Exploring three undervalued small caps with insider information in the region

With global markets showing mixed reactions and moving significantly towards small-cap and value stocks, investors are closely monitoring changes in market dynamics influenced by economic indicators and geopolitical tensions. Under these conditions, it can be particularly interesting to identify undervalued small-cap stocks that show evidence of insider buying, as such actions often signal confidence from those who know the company best.

Top 10 undervalued small caps with insider purchases

|

Surname |

SPORTS |

PS |

Discount to fair value |

Value assessment |

|---|---|---|---|---|

|

Bytes Technology Group |

25.0x |

5.7x |

0.71% |

★★★★★☆ |

|

Hanover Bancorp |

8.9x |

2.0x |

46.13% |

★★★★★☆ |

|

Calfrac Well Services |

2.3x |

0.2x |

27.94% |

★★★★★☆ |

|

Primaris Real Estate Investment Trust |

11.5x |

3.0x |

34.80% |

★★★★★☆ |

|

Thryv investments |

N/A |

0.7x |

28.59% |

★★★★★☆ |

|

AtriCure |

N/A |

2.8x |

46.29% |

★★★★★☆ |

|

Norcros |

8.2x |

0.6x |

-16.38% |

★★★☆☆☆ |

|

Russel Metals |

9.2x |

0.5x |

-7.78% |

★★★☆☆☆ |

|

Community West Bancshares |

18.7x |

2.9x |

42.25% |

★★★☆☆☆ |

|

Delek US Holdings |

N/A |

0.1x |

-120.08% |

★★★☆☆☆ |

Click here to see the full list of 224 stocks from our Undervalued Small Caps with Insider Buying screener.

Here’s a quick look at some of the choices from the screener.

Simply Wall St Value Rating: ★★★★★☆

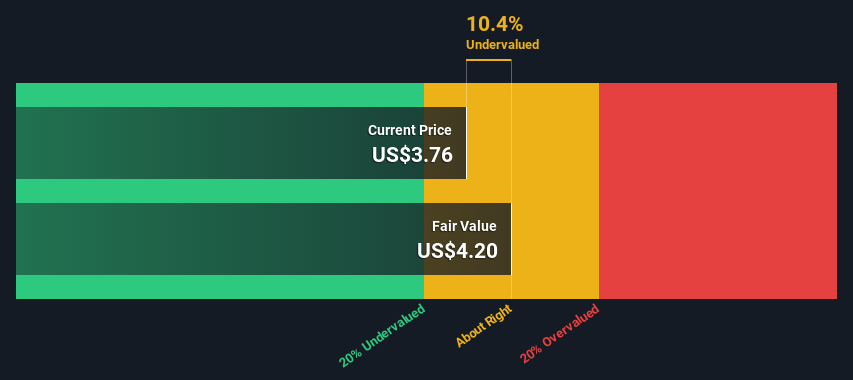

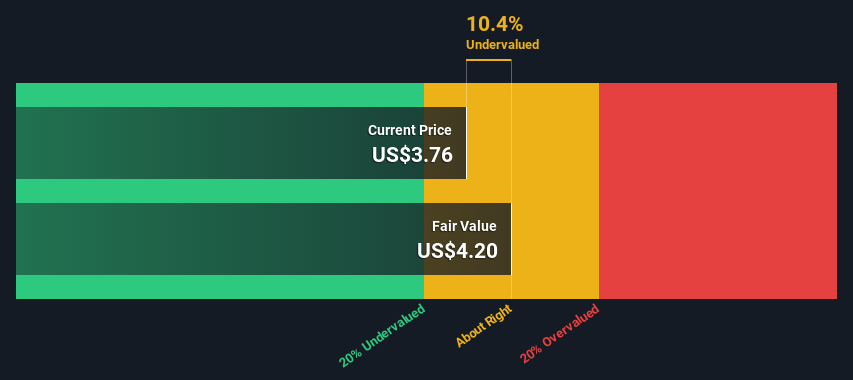

Overview: Petco Health and Wellness Company is a specialty retailer of pet-related products and services with a market capitalization of approximately $2.53 billion.

Operations: Specialty Retail generates substantial revenue totaling $6.23 billion with a notable gross profit margin of 37.38% in the last fiscal year. The company’s cost of goods sold was last reported at $3.90 billion, reflecting significant operating expenses that impact profitability.

SPORTS: -0.7x

Petco Health and Wellness Company, recently added to the Russell 2000 Index, reflects a strategic turnaround with the appointment of Joel D. Anderson as CEO, effective July 29, 2024. Under Anderson’s leadership at Five Below, the company has experienced significant expansion and revenue growth, suggesting the potential for similar success at Petco. Despite recent earnings volatility and a net loss in the first quarter of 2025, insider confidence is evident, with executives recently purchasing shares, underscoring belief in the company’s trajectory amid operational improvements.

Simply Wall St Value Rating: ★★★☆☆☆

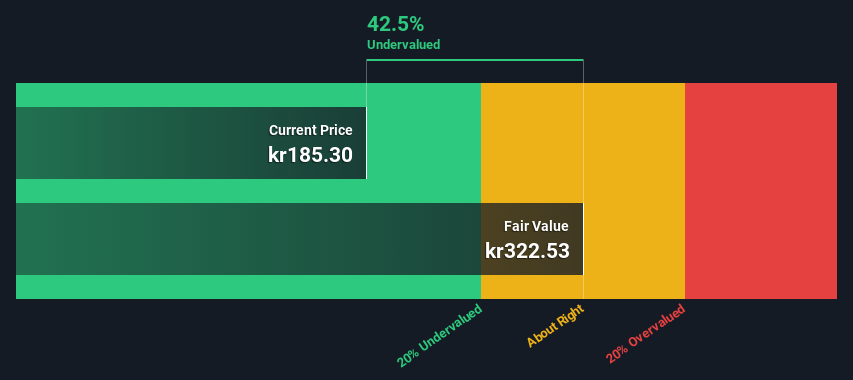

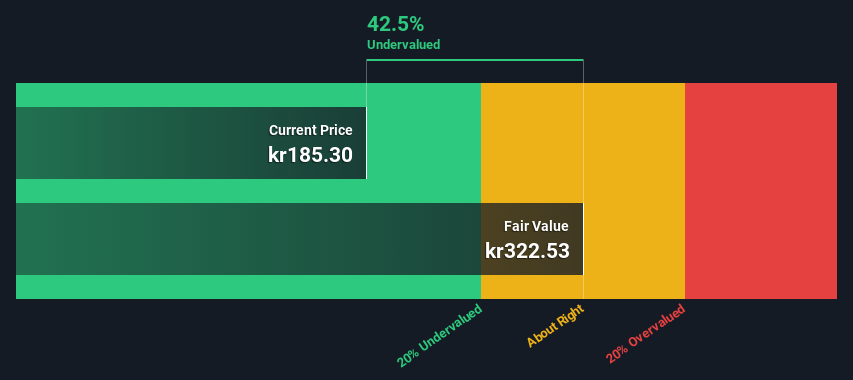

Overview: Biotage is a company specializing in healthcare software with a market capitalization of approximately SEK 2.08 billion.

Operations: Healthcare Software generated revenue of SEK 2.08 billion and had a remarkable gross profit margin of 62.73% in the last period. The company’s net profit for the same period was SEK 251 million, which corresponds to a net profit margin of approximately 12.08%.

SPORTS: 59.1x

Amid a landscape full of merger and acquisition rumors, Biotage has demonstrated financial resilience: revenue increased to SEK 504 million in the second quarter from SEK 409 million a year ago and net profit increased to SEK 48 million. This growth story is complemented by insider confidence, as demonstrated by recent share purchases by company insiders signaling their belief in the company’s solid prospects. In addition, Biotage’s strategic considerations regarding potential acquisitions or partnerships underscore its proactive stance in seizing industry opportunities.

Simply Wall St Value Rating: ★★★☆☆☆

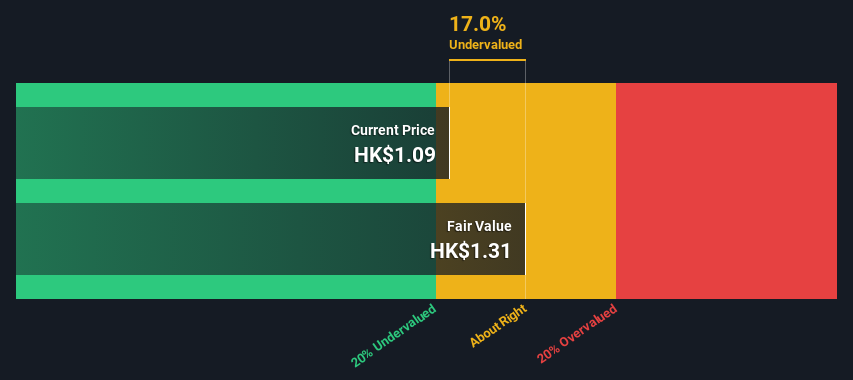

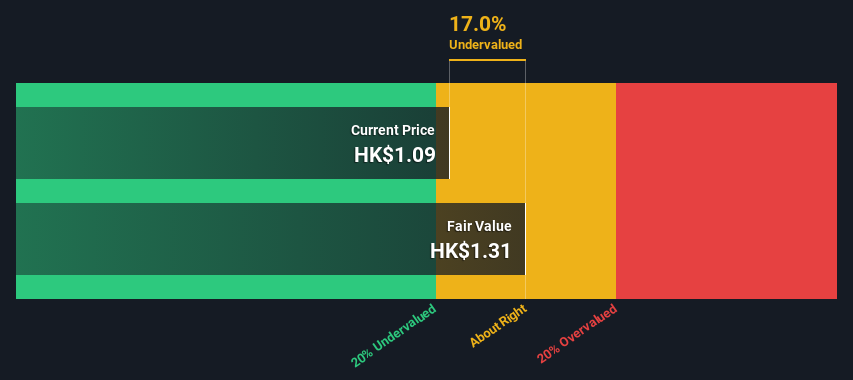

Overview: Kinetic Development Group is a company primarily engaged in real estate development and investment activities and has a market capitalization of approximately 1.27 billion Chinese yen.

Operations: The company recorded a significant increase in gross profit margin from 9.05% in September 2013 to 59.07% in July 2024, demonstrating significant improvements in cost management relative to revenue generation. This financial trend is supported by a steady increase in revenue from CN¥102.90 million to CN¥4745.07 million during the same period, demonstrating significant growth in business scale and efficiency.

SPORTS: 4.3x

Reflecting a strategic position in the market, Kinetic Development Group has recently gained insiders’ trust through significant share purchases. The company operates on a financing model based solely on external borrowings – which is considered riskier but potentially more rewarding – underscoring its attractiveness for undervalued companies. Despite a dividend cut to HKD 0.05 per share from May 2024, adjustments to the company’s charter indicate a streamlined corporate governance structure designed to ensure future resilience and growth prospects in the sector.

Next Steps

Ready for a different approach?

This Simply Wall St article is of a general nature. We comment solely on the basis of historical data and analyst forecasts, using an unbiased methodology. Our articles do not constitute financial advice. It is not a recommendation to buy or sell any stock and does not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.

Companies discussed in this article include NasdaqGS:WOOF OM:BIOT and SEHK:1277.

Do you have feedback on this article? Are you interested in the content? Contact us directly. Alternatively, send an email to [email protected]