The three largest ASX stocks are expected to trade below their intrinsic value in July 2024

Amid a turbulent week that saw the ASX200 pare gains and close lower, investors are facing a challenging environment marked by industry-wide declines and volatile commodity prices. In such an environment, identifying stocks that appear undervalued relative to their intrinsic value could present potential opportunities for sophisticated investors looking to navigate these uncertain market conditions.

The 10 most undervalued stocks in Australia based on cash flows

| Surname | Current price | Fair value (estimated) | Discount (estimated) |

| Fenix Resources (ASX:FEX) | 0,39 € | 0,77 € | 49.2% |

| MaxiPARTS (ASX:MXI) | 2,08 € | 3,99 € | 47.9% |

| GTN (ASX:GTN) | 0,43 € | 0,85 € | 49.4% |

| Ansell (ASX:ANN) | 26,72 € | 49,99 € | 46.6% |

| VEEM (ASX:VEE) | 1,795 € | 3,55 € | 49.4% |

| IPH (ASX:IPH) | 6,14 € | 11,83 € | 48.1% |

| hipages Group Holdings (ASX:HPG) | 1,09 € | $2.06 | 47.1% |

| Australian Clinical Laboratories (ASX:ACL) | 2,48 € | 4,70 € | 47.3% |

| Millennium Services Group (ASX:MIL) | 1,145 € | 2,24 € | 48.9% |

| MedAdvisor (ASX:MDR) | 0,54 € | 1.07 A$ | 49.6% |

Click here to see the full list of 47 stocks from our Undervalued ASX Stocks Based on Cash Flows screener.

Let’s go through some notable picks from our reviewed stocks.

Overview: Flight Centre Travel Group Limited is a travel retailer serving both the leisure and corporate sectors across various geographies including Australia, New Zealand, the Americas, Europe, the Middle East, Africa and Asia with a market capitalisation of approximately A$4.98 billion.

Operations: The company generates its revenue primarily in two segments: the leisure sector, which generated A$1.28 billion, and the corporate sector, which generated A$1.06 billion.

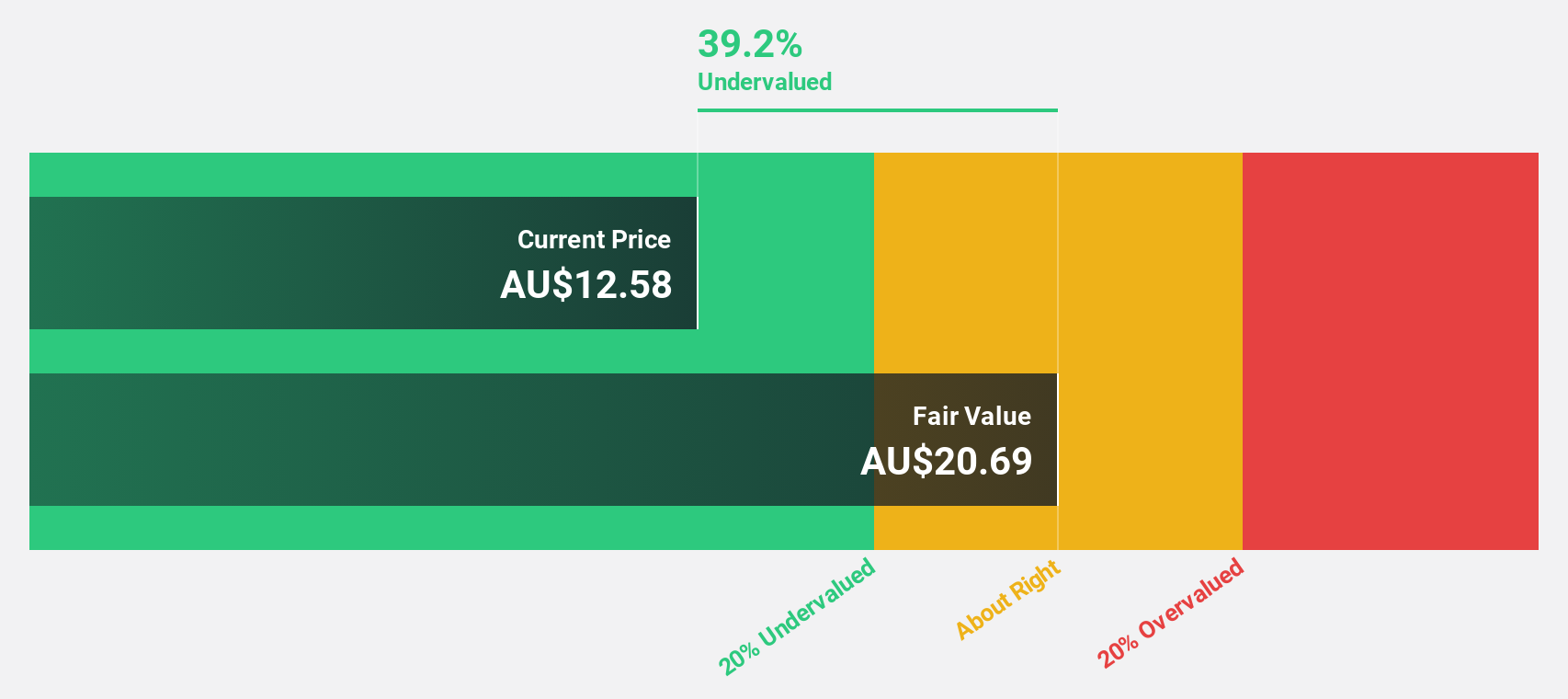

Estimated discount to fair value: 26.6%

Flight Centre Travel Group trades at A$22.66, below the estimated fair value of A$30.88, suggesting a significant undervaluation on a discounted cash flow basis. FLT, which has recently turned profitable, is expected to grow at 19.1% annually, beating the Australian market forecast of 13.5%. While revenue growth of 9.7% per year is also above the national average of 5.6%, it falls short of the 20%+ growth mark.

Overview: James Hardie Industries plc specializes in the manufacture and distribution of fiber cement, fiber gypsum and cementitious building products for various building construction applications and primarily serves markets in the United States, Australia, Europe, New Zealand and the Philippines. The company has a market capitalization of 23.18 billion Australian dollars.

Operations: The company’s revenue is generated in three main segments: Building Products in Europe at $482.10 million, Fiber Cement in Asia Pacific at $562.80 million and Fiber Cement in North America at $2.89 billion.

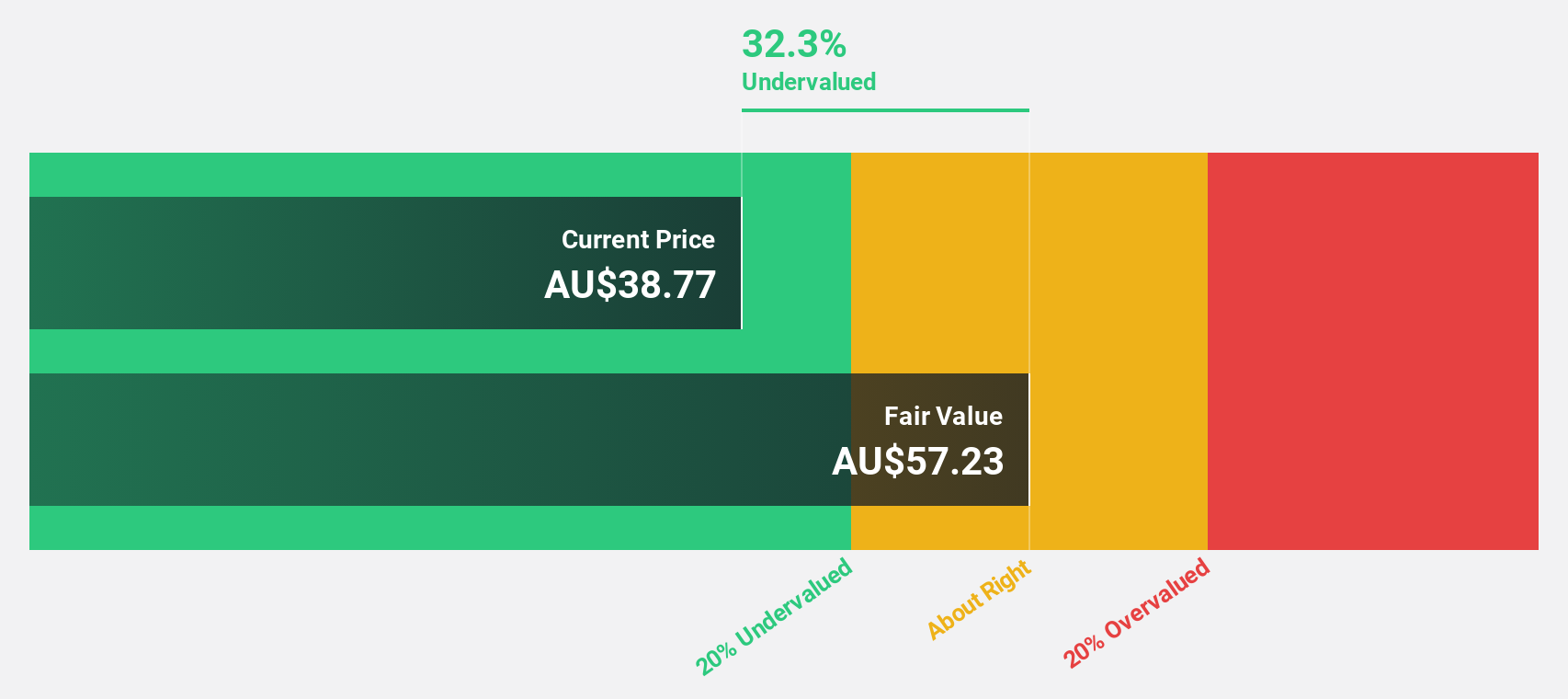

Estimated discount to fair value: 22%

James Hardie Industries, trading at A$53.73, is potentially undervalued with an estimated fair value of A$68.87. The company’s earnings and revenues are expected to outperform the Australian market with forecasts of 14% and 8% growth respectively. However, the growth rates do not exceed the high threshold of 20%. Despite this modest growth forecast, the company remains attractive due to a trading price 22% below estimated fair value and recent strategic moves such as expanding its buyback plan by A$50 million and joining the S&P/ASX 20 Index.

Overview: Webjet Limited is an online travel booking service in Australia, New Zealand, the United Arab Emirates, the United Kingdom and other international markets with a market capitalization of approximately A$3.51 billion.

Operations: The company generates total revenues of A$327.90 million and A$142.80 million in its Business to Business Travel (B2B) and Business to Consumer Travel (B2C) segments, respectively.

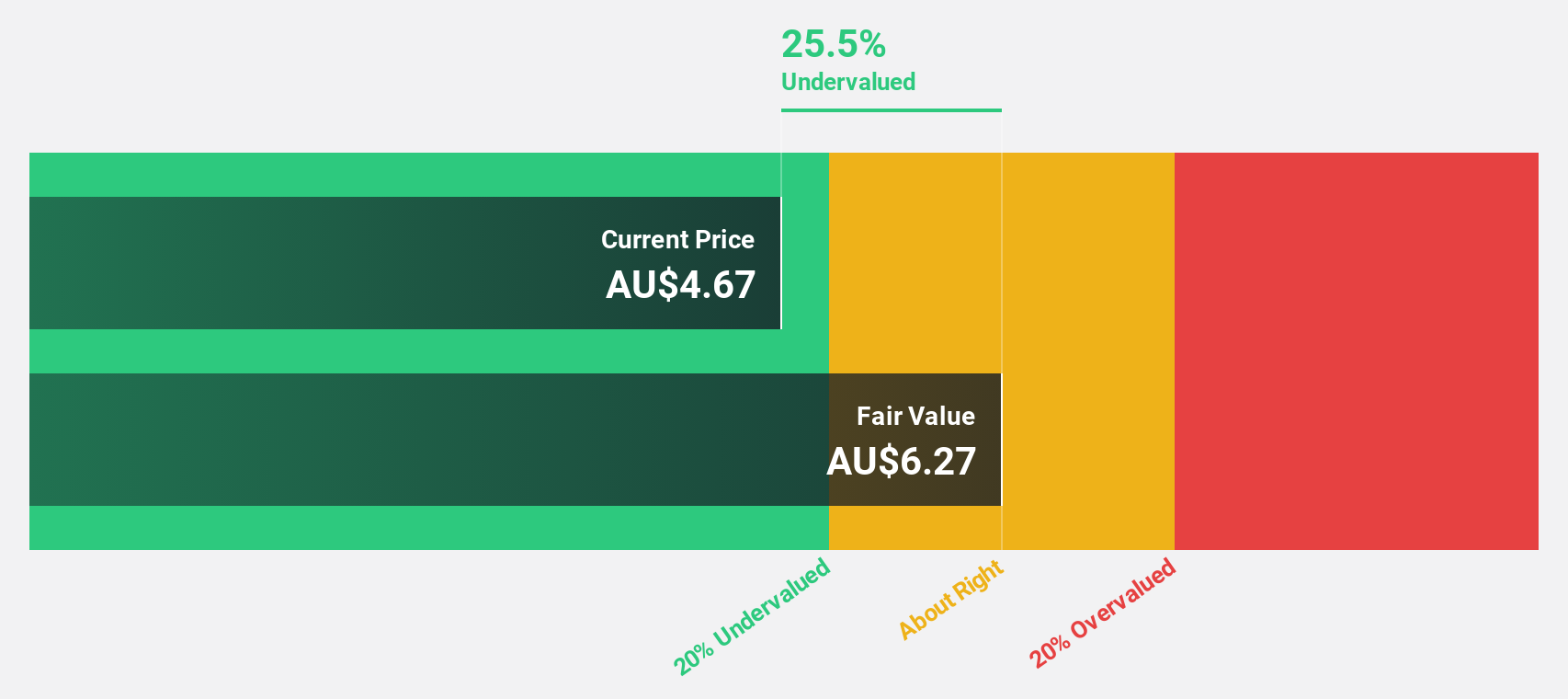

Estimated discount to fair value: 13.1%

Webjet Limited currently trades at AUD 8.97, below the estimated fair value of AUD 10.32. With revenue growth forecast at 10.6% per annum and earnings growth expected at 20.26% per annum, the company is outperforming the Australian market’s average growth rates in both areas. Despite these positive indicators and significant past earnings growth of 401.4%, Webjet’s return on equity is expected to remain low at 15.9% in three years, indicating potential concerns over future profitability efficiency as the company undergoes ongoing restructuring, including a planned spin-off to improve operational focus and market positioning.

Next Steps

Are you looking for alternative options?

This Simply Wall St article is of a general nature. We comment based solely on historical data and analyst forecasts, using an unbiased methodology. Our articles are not intended as financial advice. They do not constitute a recommendation to buy or sell stocks and do not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.

Valuation is complex, but we help simplify it.

Find out if Flight Center Travel Group may be over- or undervalued by checking our comprehensive analysis which includes Fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View free analysis

Do you have feedback on this article? Are you interested in the content? Contact us directly. Alternatively, send an email to [email protected]