B&M European Value Retail (LON:BME) dividend will be £0.096

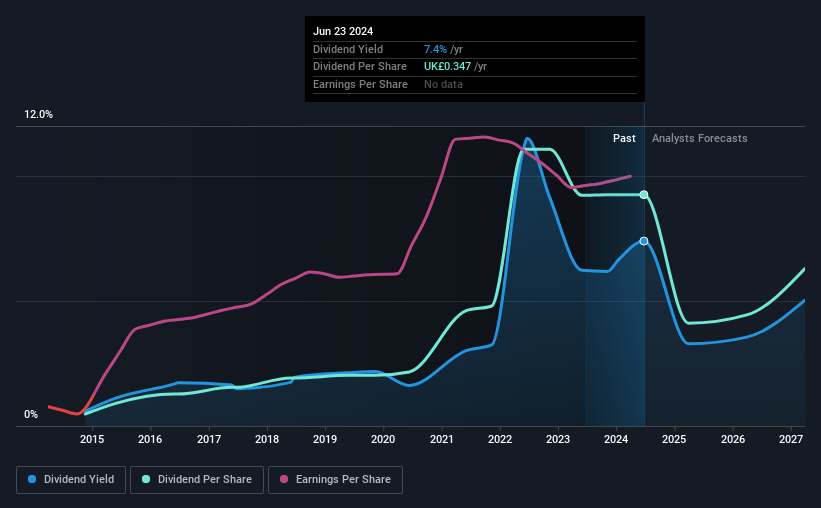

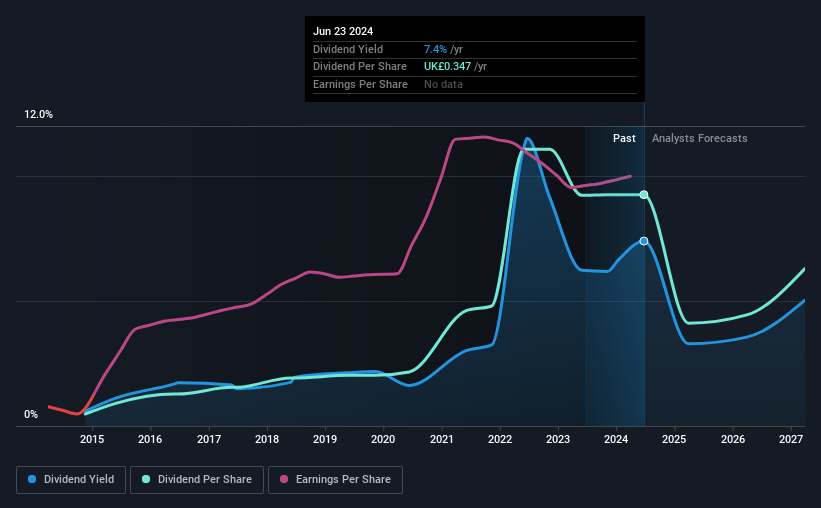

The Board of B&M European Value Retail SA (LON:BME) has announced that it will declare a dividend on August 2. Investors will receive £0.096 per share. The dividend yield based on this payment will be 7.4%, still above the industry average.

Check out our latest analysis for B&M European Value Retail

B&M European Value Retail’s profits easily cover the distributions

We like to see solid dividend yields, but that doesn’t matter if the payment isn’t sustainable. Prior to this announcement, B&M European Value Retail’s dividend was comfortably covered by cash flow and profits. This suggests that a lot of the profits are being reinvested in the business to fuel growth.

Earnings per share are expected to grow 25.2% next year. If the dividend follows recent trends, we believe the payout ratio could reach 88%, which is quite high but still doable.

Dividend volatility

Although the company has a long dividend history, it has been cut at least once in the last 10 years. Since 2014, the dividend has increased from £0.018 annually to £0.347. This means that the company has increased its payouts by about 34% annually during this period. Dividends have increased rapidly during this time, but given the history of cuts, we are not sure if this stock will be a reliable source of income in the future.

The dividend is likely to increase

Rising earnings per share could be a mitigating factor, given past dividend fluctuations. It is encouraging to see that B&M European Value Retail has grown its earnings per share by 13% per year over the past five years. Shareholders are getting a large portion of the profits back, which, combined with the strong growth, makes this quite attractive.

We like B&M European Value Retail’s dividend very much

Overall, we think this is a great income investment and believe that maintaining the dividend this year may have been a conservative decision. The company easily earns enough to cover its dividend payments and it’s nice to see those earnings being converted into cash flow. All in all, this meets many of the criteria we look for when choosing an income stock.

It is important to note that companies with a consistent dividend policy generate more confidence among investors than those with an irregular one. However, despite the importance of dividend payments, they are not the only factors our readers should know when evaluating a company. To take the debate a little further, we have identified the following: 2 warning signals for B&M European Value Retail that investors need to be aware that they are moving forward. Is B&M European Value Retail not quite the opportunity you have been looking for? Check out our Selection of the highest dividend stocks.

Do you have feedback on this article? Are you concerned about the content? Get in touch directly from us. Alternatively, send an email to editorial-team (at) simplywallst.com.

This Simply Wall St article is of a general nature. We comment solely on historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.

Do you have feedback on this article? Are you interested in the content? Contact us directly. Alternatively, send an email to [email protected]