Three SEHK shares are expected to trade 23.7 to 49.4 percent below their intrinsic value

Amid global market volatility and heightened trade tensions, the Hong Kong stock market has experienced its own challenges, with the Hang Seng Index declining significantly. This environment potentially provides investors with an opportunity to identify stocks that may be undervalued relative to their intrinsic value. During such times, sophisticated investors often look for companies with solid fundamentals that appear undervalued by the market – stocks that could represent value in an otherwise turbulent investment landscape.

Top 10 undervalued stocks in Hong Kong based on cash flows

|

Surname |

Current price |

Fair value (estimated) |

Discount (estimated) |

|

Giant Biogene Holding (SEHK:2367) |

HK$41.10 |

HK$75.91 |

45.9% |

|

China Cinda Asset Management (SEHK:1359) |

HK$0.67 |

1.29HK$ |

48% |

|

Super Hi International Holding (SEHK:9658) |

HK$12.92 |

HK$25.75 |

49.8% |

|

Zijin Mining Group (SEHK:2899) |

HK$16.20 |

HK$32.23 |

49.7% |

|

West China Cement (SEHK:2233) |

1.09HK$ |

HK$2.15 |

49.4% |

|

BYD (SEHK:1211) |

246,00 € |

464,63 € |

47.1% |

|

Hangzhou SF Intra-city Industrial (SEHK:9699) |

HK$10.30 |

HK$19.37 |

46.8% |

|

Mobvista (SEHK:1860) |

HK$1.98 |

HK$3.72 |

46.8% |

|

Vobile Group (SEHK:3738) |

1.22HK$ |

HK$2.31 |

47.2% |

|

MicroPort Scientific (SEHK:853) |

HK$5.36 |

9,69 € |

44.7% |

Click here to see the full list of 39 stocks from our Undervalued SEHK Stocks Based on Cash Flows screener.

We examine a selection of our screener results.

Overview: China Cinda Asset Management Co., Ltd. is engaged in the acquisition, management, investment and disposal of distressed assets of financial and non-financial institutions in the People’s Republic of China and Hong Kong and has a market capitalization of approximately HK$25.57 billion.

Operations: The company’s revenues mainly come from financial services, which generates CNY 12.71 billion, and from non-performing asset management, which includes financial investments and asset management activities, contributing CNY 11.04 billion.

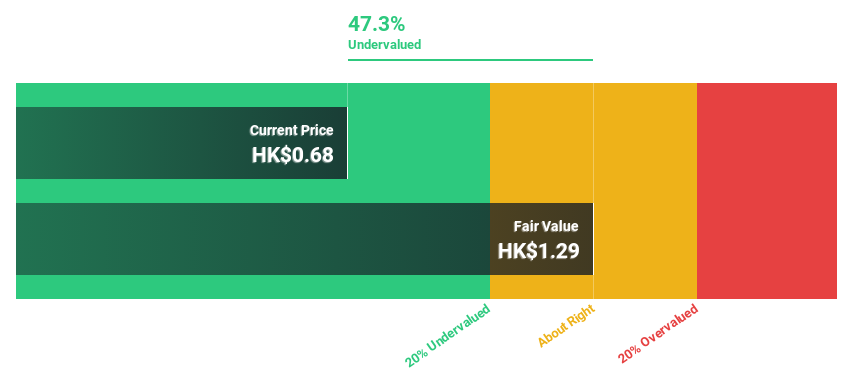

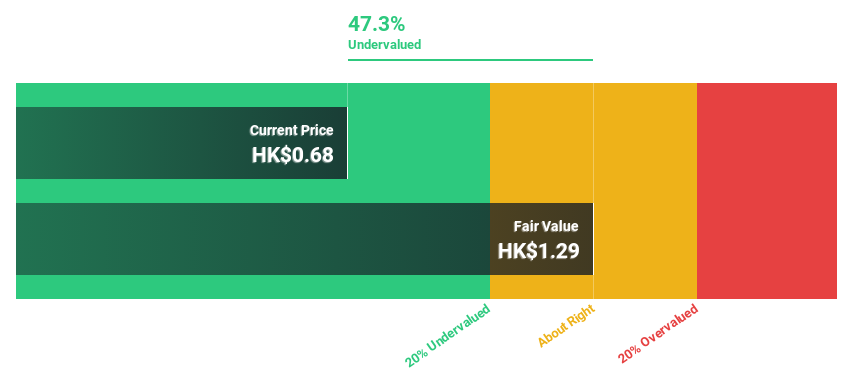

Estimated discount to fair value: 48%

China Cinda Asset Management is currently trading at HK$0.67, well below the estimated fair value of HK$1.29, indicating potential undervaluation. Despite a recent dividend cut to RMB0.4576 per 10 shares, the company’s revenue and earnings growth is expected to significantly outperform that of the Hong Kong market. Revenues are expected to grow 31.3% and earnings 20.17% annually. However, the company’s debt is not well covered by operating cash flow, and return on equity is expected to remain low at 3.5%.

Overview: West China Cement Limited is an investment holding company that produces and markets cement and cement products in the People’s Republic of China. Its market capitalization is approximately HK$5.95 billion.

Operations: The company generates its revenue mainly from business activities in the People’s Republic of China and internationally, with sales of CNY 6.31 billion and CNY 2.77 billion respectively.

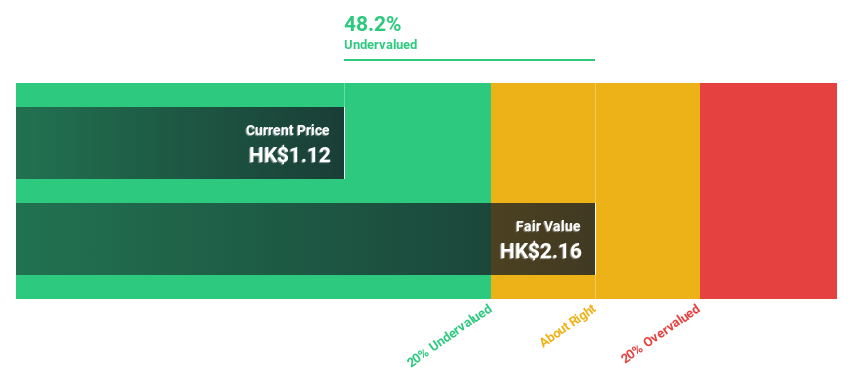

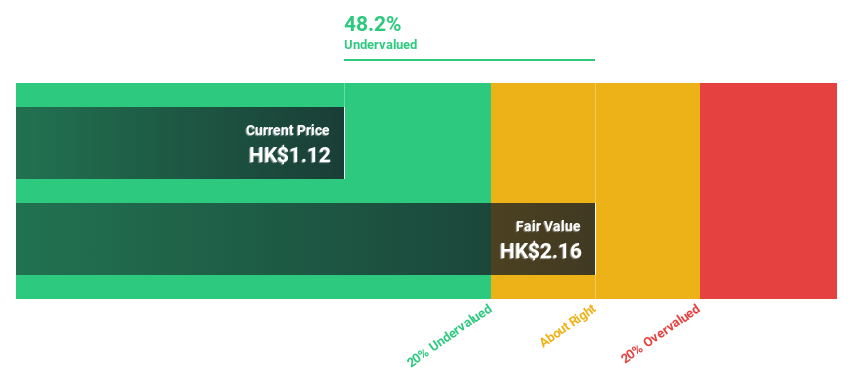

Estimated discount to fair value: 49.4%

West China Cement is trading at HK$1.09, well below its calculated fair value of HK$2.15, suggesting significant undervaluation based on cash flows. Recent corporate changes include a reduced dividend payout and an update to the company’s charter. While the company’s revenue is expected to grow 20.2% annually, outpacing Hong Kong’s average growth rate, its profit margins have declined year-on-year. In addition, despite a high level of debt, profits are expected to grow significantly over the next three years.

Overview: Yunkang Group Limited, a medical surgery services provider based in the People’s Republic of China, has a market capitalization of approximately HK$5.33 billion.

Operations: The company generates its revenue primarily through the provision of diagnostic tests to hospitals and non-medical customers; the total revenue amounts to CNY 891.50 million.

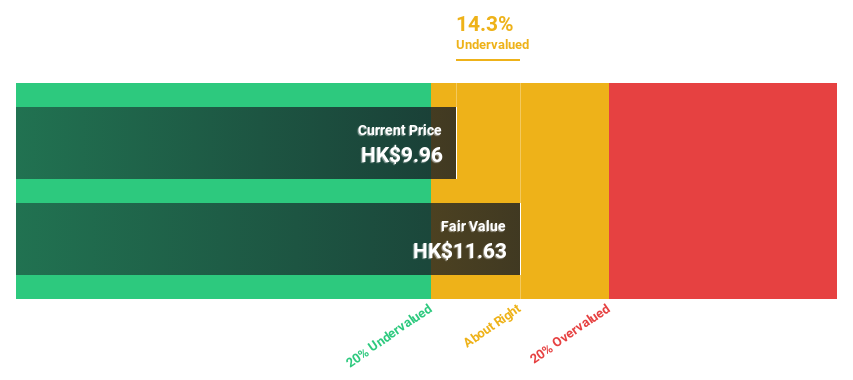

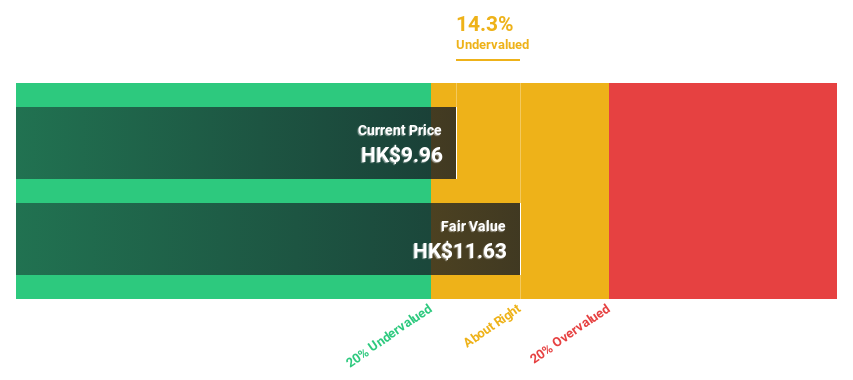

Estimated discount to fair value: 23.7%

Yunkang Group Limited trades at HK$8.86 and is considered undervalued. The estimated fair value is HK$11.61 based on discounted cash flows, which represents an undervaluation of 23.7%. Despite a recent dividend cut to HK$0.02 per share, analysts forecast the share price could rise by 57.9%. The company’s revenue growth is estimated at 10.9% annually over the next three years – outperforming the Hong Kong market average of 7.8%. However, the forecast return on equity remains low at 2.4%.

Next Steps

Looking for other investments?

This Simply Wall St article is of a general nature. We comment based solely on historical data and analyst forecasts, using an unbiased methodology. Our articles are not intended as financial advice. They do not constitute a recommendation to buy or sell stocks and do not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.

The companies discussed in this article include SEHK:1359, SEHK:2233 and SEHK:2325.

Do you have feedback on this article? Are you interested in the content? Contact us directly. Alternatively, send an email to [email protected]