How we use the (HNW) price action to our advantage

Longer-term trading plans for HNW

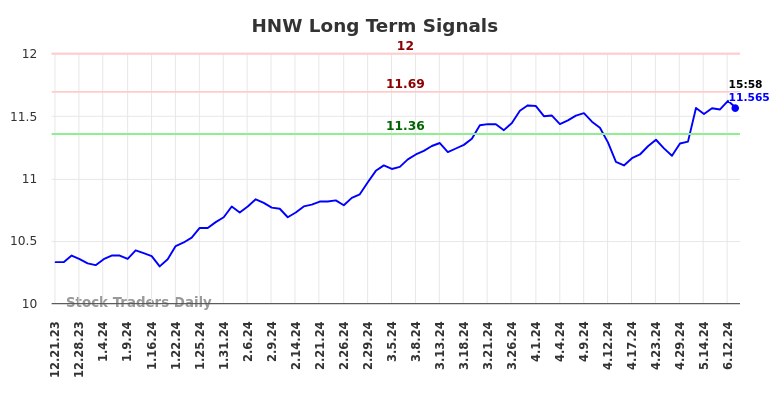

- Buy HNW just above 11.36, target 11.69, stop loss at 11.33

- Short HNW just below 11.69, target 11.36, stop loss at 11.72

Swing Trading Plans for HNW

- Buy HNW just above 11.69, target nz, stop loss at 11.66

- Short HNW just near 11.69, target 11.36, stop loss at 11.72.

Day trading plans for HNW

- Buy HNW just above 11.69, target 12, stop loss at 11.66

- Short HNW just near 11.69, target 11.36, stop loss at 11.72.

Check the timestamp of this data. Updated AI-generated signals for Pioneer Diversified High Income Fund Inc. (HNW) available here: HNW.

HNW ratings for June 22:

| Term → | Vicinity | center |

Long |

|---|---|---|---|

| reviews | Neutral | Neutral | Strong |

| 1st place | 0 | 0 | 11.36 |

| place 2 | 11.58 | 11.64 | 11.69 |

| place 3 | 0 | 12 |

AI-generated signals for HNW

Blue = Current price

Red = resistance

Green = support

Real-time updates for institutional readers who read regularly:

Instructions:

-

Click the “Get real-time updates” button below.

-

At the login prompt, select “Forgot username?”

-

Enter the email address you use for Factset

-

Log in with the username/password you received.

-

You have access to real-time updates 24/7.

Click the “Get real-time updates” button below.

At the login prompt, select “Forgot username?”

Enter the email address you use for Factset

Log in with the username/password you received.

You have access to real-time updates 24/7.

From then on, you can get the real-time update at any time with a single click.

GET REAL-TIME UPDATES

Our leading indicator for a market crash isEvitar Corte.

-

Evitar Corte has warned of the risk of a market crash four times since 2000.

-

The Internet debacle was recognized before it happened.

-

The credit crisis was identified before it occurred.

-

The Corona crash was also recognized in this way.

-

See what Evitar Corte says now.

Get notified when our ratings change:Try it

Our task as #Investors is to pay attention to the #stocks we own. Part of that is looking at the #fundamentals, but half of the disclosure comes from looking at price action. The Pioneer Diversified High Income Fund Inc. The data table (NYSE:HNW) below can help you with the price action and we also have more details. Trading plans for HNW are also displayed here; these plans are updated in real-time for subscribers, this report is static. If you want an update or report on another stock, you can get it here: Unlimited Real-Time Reports.

Fundamental charts for HNW: