KRX stock tips for June 2024 are expected to trade below their true value

The South Korean stock market has witnessed a remarkable uptrend recently, hitting a 30-month high while the KOSPI index has risen steadily over three sessions. With mixed global forecasts and potential profit-taking in technology sectors, investors are closely monitoring market movements. In this context, identifying stocks trading below their intrinsic value can provide attractive opportunities for those looking to invest in potentially undervalued assets.

The 10 most undervalued stocks in South Korea based on cash flows

|

Surname |

Current price |

Fair value (estimated) |

Discount (estimated) |

|

Solum (KOSE:A248070) |

21,750.00 € |

40,080.13 € |

45.7% |

|

Ilyin Electric Ltd (KOSE:A103590) |

26550,00 € |

50969,74 € |

47.9% |

|

Grand Korea Leisure (KOSE:A114090) |

₩13030.00 |

24618,09 € |

47.1% |

|

Protec (KOSDAQ:A053610) |

30,050.00 € |

55214,32 € |

45.6% |

|

Interojo (KOSDAQ:A119610) |

24900,00 € |

49600,76 € |

49.8% |

|

Revu (KOSDAQ:A443250) |

₩11510.00 |

21,005.02 € |

45.2% |

|

Intellian Technologies (KOSDAQ:A189300) |

56000,00 € |

107495,29 € |

47.9% |

|

IMLtd (KOSDAQ:A101390) |

7070,00 € |

13607,27 € |

48% |

|

Hancom Lifecare (KOSE:A372910) |

5430,00 € |

10711,17 € |

49.3% |

|

NEXON Games (KOSDAQ:A225570) |

₩14150.00 |

25731,72 € |

45% |

Click here to see the full list of 34 stocks from our Undervalued KRX Stocks Based on Cash Flows screener.

Let’s review some notable picks from our reviewed stocks

Overview: Anapass, Inc. is a South Korean company specializing in SoC semiconductor solutions for the display market and has a market capitalization of approximately ₩350.37 billion.

Operations: The company specializes in SoC semiconductor solutions and mainly serves the display market in South Korea.

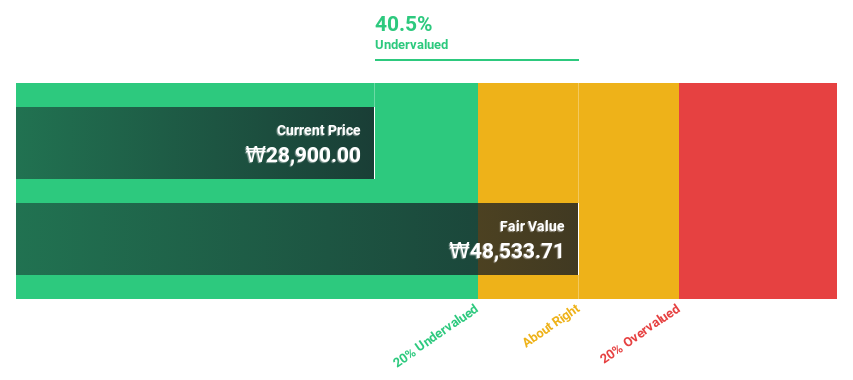

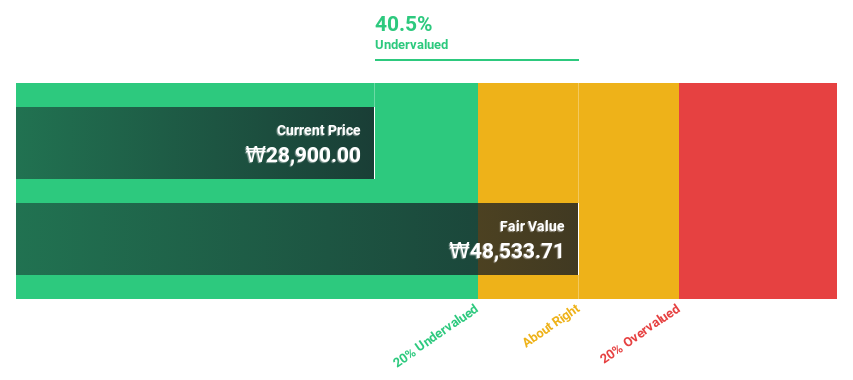

Estimated discount to fair value: 40.5%

Anapass, a South Korean company, is currently trading at ₩28,900, which is 40.5% below its estimated fair value of ₩48,533.71, indicating significant undervaluation based on discounted cash flows. The company has turned profitable this year and has robust growth forecasts. Earnings are expected to grow 115.5% annually over the next three years and revenue is expected to grow 60.7% annually – both figures well above the market average. However, shareholders have suffered dilution over the past year.

Overview: Viol Co., Ltd., a company listed on KOSDAQ under the ticker symbol A335890, specializes in the manufacture of electrical diagnostic and medical equipment and has a market capitalization of approximately ₩588.98 billion.

Operations: The company’s sales in the medical device sector amounted to approximately ₩35.49 billion.

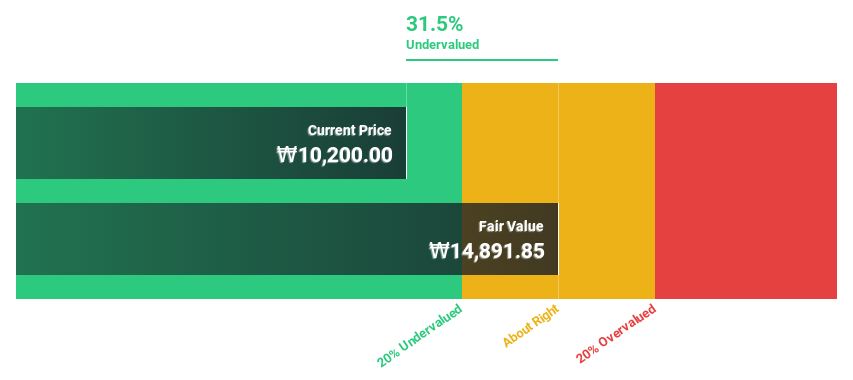

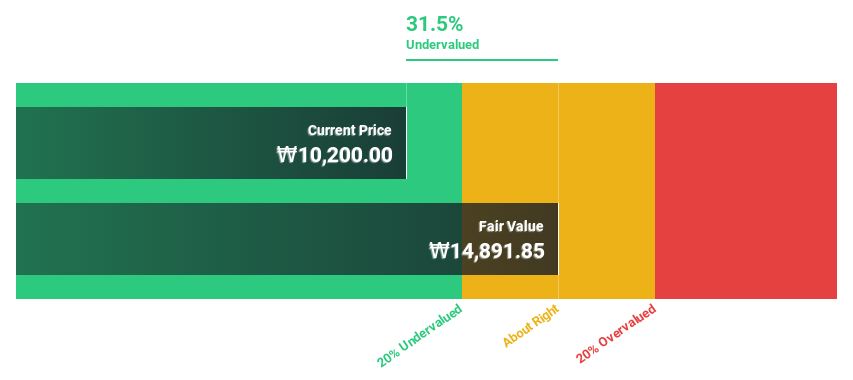

Estimated discount to fair value: 31.5%

VIOL is trading at ₩10,200, well below its fair value of ₩14,891.85, which represents an undervaluation of 31.5%. This South Korean company is poised for significant growth, with earnings expected to grow 30.6% annually, outpacing the market’s 28.7% growth. Revenue growth forecasts are also strong at 29.3% annually, above the market’s 10.5% forecast. Despite these positives, potential investors should note the stock’s high volatility in recent months and the consensus that its price could rise 32.7%.

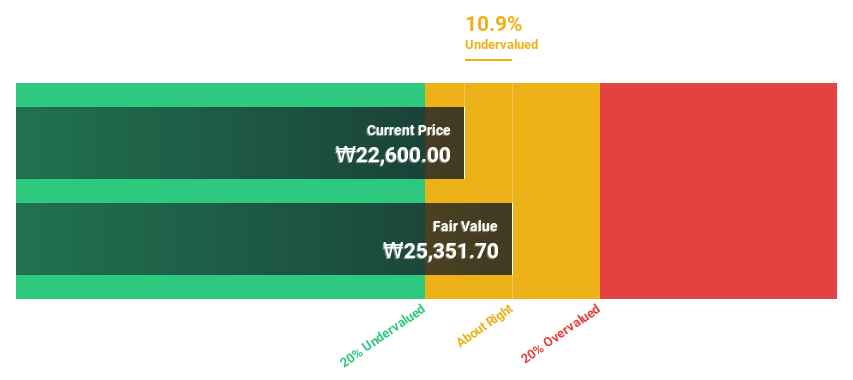

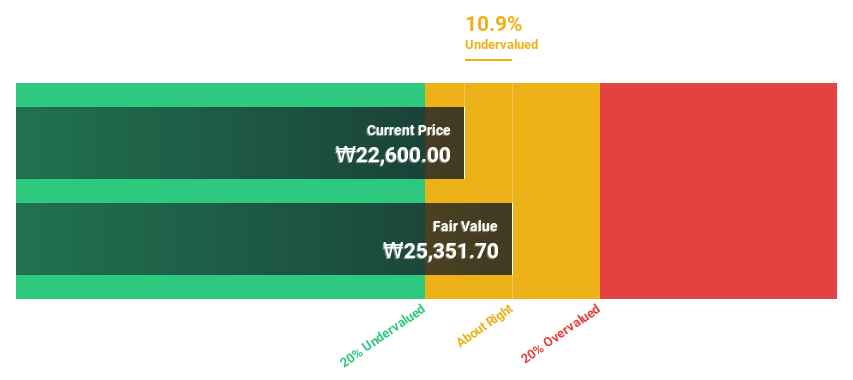

Overview: Doosan Fuel Cell Co., Ltd. is a South Korean company specializing in the development and sales of fuel cells for power generation and has a market capitalization of approximately ₩1.48 trillion.

Operations: The company generates its sales mainly from electrical appliances and totals approximately ₩260.89 billion.

Estimated discount to fair value: 10.9%

Doosan Fuel Cell currently trades at ₩22,600, below our fair value estimate of ₩25,351.7, suggesting slight undervaluation. The company’s earnings are expected to grow 73.25% annually, with revenue growth estimated at 25.4% per year – significantly higher than the South Korean market average of 10.5%. However, the company’s financial position is a concern, as interest payments are not well covered by earnings and the projected return on equity in three years is relatively low at 7.2%.

Make it happen

Looking for a new perspective?

This Simply Wall St article is of a general nature. We provide commentary based solely on historical data and analyst forecasts, using an unbiased methodology. Our articles are not intended as financial advice. They do not constitute a recommendation to buy or sell stocks, and do not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.

Companies discussed in this article include KOSDAQ:A123860KOSDAQ:A335890 and KOSE:A336260

Do you have feedback on this article? Are you interested in the content? Contact us directly. Alternatively, send an email to [email protected]