McKinsey estimates that the market value of tokenized RWAs will reach $4 trillion

The US multinational consulting firm McKinsey expects the market value of tokenized real assets to reach up to $4 trillion in six years.

The market capitalization of tokenized real-world assets (RWAs) could reach around $2 trillion by 2030 in a baseline scenario, says consulting giant McKinsey & Company, adding that the value could double to $4 trillion in the optimistic scenario.

In a blog post, the New York-based company says adoption is likely to be driven by mutual funds, bonds, exchange-traded notes (ETNs), loans, securitizations and alternative funds. However, analysts at McKinsey tempered their expectations, saying they are “less optimistic” about the bullish forecast.

Regarding the adoption rate and timing, analysts expect both timing to “vary across asset classes” due to differences in “expected benefits, feasibility, time to impact and risk appetite of market participants.”

“Asset classes with higher market value, higher friction along today’s value chain, less mature traditional infrastructure, or lower liquidity are more likely to disproportionately benefit from tokenization.”

McKinsey

McKinsey is also considering the scenario that risk-weighted assets (RWAs) do not gain the expected traction. However, the firm believes that even in this case, market capitalization could still rise from current levels to around $1 trillion, as the industry is still in the “early stages of adoption.”

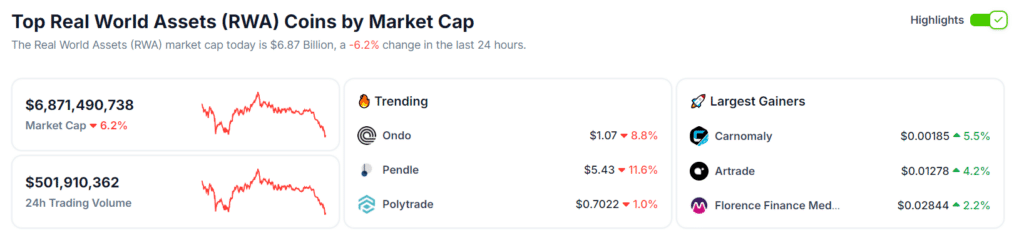

According to CoinGecko data, the total market capitalization of RWAs is about $6.8 billion as of mid-June. Numerous startups in this sector, such as Propy and ONDO Finance, launched their offerings only after 2020, suggesting that they are still in their early stages and that significant developments are only to be expected in the future if all goes well.

Centrifuge, an infrastructure protocol for decentralized finance of real-world assets on the blockchain, was founded in 2017 but only secured $15 million in Series A funding round in 2024, with investments from ParaFi Capital, Greenfield, Arrington Capital, and Circle Ventures, among others.

Despite the promising prospects, McKinsey warns that the current landscape is still evolving. “There are both risks and opportunities for first movers,” the firm says, highlighting the lack of regulatory and legal clarity in many jurisdictions. It underscores the need for “widespread availability of tokenized cash and deposits for wholesale settlement,” which has not yet materialized.

/cloudfront-us-east-1.images.arcpublishing.com/tbt/5F6TFMKHBVHJRAOIZ6AVI24KHY.jpg)