Three elite stocks on the SIX Swiss Exchange with discounts of up to 47.3%

The Swiss stock market experienced a significant decline on Friday, with the SMI index closing down 0.95% amid growing concerns about global economic growth. This recent volatility underscores the importance of identifying stocks that potentially offer intrinsic value, which can be particularly attractive in uncertain market conditions.

The 10 most undervalued stocks in Switzerland based on cash flows

|

Surname |

Current price |

Fair value (estimated) |

Discount (estimated) |

|

COLTENE Holding (SWX:CLTN) |

CHF 48.30 |

CHF 76.14 |

36.6% |

|

Burckhardt Compression Holding (SWX:BCHN) |

CHF 581.00 |

823,07 CHF |

29.4% |

|

Julius Baer Group (SWX:BAER) |

CHF 50.74 |

CHF 96.33 |

47.3% |

|

Sonova Holding (SWX:SOON) |

CHF 271.20 |

CHF 449.27 |

39.6% |

|

Temenos (SWX:TEMN) |

CHF 61.00 |

84,12 CHF |

27.5% |

|

SGS (SWX:SGSN) |

81,20 CHF |

CHF 122.46 |

33.7% |

|

Comet Holding (SWX:COTN) |

CHF 364.50 |

CHF 546.29 |

33.3% |

|

Medartis Holding (SWX:MED) |

CHF 71.00 |

CHF 120.79 |

41.2% |

|

Kudelski (SWX:KUD) |

1,42 CHF |

1,86 CHF |

23.7% |

|

Galderma Group (SWX:GALD) |

CHF 74.86 |

CHF 149.66 |

50% |

Click here to see the full list of 13 stocks from our Undervalued SIX Swiss Exchange Stocks Based on Cash Flows screener.

Let’s examine some outstanding options from the results in the screener

Overview: Julius Baer Group Ltd. is a global asset management company operating in Switzerland, Europe, the Americas and Asia and has a market capitalization of approximately CHF 10.39 billion.

Operations: The company’s turnover in private banking amounts to 3.24 billion francs.

Estimated discount to fair value: 47.3%

The Julius Baer Group is significantly undervalued at CHF 50.74 based on a discounted cash flow valuation with an estimated fair value of CHF 96.33, suggesting significant upside potential. Despite a high bad loan ratio of 2% and a low bad loan provision of 92%, the company’s earnings are expected to significantly outperform the Swiss market, with forecasts showing a CAGR of 21.88%. Recent leadership changes could impact operational dynamics, with Benjamin Sim taking on a key leadership role in Greater China Singapore.

Overview: Swissquote Group Holding Ltd operates worldwide and offers a range of online financial services to retail, high net worth individuals and professional institutional clients with a market capitalization of CHF 4.22 billion.

Operations: The company generates its revenue primarily in two segments: Leveraged Forex, which generated CHF 101.09 million, and Securities Trading, which contributed CHF 429.78 million.

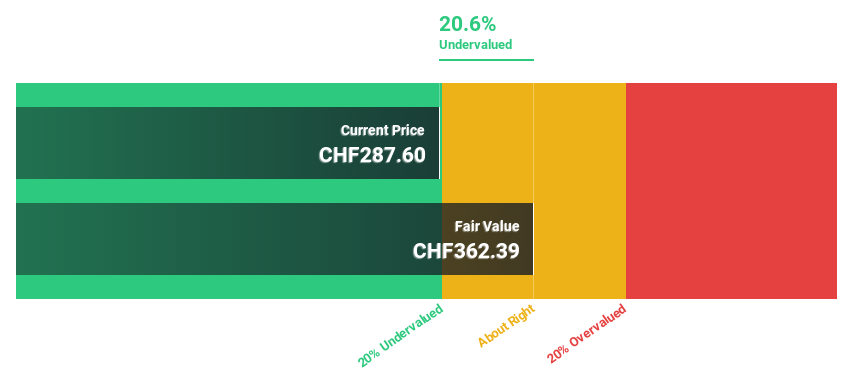

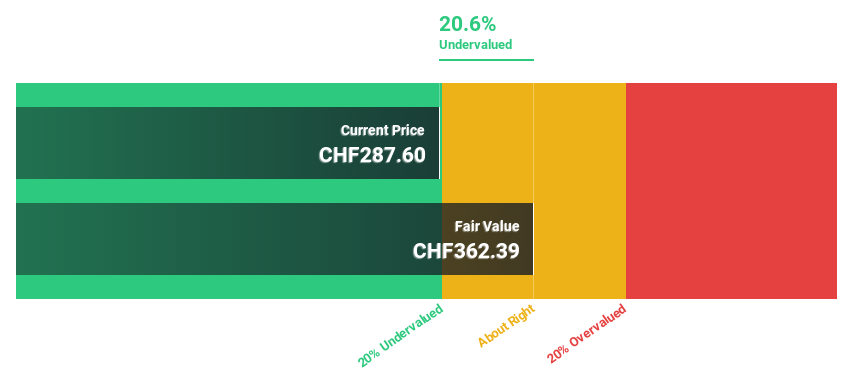

Estimated discount to fair value: 21.8%

Swissquote Group Holding, valued at CHF 284, appears to be undervalued with an estimated fair value of CHF 363.39 (discounted cash flow). The company’s earnings and revenue growth forecasts of 14% and 10.3%, respectively, beat the Swiss market forecasts of 8.3% and 4.4%, respectively. Although the stock trades at a significant discount (21.8%) to its fair value, caution is warranted as the expected annual earnings growth is not exceptionally high but remains robust compared to the market average.

Overview: Temenos AG is a global company that develops, markets and sells integrated banking software systems to financial institutions. Its market capitalization is approximately CHF 4.42 billion.

Operations: The company generates its revenue by providing integrated banking software systems to financial institutions worldwide.

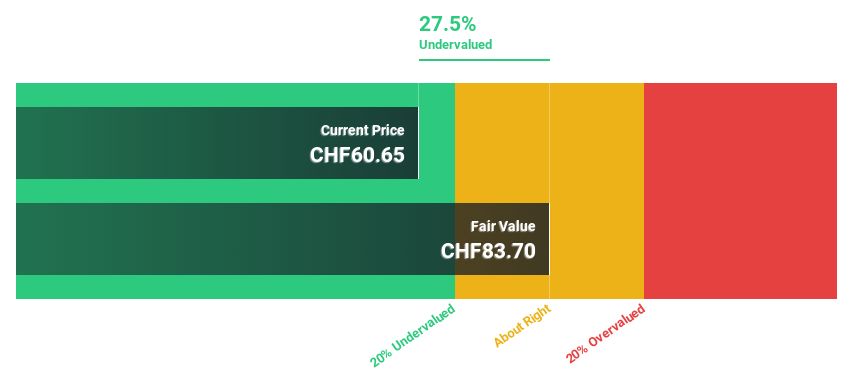

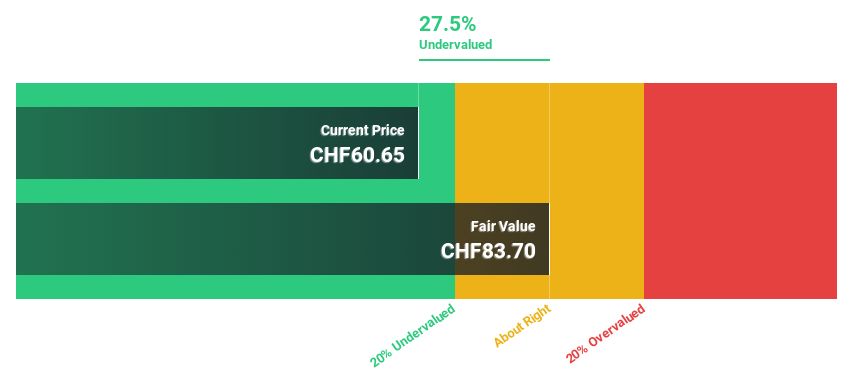

Estimated discount to fair value: 27.5%

Temenos is trading at CHF 61 below its estimated fair value of CHF 84.12, suggesting a potential undervaluation based on cash flows. Recent share buyback plans totaling CHF 200 million underscore confidence in the company’s valuation and capital structure. While Temenos’ earnings are expected to grow 14.7% annually, outperforming the Swiss market at 8.3%, its revenue growth forecast of 7.6% annually is modest compared to high-growth industries, but still beats the Swiss market average of 4.4%. Despite this positive outlook, investors should consider the company’s high level of debt and the volatility of its share price over the past three months.

Take advantage

Looking for a new perspective?

This Simply Wall St article is of a general nature. We provide commentary based solely on historical data and analyst forecasts, using an unbiased methodology. Our articles are not intended as financial advice. They do not constitute a recommendation to buy or sell stocks, and do not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.

Companies discussed in this article include SWX:BAER, SWX:SQN and SWX:TEMN.

Do you have feedback on this article? Are you interested in the content? Contact us directly. Alternatively, send an email to [email protected]