June 23, 2024, 7:48 AM ET, BY Quentin W. – Contributor | Editor: Thomas H. Kee Jr. (Follow on LinkedIn)

Longer-term trading plans for MSBI

- NONE. details

Currently, there is no support plan that would trigger a purchase of this stock. This usually means that there are currently no clear support levels, so buying the stock when the price is falling could be considered catching a falling knife. Buy signals only occur when resistance breaks to the upside.

This is often a signal that the stock you are watching is weak. Waiting for an uptrend may be wiser than trying to catch a falling knife. New support levels are usually added to the database at the start of the next trading session.

- Short MSBI just below 21.98, target nz, stop loss at 22.04 details

The technical summary data suggests a short of MSBI as it approaches 21.98, but the downside target is not available from the current data. This tells us to hold this position if it is triggered until a new downside target is set (updates occur at the start of each trading session) or until the position is stopped. The summary data tells us to set a stop loss at 22.04. 21.98 is the first resistance level above 21.41, and according to the rule, any test of resistance is a short signal. In this case, a short signal would be present if the 21.98 resistance is tested.

Swing Trading Plans for MSBI

- Buy MSBI just above 21.71, target 21.98, stop loss at 21.65 details

If 21.71 starts to rise, the technical summary data tells us to buy MSBI just above 21.71, with an upside target of 21.98. The data also tells us to set a stop loss at 21.65 in case the stock turns against the trade. 21.71 is the first resistance level above 21.41, and any break above resistance is usually a buy signal. In this case, 21.71, the initial resistance, would rise to the upside, so a buy signal would be present. Since this plan is based on a break of resistance, it is called a Long Resistance Plan.

- Short MSBI just near 21.71, target 21.12, stop loss at 21.77. details

The technical summary data suggests a short MSBI if it tests 21.71 with a downside target of 21.12. However, we should place a stop loss at 21.77 in case the stock starts moving against the trade. Any test of resistance is basically a short signal. In this case, a short signal would be present if the resistance 21.71 is tested. Since this plan is a short plan based on a test of resistance, it is called a short resistance plan.

Day trading plans for MSBI

- Buy MSBI just above 21.46, target 21.98, stop loss at 21.41 details

If 21.46 starts to rise, the technical summary data tells us to buy MSBI just above 21.46, with an upside target of 21.98. The data also tells us to set a stop loss at 21.41 in case the stock turns against the trade. 21.46 is the first resistance level above 21.41, and any break above resistance is usually a buy signal. In this case, 21.46, the initial resistance, would rise to the upside, so a buy signal would be present. Since this plan is based on a break of resistance, it is called a Long Resistance Plan.

- Short MSBI just near 21.46, target 21.12, stop loss at 21.51. details

The technical summary data suggests a short MSBI if it tests 21.46 with a downside target of 21.12. However, we should place a stop loss at 21.51 in case the stock starts moving against the trade. Any test of resistance is basically a short signal. In this case, a short signal would be present if the resistance 21.46 is tested. Since this plan is a short plan based on a test of resistance, it is called a short resistance plan.

Check the timestamp of this data. Updated AI-generated signals for Midland States Bancorp Inc. (MSBI) available here: MSBI.

MSBI ratings for June 23:

| Term → |

Vicinity |

center |

Long |

| reviews |

Weak |

Weak |

Strong |

| 1st place |

0 |

0 |

21.98 |

| place 2 |

21.46 |

21.12 |

24.4 |

| place 3 |

21.84 |

21.71 |

26,99 |

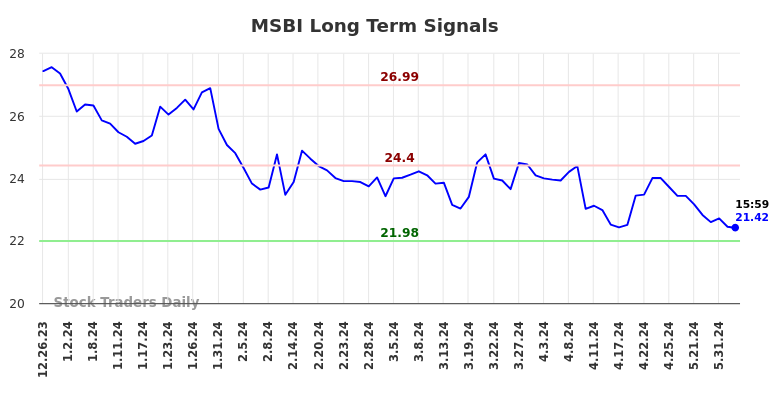

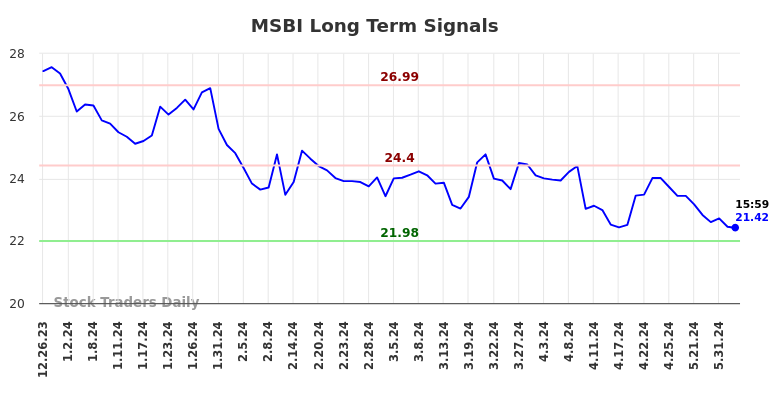

AI-generated signals for MSBI

Blue = Current price

Red = resistance

Green = support

Real-time updates for institutional readers who read regularly:

Instructions:

-

Click the “Get real-time updates” button below.

-

At the login prompt, select “Forgot username?”

-

Enter the email address you use for Factset

-

Log in with the username/password you received.

-

You have access to real-time updates 24/7.

From then on, you can get the real-time update at any time with a single click.

GET REAL-TIME UPDATES

Our leading indicator for a market crash isEvitar Corte.

-

Evitar Corte has warned of the risk of a market crash four times since 2000.

-

The Internet debacle was recognized before it happened.

-

The credit crisis was identified before it occurred.

-

The Corona crash was also recognized in this way.

-

See what Evitar Corte says now.

Get notified when our ratings change:Try it

Our task as #Investors is to pay attention to the #stocks we own. Part of that is looking at the #fundamentals, but half of the disclosure comes from looking at price action. The Midland States Bancorp Inc. The data table (NASDAQ:MSBI) below can help you with the price action and we also have more details. Trading plans for MSBI are also displayed here; these plans are updated in real-time for subscribers for whom this report is static. If you want an update or report on another stock, you can get it here: Unlimited Real-Time Reports.

Fundamental charts for MSBI: