Valuation in China: Three stocks are trading on the Chinese stock exchange between 27.2% and 40.2% below their estimated intrinsic value

In an environment of volatile global markets, where significant tensions between the US and China are affecting trade dynamics, Chinese equities have proven resilient. This context presents an interesting opportunity for investors to consider undervalued stocks in China, particularly those that may be trading below their estimated intrinsic value due to these broader economic currents.

The 10 most undervalued stocks in China based on cash flows

|

Surname |

Current price |

Fair value (estimated) |

Discount (estimated) |

|

Imeik Technology Development Ltd (SZSE:300896) |

171.21 CN¥ |

CN¥322.86 |

47% |

|

Ningbo Dechang Electrical Machinery Manufactured (SHSE:605555) |

17.45 CN¥ |

33.00 CN¥ |

47.1% |

|

Beijing Kawin Technology Share Holding (SHSE:688687) |

24.29 CN¥ |

46.09 CN¥ |

47.3% |

|

Shenzhen Ridge Engineering Consulting (SZSE:300977) |

15.64 CN¥ |

29.91 CNY |

47.7% |

|

INKON Life Technology (SZSE:300143) |

7.47 CNY |

14.64 CNY |

49% |

|

China Film (SHSE:600977) |

10.58 CNY |

20.30 CN¥ |

47.9% |

|

Jiangsu Chuanzhiboke Education Technology (SZSE:003032) |

8.71 CNY |

17.33 CNY |

49.7% |

|

Seres Group Ltd (SHSE:601127) |

75.30 CN¥ |

149.83 CNY |

49.7% |

|

Shanghai Milkground Food Tech (SHSE:600882) |

13.83 CNY |

26.97 CNY |

48.7% |

|

Quectel Wireless Solutions (SHSE:603236) |

50.86 CNY |

CN¥96.89 |

47.5% |

Click here to see the full list of 102 stocks from our Undervalued China Stocks Based on Cash Flows screener.

Here’s a quick look at some of the choices from the screener.

Overview: Ningxia Baofeng Energy Group Co., Ltd. is a Chinese company engaged in the production and sale of coal mining, coal washing, coal coking, coal tar, crude benzene, C4 deep processing products, methanol and olefins, with a market capitalization of approximately CNY 128.72 billion.

Operations: The company generates revenues in various segments, including coal mining, coal washing, coking, and the production and sale of coal tar, crude benzene, C4 deep processing products, methanol and olefins.

Estimated discount to fair value: 38%

Ningxia Baofeng Energy Group is showing solid financial performance, with revenues up CNY8.23 billion in the first quarter. Although the company is trading 38% below estimated fair value and showing promising revenue growth of 26.4% annually, concerns remain due to high debt and dividends that are not well covered by free cash flows. Analysts are forecasting significant earnings growth over the next three years, which could potentially increase the company’s attractiveness as an undervalued stock based on cash flows in the Chinese market.

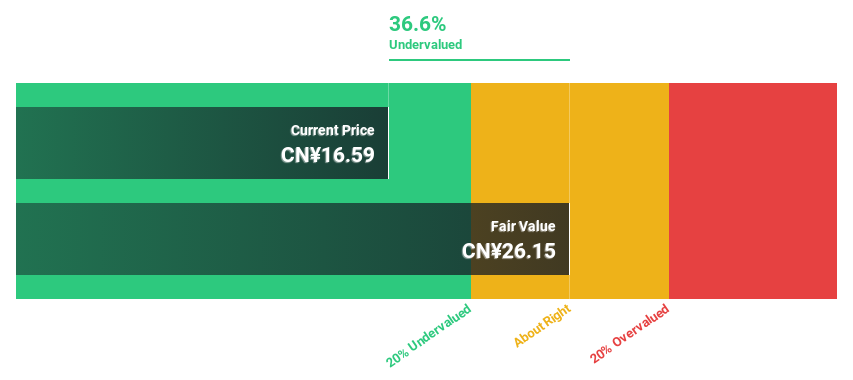

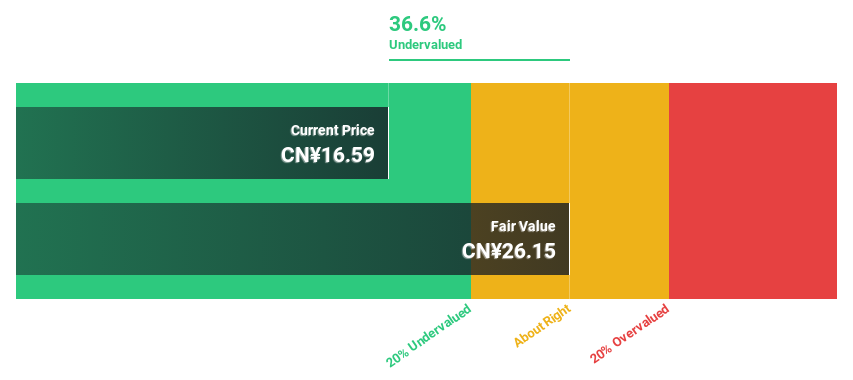

Overview: Ningbo Jifeng Auto Parts Co., Ltd. specializes in the manufacture of auto interior parts in China and has a market capitalization of approximately 14.49 billion Chinese yen.

Operations: The company generates its revenue from the production of car interior parts.

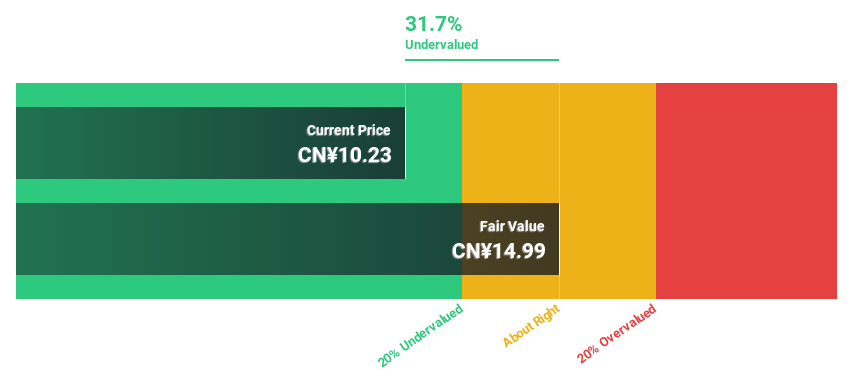

Estimated discount to fair value: 27.2%

Ningbo Jifeng Auto Parts, which has recently been involved in significant M&A activity and sold shares for significant sums, is showing a mixed financial picture. While the stock is trading 27.2% below estimated fair value and annual earnings growth of 59.6% is expected, there are concerns as interest payments are barely covered by earnings. Despite these challenges, the company’s revenue growth forecast is outperforming the broader Chinese market, suggesting potential at current valuations based on cash flows.

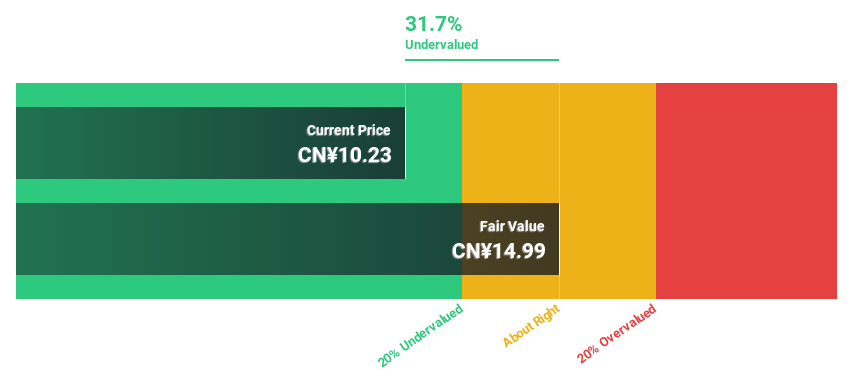

Overview: Hunan Jiudian Pharmaceutical Co., Ltd. is a company engaged in the research, development, manufacture and sale of pharmaceutical products at home and abroad, with a market capitalization of approximately 13.43 billion Chinese yen.

Operations: The company generates its revenue primarily from its pharmaceutical manufacturing business, which amounts to CNY 2.78 billion.

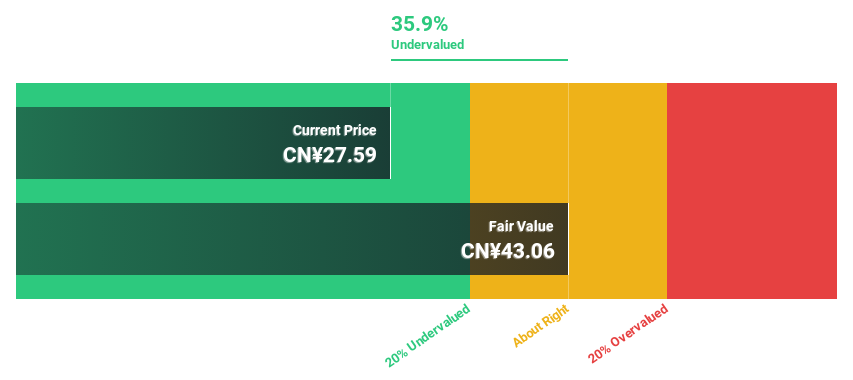

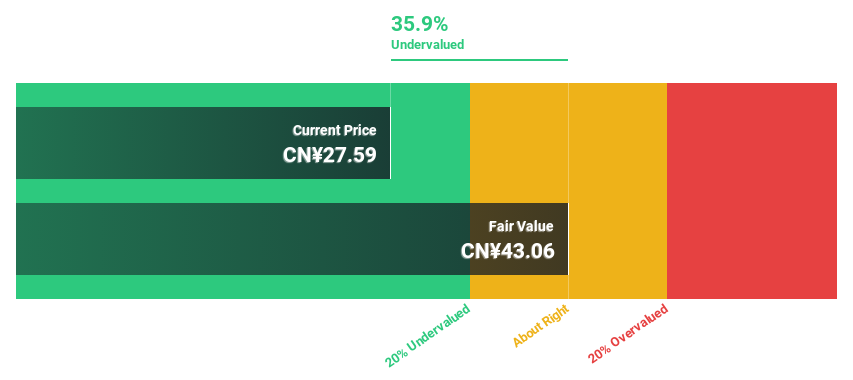

Estimated discount to fair value: 40.2%

Hunan Jiudian Pharmaceutical is trading at a share price of CNY27.61, well below its estimated fair value of CNY46.17, suggesting a potential undervaluation based on cash flows. Despite a slower revenue growth forecast compared to some market averages (17.2% per year), the company’s earnings are expected to grow at a robust 27.2% annually. Recent events include a stock split and a dividend increase, suggesting management confidence given the strong earnings growth of 43.5% in the past. However, the dividend track record remains unstable.

Summarize everything

Are you looking for alternative options?

This Simply Wall St article is of a general nature. We comment based solely on historical data and analyst forecasts, using an unbiased methodology. Our articles are not intended as financial advice. They do not constitute a recommendation to buy or sell stocks and do not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.

The companies discussed in this article include SHSE:600989, SHSE:603997 and SZSE:300705.

Do you have feedback on this article? Are you interested in the content? Contact us directly. Alternatively, send an email to [email protected]