Exploring value opportunities on the Swedish stock exchange in July 2024

As global markets go through a period marked by rising trade tensions and shifting investment trends towards value and small-cap stocks, the Swedish stock market offers unique opportunities for those looking for undervalued assets. Under these conditions, identifying stocks that have strong fundamentals but are trading below their intrinsic value could offer the potential for significant returns.

The 10 most undervalued stocks in Sweden based on cash flow

| Surname | Current price | Fair value (estimated) | Discount (estimated) |

| Gränges (OM:GRNG) | 136,90 SEK | 260,89 SEK | 47.5% |

| Truecaller (OM:TRUE B) | 35.66 SEK | 70.77 SEK | 49.6% |

| Nordic Waterproofing Holding (OM:NWG) | 160,60 SEK | 313,50 SEK | 48.8% |

| Scandi Standard (OM:SCST) | 74,80 SEK | 145,57 SEK | 48.6% |

| TF Bank (OM:TFBANK) | 260,00 SEK | 518,40 SEK | 49.8% |

| RaySearch Laboratories (OM:RAY B) | 139,80 SEK | 278,37 SEK | 49.8% |

| Nordisk Bergteknik (OM:NORB B) | 17,00 SEK | 31.02 SEK | 45.2% |

| Humble Group (OM:HUMBLE) | 10.27 SEK | 18.71 SEK | 45.1% |

| Image systems (OM:IS) | 1,465 SEK | 2.85 SEK | 48.6% |

| Bactiguard Holding (OM:BACTI B) | 69,40 SEK | 132.12 SEK | 47.5% |

Click here to see the full list of 47 stocks from our Undervalued Swedish Stocks Based on Cash Flows screener.

We’ll look at some of the best tips from our screener tool.

Overview: Billerud AB (publ) is a global supplier of paper and packaging materials with a market capitalization of approximately SEK 26.69 billion.

Operations: The company generates its revenue primarily in Europe and North America, where it generates SEK 26.57 billion and SEK 10.96 billion respectively, plus additional contributions from other solutions totaling SEK 2.84 billion.

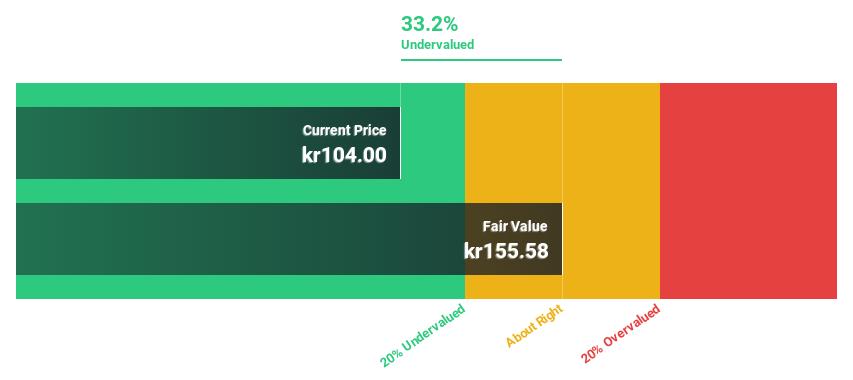

Estimated discount to fair value: 35%

Billerud, which has recently recovered earnings and boasts an impressive 41.82% annual earnings growth forecast, appears to be undervalued based on cash flows. It is trading at SEK 107.3, well below the estimated fair value of SEK 165.03. Despite some challenges such as a low return on equity expected to be 8.3% in three years and a dividend coverage problem as current dividends are not well covered by earnings, the company offers a potential opportunity. Recent leadership changes and strategic shifts towards US packaging materials may impact future performance.

Overview: CellaVision AB (publ) specializes in the development and sale of instruments, software and reagents for the analysis of blood and body fluids. The company operates both in Sweden and internationally and has a market capitalization of approximately SEK 6.14 billion.

Operations: The company generates SEK 708.28 million from its automated microscopy systems and reagents segment in hematology.

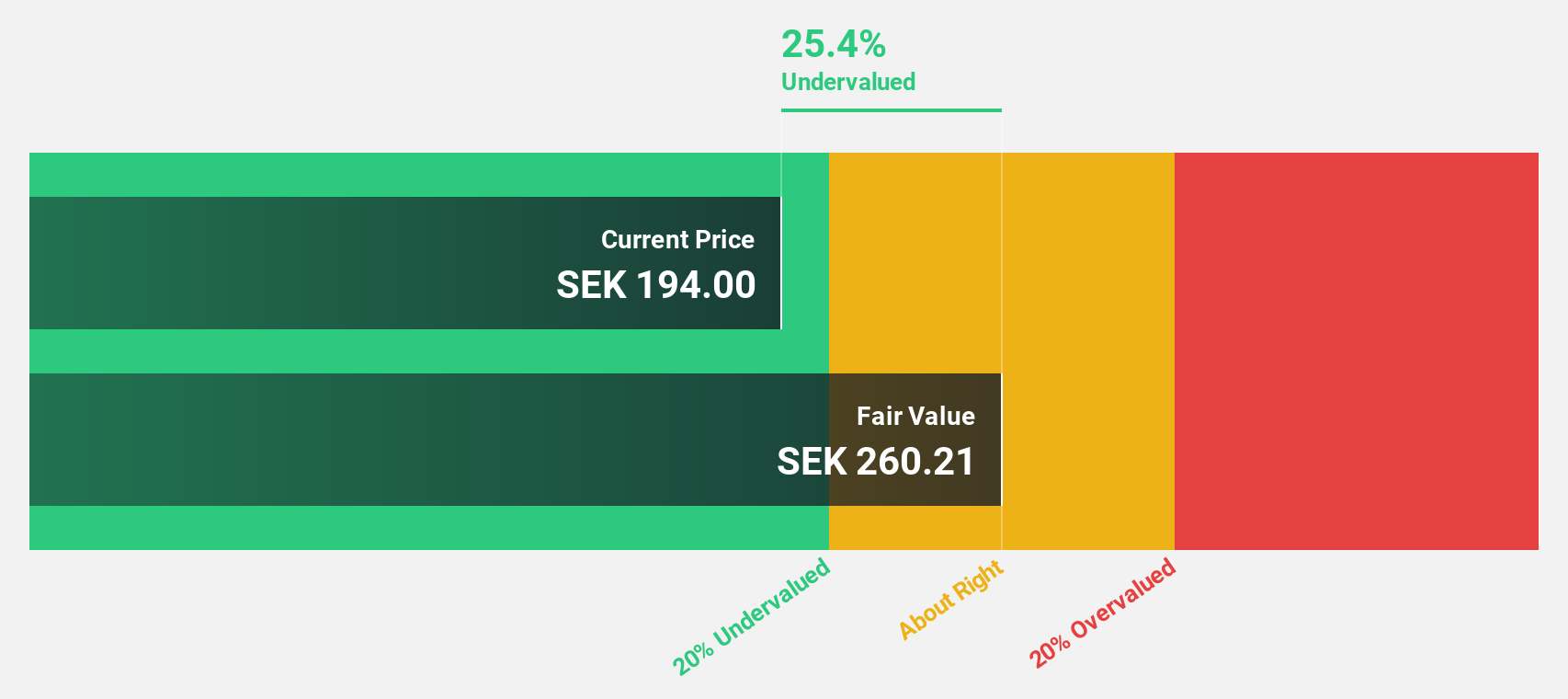

Estimated discount to fair value: 20.8%

Currently trading at SEK 257.5, CellaVision is trading below its fair value of SEK 325.33, which represents an undervaluation of 20.8% on a discounted cash flow basis. With forecast earnings growth of 24.28% annually over the next three years – beating the Swedish market’s expected 15% – and a robust forecast return on equity of 23.8%, CellaVision has strong financial health and growth potential. However, the revenue growth estimate of 13.6% annually is below the high growth benchmark, but still exceeds the broader market forecast of 1%.

Overview: Scandi Standard AB (publ) is a producer and seller of chilled, frozen and ready-to-eat chicken products in Sweden, Norway, Ireland, Denmark, Finland, Germany, the United Kingdom and other European countries with a market capitalization of approximately SEK 4.89 billion.

Operations: The company generates its sales primarily from its ready-to-cook and ready-to-eat chicken products, with the individual segments generating SEK 9.70 billion and SEK 2.61 billion respectively.

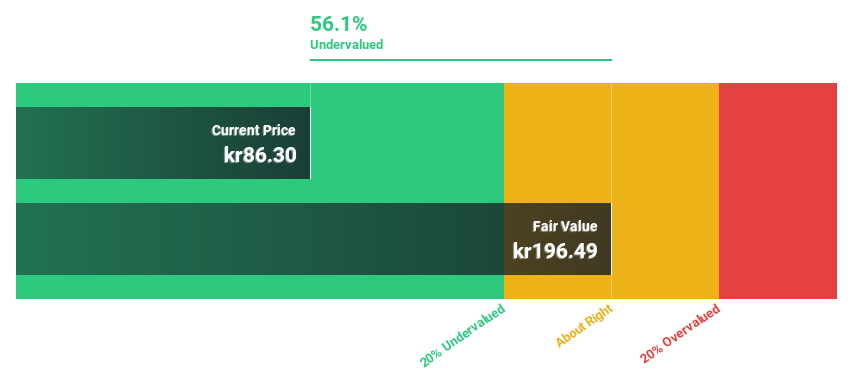

Estimated discount to fair value: 48.6%

Scandi Standard is trading at a current price of SEK 74.8, well below its calculated fair value of SEK 145.57, suggesting a possible undervaluation based on cash flows. Nevertheless, the company’s high debt and unstable dividend history are cause for concern. Recent financial agreements aim to refinance existing debt and support growth strategies, potentially improving financial flexibility. Earnings are expected to grow by 20.39% annually, beating the Swedish market forecast of 15% growth per year.

Seize the opportunity

Interested in other options?

This Simply Wall St article is of a general nature. We comment based solely on historical data and analyst forecasts, using an unbiased methodology. Our articles are not intended as financial advice. They do not constitute a recommendation to buy or sell stocks and do not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.

Valuation is complex, but we help simplify it.

Find out if Billerud may be over- or undervalued by checking our comprehensive analysis which includes Fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View free analysis

Do you have feedback on this article? Are you interested in the content? Contact us directly. Alternatively, send an email to [email protected]