Exploring undervalued small caps with insider action in Hong Kong, July 2024

Against the backdrop of changing market dynamics, the small-cap sector in Hong Kong offers interesting opportunities for sophisticated investors. As global indices reflect a shift towards value and small-cap stocks, this article examines three undervalued small caps in Hong Kong that exhibit promising insider activity.

Top 10 undervalued small caps with insider buying in Hong Kong

|

Surname |

SPORTS |

PS |

Discount to fair value |

Value assessment |

|---|---|---|---|---|

|

China Overseas Grand Oceans Group |

2.4x |

0.1x |

11.76% |

★★★★★☆ |

|

Ever Sunshine Services Group |

5.6x |

0.4x |

21.41% |

★★★★★☆ |

|

Wasion Holdings |

10.5x |

0.8x |

37.01% |

★★★★☆☆ |

|

Nissin Foods |

14.2x |

1.3x |

42.04% |

★★★★☆☆ |

|

China Leon Inspection Holding |

9.6x |

0.7x |

29.33% |

★★★★☆☆ |

|

Investments of the China Education Group |

7.1x |

1.7x |

49.95% |

★★★★☆☆ |

|

Transport International Holdings |

11.7x |

0.6x |

43.90% |

★★★★☆☆ |

|

Skyworth Group |

5.6x |

0.1x |

-304.55% |

★★★☆☆☆ |

|

Kinetic Development Group |

4.0x |

1.8x |

19.31% |

★★★☆☆☆ |

|

Shenzhen International Holdings |

8.0x |

0.7x |

14.62% |

★★★☆☆☆ |

Click here to see the full list of 17 stocks from our Undervalued SEHK Small Caps with Insider Buying screener.

Let’s go through some notable picks from our reviewed stocks.

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Kinetic Development Group is a diversified business company with a market capitalization of approximately CNY 1.23 billion.

Operations: The Company’s gross profit margin has shown a significant upward trend, increasing from 9.05% in September 2013 to approximately 59.07% in July 2024. This improvement reflects a significant increase in cost management efficiency and operational execution over the period and indicates robust growth in profitability relative to cost of goods sold (COGS).

SPORTS: 4.0x

Kinetic Development Group, a lesser-known company in Hong Kong’s busy market, recently changed its corporate governance structures and reduced its annual dividend to HK$0.05 per share starting May 7, 2024. These changes reflect a strategic pivot within a funding model that relies solely on external borrowings – which is considered riskier than customer deposits. Despite these challenges, insider confidence is evident in executives’ recent share purchases, indicating belief in the company’s potential growth and resilience. This activity suggests that Kinetic may be poised for recovery or growth despite current concerns about its financial structuring.

Simply Wall St Value Rating: ★★★★☆☆

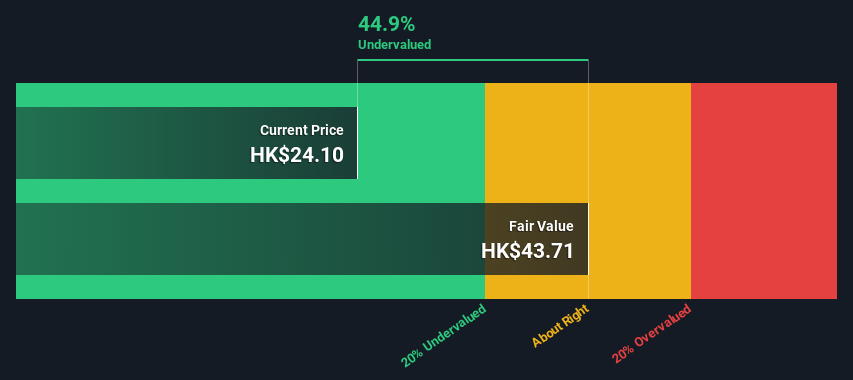

Overview: Comba Telecom Systems Holdings specializes in the provision of wireless telecommunications network system equipment and services, primarily serving operators in the telecommunications sector. The company has a market capitalization of approximately HK$1.53 billion.

Operations: The company generates substantial revenue of HK$5.82 billion from wireless telecommunications network equipment and services, supplemented by telecommunications services from operators amounting to HK$157.83 million. In recent periods, the gross profit margin showed a fluctuation process with notable figures such as 28.44% in June 2016 and a decline to 27.79% by December 2023, indicating fluctuations in cost management relative to revenue.

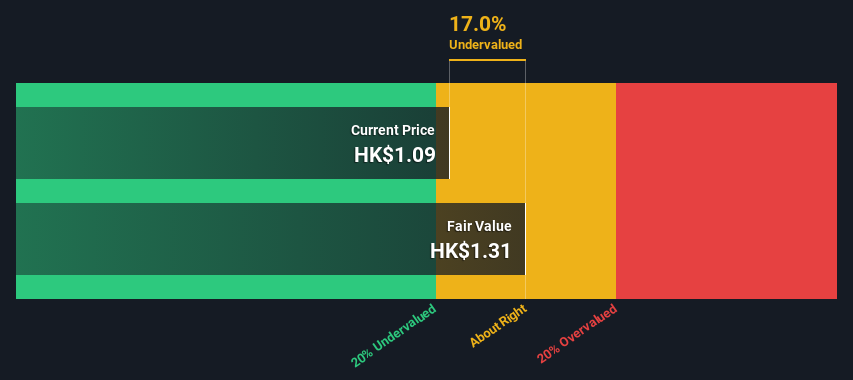

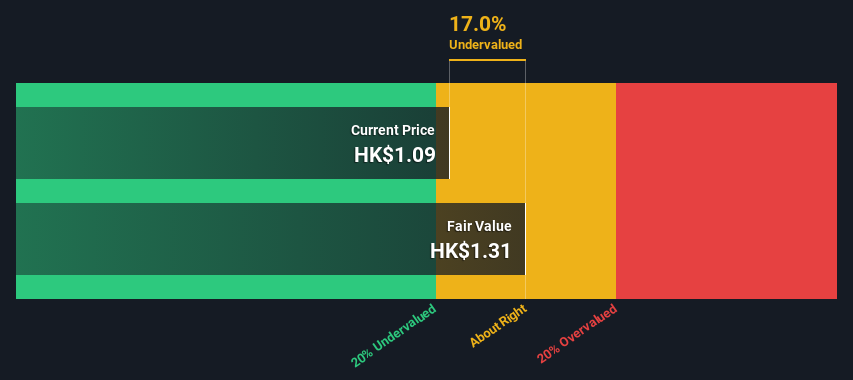

SPORTS: 373.2x

Comba Telecom Systems Holdings recently demonstrated its potential at MWC Shanghai, underlining its market presence. Tung Ling Fok’s recent acquisition of 1.83 million shares demonstrates strong insider confidence and reflects belief in the company’s growth trajectory. Despite a volatile share price and lower profit margins year-on-year, the company’s strategic buyback program launched on June 3 aims to increase shareholder value by using legally available funds. This approach could potentially increase net assets per share and earnings.

Simply Wall St Value Rating: ★★★★★☆

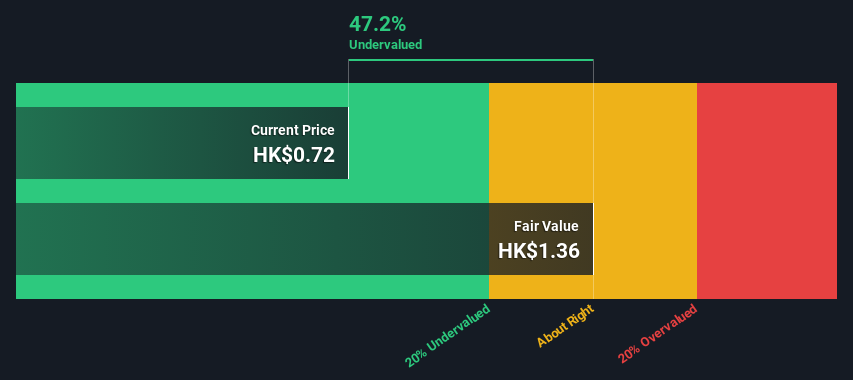

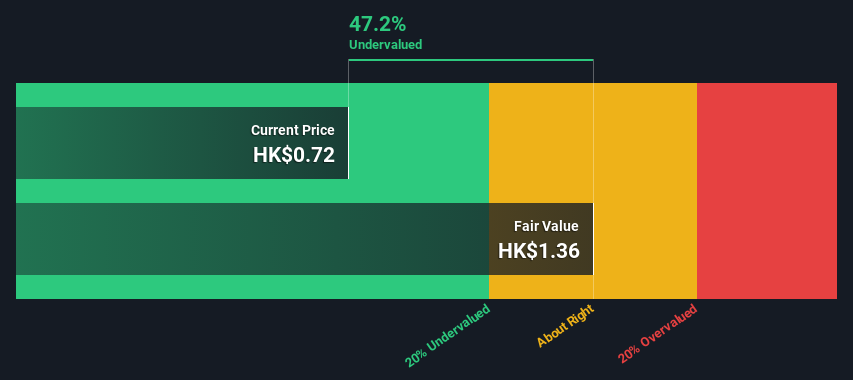

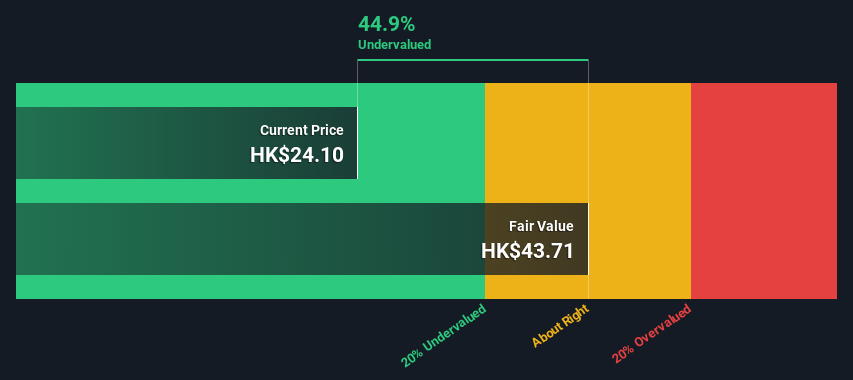

Overview: Ferretti specializes in the development, construction and marketing of yachts and sports boats and has a market capitalization of around 1.23 billion euros.

Operations: The company generates revenues of EUR 1.23 billion from the design, construction and marketing of yachts and pleasure boats. It reported a net profit of EUR 83.05 million with a gross profit margin of 37.08%.

SPORTS: 11.5x

Ferretti, a lesser-known company in the Hong Kong market, recently presented robust financial guidance at the UniCredit Italian Investment Conference, forecasting revenue growth of between 9.8% and 11.6% for 2024. Insiders’ confidence is evident as they have recently purchased shares, suggesting they believe in the company’s prospects despite its reliance on external borrowings – a riskier financing mechanism. With earnings expected to grow by about 12.46% annually, Ferretti’s mix of ambitious financial targets and insider buying activity paints a promising picture for potential growth.

Next Steps

Looking for other investments?

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.

The companies discussed in this article include SEHK:1277, SEHK:2342 and SEHK:9638.

Do you have feedback on this article? Are you interested in the content? Contact us directly. Alternatively, send an email to [email protected]