAFE score outperforms the EAFE growth index on a relative basis (right click on the diagram to enlarge)

Long-term value

In addition, we believe value stocks should participate in several structural trends, including supply chain reshoring, infrastructure investments, electrification and even artificial intelligence.

The reshoring of supply chains has been underway for several years and is expected to continue as Western countries look to move their supply chains out of China and make their supplier networks more resilient. This move should continue to encourage investment in new manufacturing facilities and new shipping routes, all of which could benefit the value companies operating in these markets.

In addition, global infrastructure spending—from roads and bridges to manufacturing facilities, clean energy and data centers—requires all the things that value-added companies typically produce: copper, cement, industrial equipment, heating, ventilation and air conditioning systems, and professional and human services.

Electrification also represents a positive long-term trend for value investing as electric vehicles and other electricity-powered devices such as residential heat pumps become increasingly popular around the world. These require not only more electricity generation but also charging infrastructure, new parts and semiconductors.

While value stocks may not yet enjoy the hype enjoyed by their higher-growth counterparts, value companies will play a critical role in global economic development and investment over the next few years, and that’s why we believe value stocks can continue to prove their worth.

WHAT ARE THE RISKS?

All investments involve risks, including the possible loss of invested capital.

Shares are subject to price fluctuations and possible loss of capital.

International investments are subject to special risks, including currency fluctuations and social, economic and political uncertainties that could increase volatility. These risks are even greater in emerging markets.

Securities The price may not increase as expected or may continue to decline in value. Growth or value as an investment style may go out of fashion, which can negatively impact performance.

Active management does not guarantee profits and does not protect against market declines.

IMPORTANT LEGAL INFORMATION

This material is intended for general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any securities or to adopt any investment strategy. It does not constitute legal or tax advice. This material may not be reproduced, distributed or published without the prior written consent of Franklin Templeton.

The views expressed are those of the investment manager and the comments, opinions and analyses are reflected as of the date of publication and are subject to change without notice. The underlying assumptions and these views may change depending on market and other conditions and may differ from those of other portfolio managers or the firm as a whole. The information provided in this material does not constitute a complete analysis of all material facts about any country, region or market. There is no guarantee that any prediction, projection or forecast about the economy, the stock market, the bond market or the economic trends of the markets will prove to be correct. The value of investments and the income from them can fall as well as rise and you may not get back the full amount invested. Past performance is not necessarily an indicator or guarantee of future performance. All investments involve risk, including the possible loss of the capital invested..

All research and analysis contained in this material has been obtained by Franklin Templeton for its own purposes and may be used in that context and is therefore provided to you as an aside. Data from third party sources may have been used in the preparation of this material and Franklin Templeton (“FT”) has not independently verified, validated or audited such data. Although the information has been obtained from sources Franklin Templeton believes to be reliable, no guarantee can be given as to its accuracy and such information may be incomplete or condensed and subject to change at any time without notice. The mention of individual securities does not constitute or should be construed as a recommendation to buy, hold or sell any securities and the information provided on such individual securities (if any) is not a sufficient basis for making an investment decision. FT accepts no liability whatsoever for any loss arising from the use of this information and reliance on the commentary, opinions and analysis contained in the material is at the sole discretion of the user.

Products, services and information may not be available in all jurisdictions and are offered outside the United States by other FT affiliates and/or their distribution partners, to the extent permitted by local laws and regulations. Please consult your own financial professional or Franklin Templeton institutional contact for more information regarding the availability of products and services in your jurisdiction.

CFA® and Chartered Financial Analyst® are trademarks of CFA Institute.

________________________________

1. Source: “Charge-off and Delinquency Rates on Loans and Leases at Commercial Banks”. US Federal Reserve. First quarter of 2024.

2. Source: World Economic Outlook. International Monetary Fund. April 2024. There is no guarantee that any estimate, forecast or prediction will prove to be true.

3. Source: US Consumer Price Index. Bureau of Labor Statistics. May 2024.

4. Source: Monthly new housing construction in the United States. US Census Bureau. April 2024.

5. “Existing home sales fell 1.9% in April.” National Association of Realtors. April 2024.

6. Source: Monthly new residential real estate sales in the United States. US Census Bureau. April 2024.

7. The “Magnificent Seven” are Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia and Tesla.

1720508564-0/nadia-Jamil-3-1024x478-(1)1720508564-0.png)