How a DCF analysis confirms Crocs’ value thesis

Crocs Inc. (NASDAQ:CROX) shares have made an interesting comeback in recent months, especially after releasing better-than-expected first-quarter results. Shares were trading at $180 at the end of 2021, but after the HeyDude acquisition, the market became fearful, and shares saw a decline of just over 70% by mid-2022.

It turns out that the company has done an excellent job since then by continuing to grow its flagship brand, generating strong cash flow and maintaining an interesting capital allocation. Nevertheless, HeyDude’s plans still face challenges.

Despite relatively high debt and nebulous near-term growth, Crocs shares trade at an attractive price, both when looking at multiples and a conservative discounted cash flow analysis. This attractive price level is consistent with the moat that has allowed the company to build a strong brand and deliver good financials.

Despite the short-term challenges, Crocs has achieved very interesting results recently. Net sales were around $1.2 billion in 2019 and have exceeded the $4 billion mark in the last 12 months. This growth is due to the acquisition of HeyDude (which accounts for about $900 million of this) and the very strong growth of the main brand, which has a compound annual growth rate of more than 20% between 2017 and 2023.

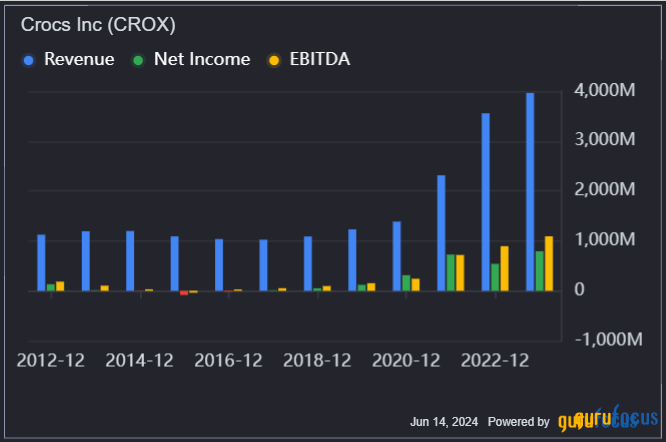

As you can see from the chart above, the company has not always been able to create value. From 2012 to 2019, its revenue was virtually stagnant and on several occasions reached a margin well below where it is today, including a negative Ebitda margin in mid-2015. This means that while the company has maintained an Ebitda margin of around 30% for the past three years, the average has fallen to 14% over the past decade, a factor that weighs heavily on financial modeling and confidence in the company’s future.

Looking at the company today, profitability is an important factor. Unsurprisingly, Crocs achieves a profitability rating of 8 out of 10 with a very good gross margin, which underlines the strength of its brand even in a competitive market, as well as very strong operating and net margins compared to the industry.

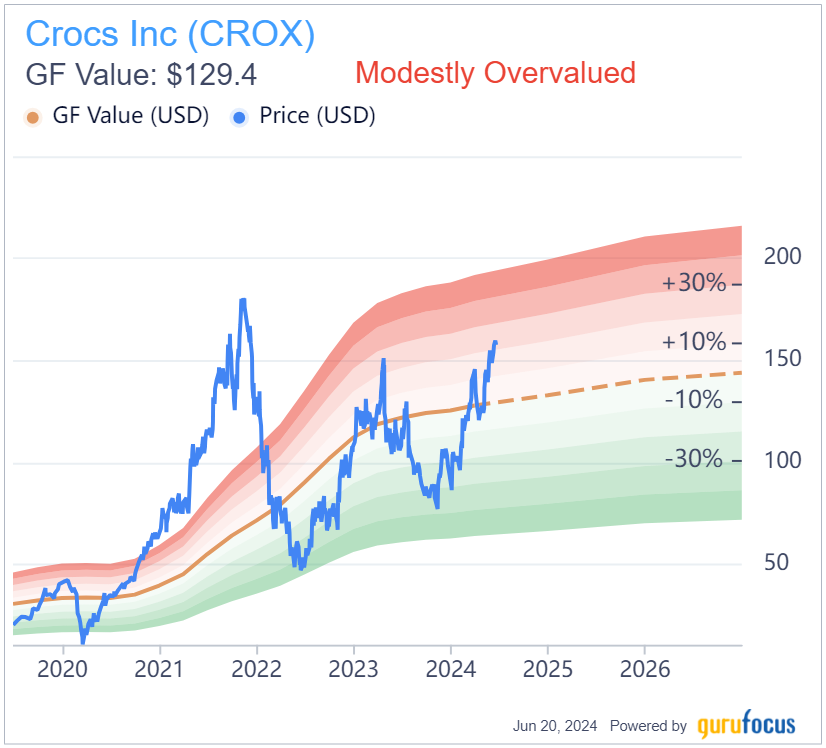

Source: GuruFocus

This margin (mainly gross) is due to the added value that Crocs has been able to add to its products, since even with a less complex production process, by creating brand awareness and using strategies such as partnerships with famous brands, they manage to sell products such as Crocs Toy Story, Crocs NBA and others at interesting prices. In addition, there is a strong demand for clog products among consumers, driven by the casual trend, along with cultural movements that are also proving strong and evidenced by the brand’s strong growth in China (triple-digit growth in the last quarter).

So the triggers for Crocs’ continued growth are not entirely clear. It is working on the brand’s execution, and it is a utility shoe that is widely used in some industries such as healthcare. But on the other hand, this growth may depend in part on fashion trends and other factors. This is one of the reasons why the HeyDude acquisition is not necessarily a bad thing, as this risk is mitigated by diversifying into another strong brand.

As for HeyDude, the forecast for the next few quarters is still weak. Sales are expected to fall by 19 to 17 percent in the second quarter and by about 10 to 8 percent in 2024, pursuing strategies to maintain price in the digital space and improve inventory levels. In addition, some synergies can still be exploited, for example by entering some international markets taking advantage of Crocs’ distribution channels.

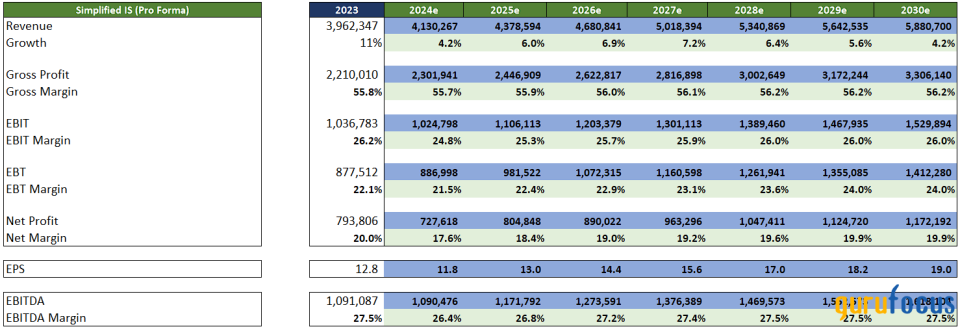

Based on this information, it would not be plausible to continue to grow Crocs aggressively. Even if the company were able to sustain double-digit revenue growth and increase EBITDA margins back to 30%, such assumptions would be unreasonable and would reduce the margin of safety. For this reason, I used realistic data in my model and assumed that the company does not face too many challenges.

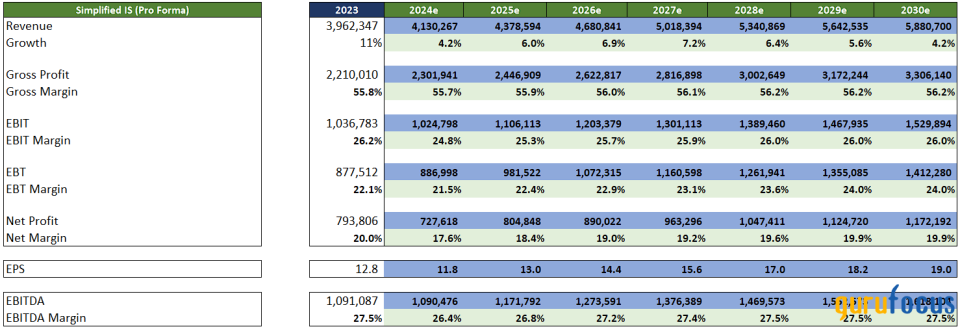

In line with the forecast, my model calculates revenue of $4.13 billion for 2024, the result of a decline of about 11% in HeyDude, offset by a 9% (year-on-year) increase in the main brand’s revenue. In addition, the EBIT margin is slightly below the forecast, which also causes earnings per share to fall short of what the company reported last quarter.

In terms of development, I predict a gradual recovery for the HeyDude brand, but lower growth for Crocs in the coming years, ranging between 4% and 7% from 2025 to 2030. At the same time, margins will reach very manageable levels. For example, maintaining an EBIT margin of 26% after 2028 and a margin of 24% after 2029.

In addition, the effective tax rate is also slightly above historical levels and will return to 17% in 2026. This means that the model takes into account a net profit margin of 19.90% in the long term, a level that the company has already achieved in the past and should reach again without major problems if initiatives are successful.

Source: Author

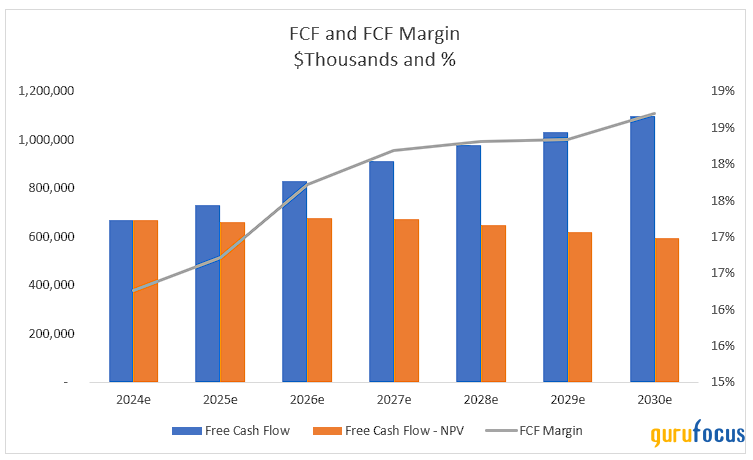

In addition to these income statement assumptions, the model takes into account other assumptions such as capital expenditure of -3% of sales until 2029, decreasing to -2.5% from 2030, stagnant depreciation of 1.50% of sales and maintaining working capital variability. This results in a good trajectory for free cash flow, with the margin reaching 19% in 2030 and an amount of over $1 billion.

Source: Author

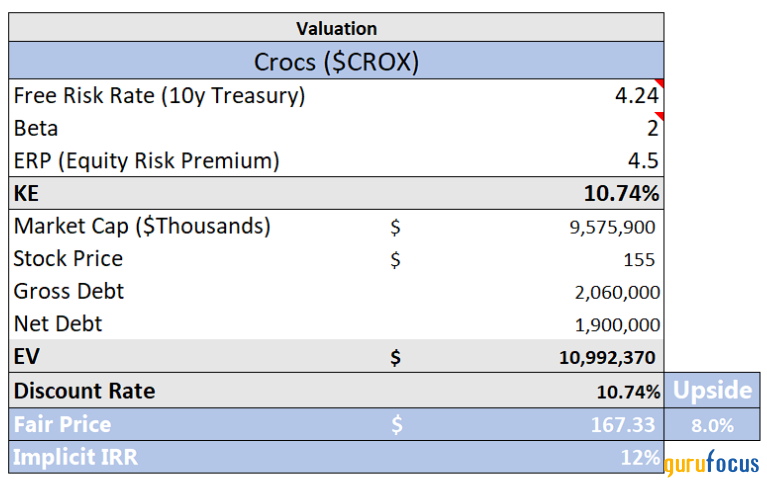

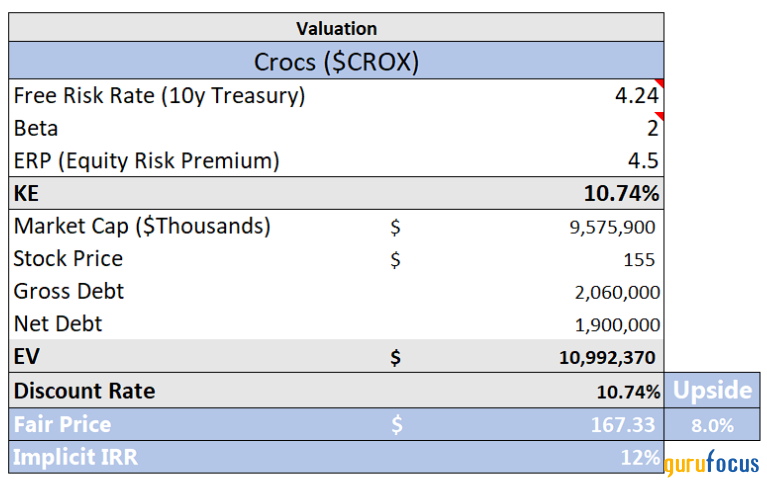

Note that the amount drops significantly when this cash flow is converted to present value, as the discount rate used is 10.74%, which reflects 4.24% for 10-year Treasuries and an equity risk premium of 4.50% (in addition to beta). The result of this calculation is a fair price of $167 for Crocs, which represents 8% upside potential from the current price. The internal rate of return implied in this modeling is about 12%.

Source: Author

Compared to other value plays, this upside may seem small, but the assumptions are conservative (and the discount rate is too), are just below the 2024 forecast, and show modest growth. This ultimately leads to a greater possibility of positive surprises (or upside risks) that are not taken into account in a conservative model, as may be the case with continued growth in the international segment, the renewal of HeyDude, and efficiency improvements that can further increase margins.

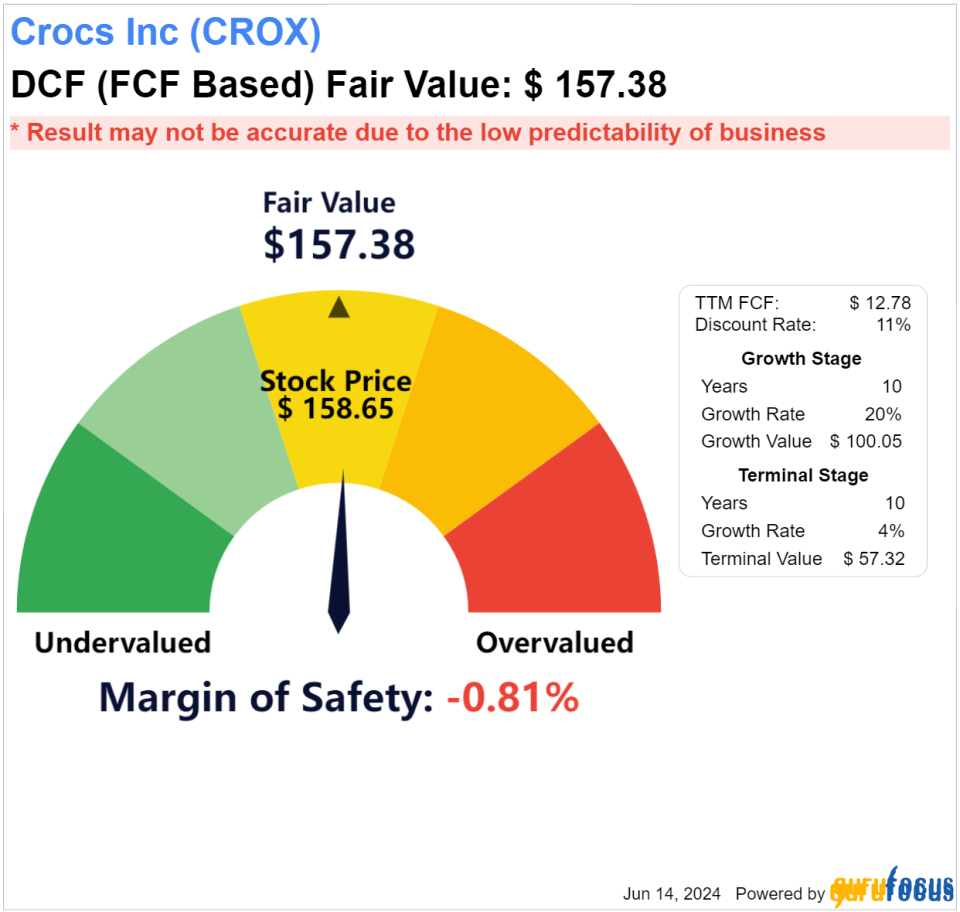

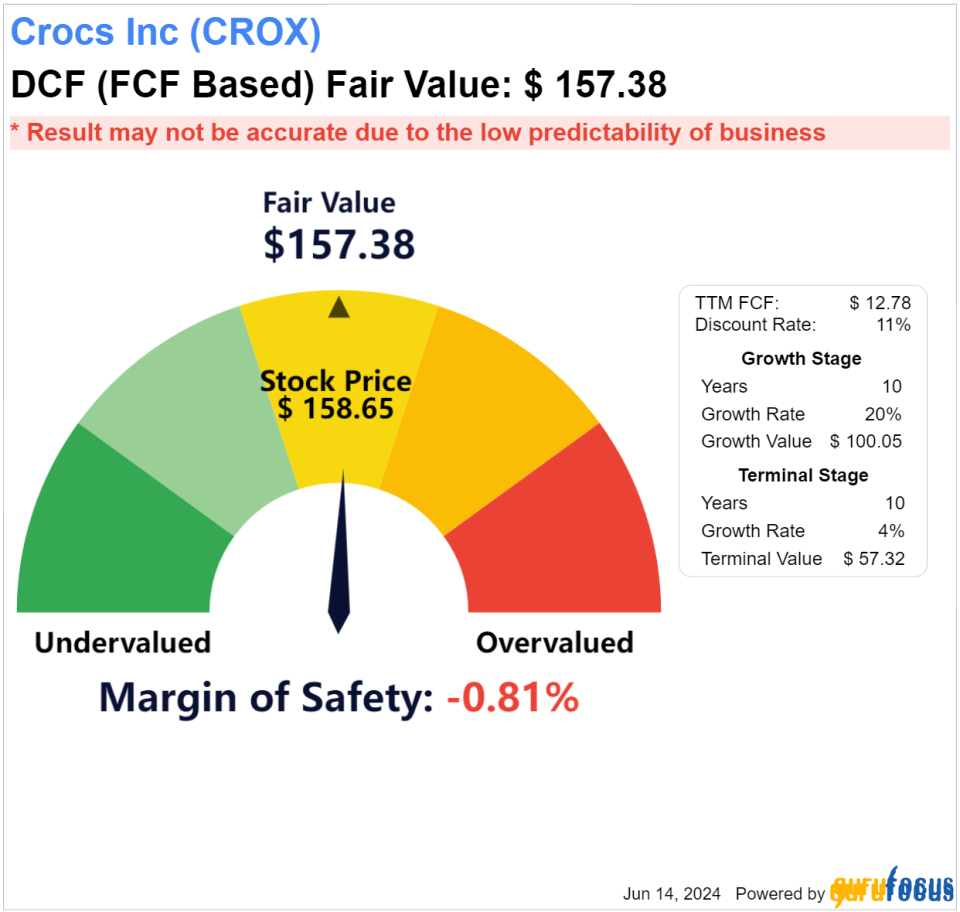

In a reverse discounted cash flow model, one can see that the market assumptions are similar to those described above, with estimates of around 6% FCF growth for the next decade and 4% for the terminal phase and a discount rate of 11%, giving us a price equal to the current one ($157). In other words, even with a history of recent growth and some initiatives that could result in growth being sustained and profitability returning to higher levels at some point in the future, the stock is trading with a certain level of suspicion.

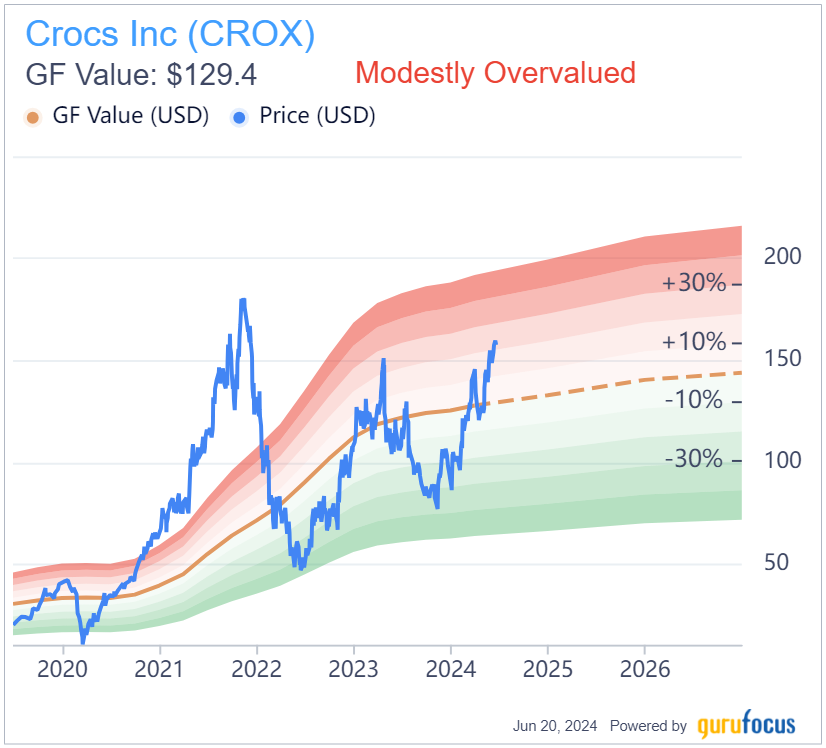

The price-to-earnings ratio is 12, which is below the average of the last five years (14.50). This is quite an attractive level, but it no longer attracts as much attention after the stock’s recent price increases. As for GF Value, recent developments have taken the stock from undervalued to slightly overvalued.

In short, I believe Crocs stands out in the apparel and footwear space, with a business model that offers interesting moats and growth opportunities. Even a DCF with conservative assumptions can support the thesis, which is why I think it’s wise to keep an eye on the stock until it reaches a better margin of safety.

This article first appeared on GuruFocus.