June 2024 Insight into three UK stocks that will be undervalued

As the UK general election approaches and caution in the markets increases, investors are closely monitoring the FTSE 100, which is showing a mixed reaction amid global economic uncertainties. In this cautious environment, identifying undervalued stocks becomes crucial as they may offer potential for value appreciation if market sentiment stabilizes. During such times, a good stock is often characterized by solid fundamentals such as strong balance sheets and consistent earnings, which can provide some resilience to market volatility.

The 10 most undervalued stocks in the UK based on cash flow

|

Surname |

Current price |

Fair value (estimated) |

Discount (estimated) |

|

Kier Group (LSE:KIE) |

1,40 € |

2,73 € |

48.7% |

|

Morgan Advanced Materials (LSE:MGAM) |

3,13 € |

6,09 € |

48.6% |

|

Mercia Asset Management (AIM:MERC) |

£0.295 |

0,58 € |

49.3% |

|

Deckchairs (AIM:LGRS) |

2,68 € |

5,26 € |

49.1% |

|

Deliveroo (LSE:ROO) |

1,286 € |

2,48 € |

48.1% |

|

Nexxen International (AIM:NEXN) |

2,47 € |

4,91 € |

49.7% |

|

Franchise brands (AIM:FRAN) |

1,51 € |

2,96 € |

49% |

|

Elementis (LSE:ELM) |

1,44 € |

2,80 € |

48.5% |

|

Aston Martin Lagonda Global Holdings (LSE:AML) |

£1,512 |

2,95 € |

48.7% |

|

eEnergy Group (Target: EAAS) |

£0.055 |

0,11 € |

49.8% |

Click here to see the full list of 65 stocks from our Undervalued UK Stocks Based on Cash Flow screener.

We will look at some of the best tips from our screener tool

Overview: Aston Martin Lagonda Global Holdings plc is a global manufacturer of luxury sports cars with design, development and marketing activities and a market capitalization of approximately £1.25 billion.

Operations: The company’s revenue was mainly £1.60 billion (£1.60 billion) and consists mostly of the automotive segment.

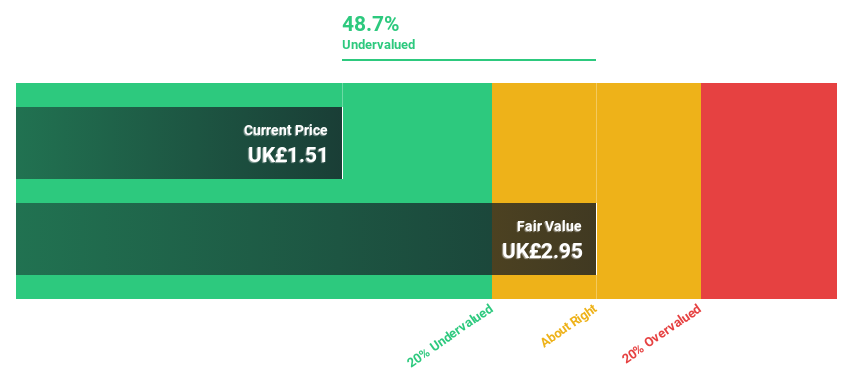

Estimated discount to fair value: 48.7%

Aston Martin Lagonda Global Holdings trades at £1.51, well below the estimated fair value of £2.95, suggesting a potential undervaluation on a discounted cash flow basis. Despite recent challenges, including a significant net loss in the first quarter of 2024, the company is expected to become profitable within three years and is expected to grow earnings by 81.69% per year. However, the forecast return on equity remains low at 1.7%, indicating cautious optimism about the long-term growth prospects.

Overview: NCC Group plc operates in the cyber and software resilience sector in the UK, Asia Pacific, North America and Europe and has a market capitalization of approximately £481.38 million.

Operations: The company generates its revenue primarily from its Cyber Security division, which contributes £251.90 million, and its Escode division, which adds another £65.10 million.

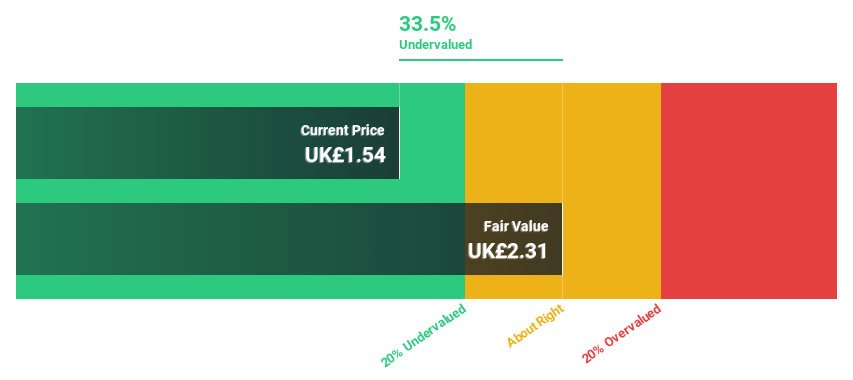

Estimated discount to fair value: 33.5%

NCC Group is undervalued by around 33.5% at £1.54 versus its fair value of £2.31 based on discounted cash flow analysis. The latest company forecasts are for revenues of around £100 million for the coming quarter, with a stable dividend of 3.15p expected in October 2024. While earnings are expected to grow at 94.04% annually, the company’s return on equity is expected to remain low at 6.2%, raising potential concerns about profitability and efficiency of capital deployment.

Overview: Severfield plc is a UK-based steel construction company engaged in the design, manufacture, fabrication, engineering and erection of steel structures in the UK, Republic of Ireland, Europe and India and has a market capitalisation of approximately £232.86 million.

Operations: The company’s core construction activities generate revenues of £463.47 million.

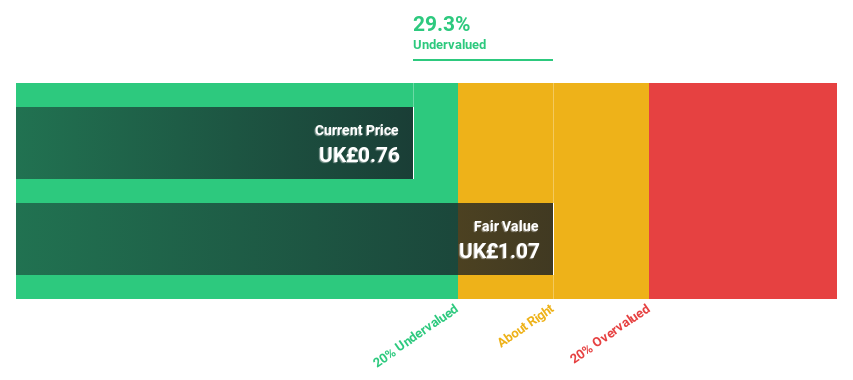

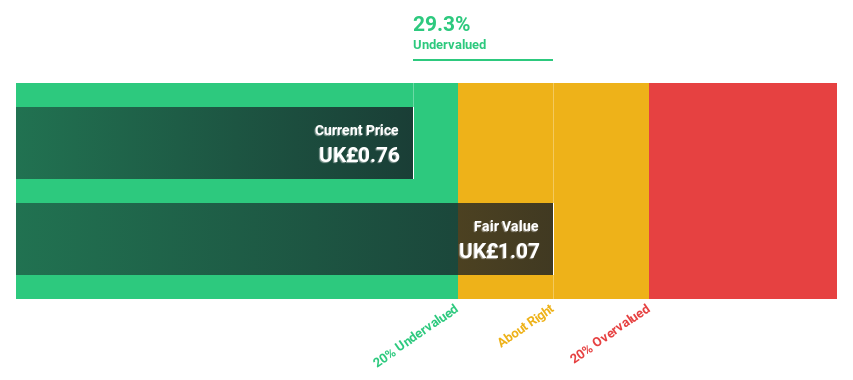

Estimated discount to fair value: 29.3%

Severfield is considered undervalued at £0.76, with its fair value estimated at £1.07. Despite a recent drop in revenue to £463.47 million and net profit down to £15.9 million, the company’s earnings are expected to grow 23.38% annually, beating the UK market’s forecast of 12.5%. Analyst consensus is for a potential price increase of 46.5%. However, concerns remain over a volatile share price and unstable dividend history that could deter risk-averse investors.

Turning ideas into action

Would you like to explore some alternatives?

This Simply Wall St article is of a general nature. We provide commentary based solely on historical data and analyst forecasts, using an unbiased methodology. Our articles are not intended as financial advice. They do not constitute a recommendation to buy or sell stocks, and do not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.

Companies discussed in this article include LSE:AML LSE:NCCLSE:SFR and

Do you have feedback on this article? Are you interested in the content? Contact us directly. Alternatively, send an email to [email protected]

:quality(70):focal(2003x350:2013x360)/cloudfront-eu-central-1.images.arcpublishing.com/irishtimes/4XIJQ63HBZAHPOHNLJMLICUGWY.jpg)