Why has inflation remained the same and what is the “Taylor-Swift effect”?

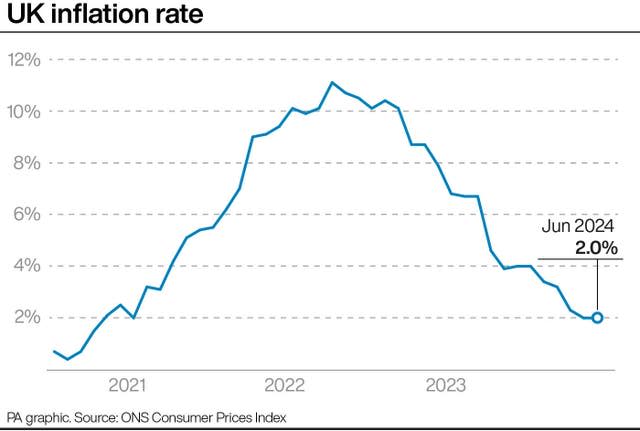

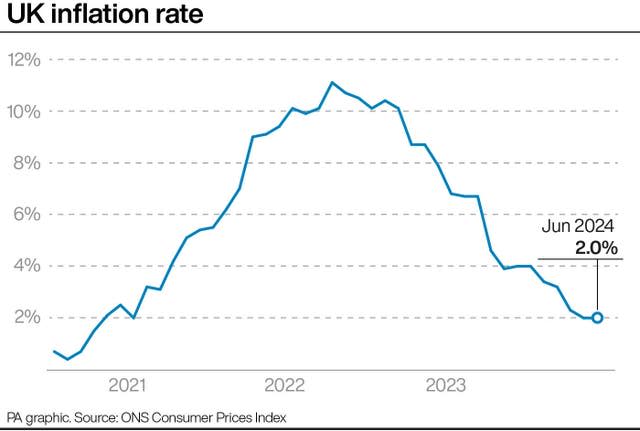

Inflation in the UK remained at 2 percent last month, new official figures show.

This means that the key interest rate has been at the target rate set by the government and the Bank of England for the second month in a row.

Here the PA news agency examines what the latest inflation data means for households and the economy.

– What is inflation?

Inflation is the increase in the prices of goods and services.

The inflation rate indicates how quickly prices are rising.

June’s inflation rate of 2% means that an item that cost £100 a year ago would cost £102 today.

It is unchanged from the inflation rate in May, meaning that prices are rising at the same pace as in the previous month.

– Does this mean that the price increase has stopped?

No, prices across the country are still rising, just much slower than before.

But the government does not want prices to fall. It has set the British central bank, the Bank of England, the target of keeping the inflation rate at two percent.

This is the ideal amount to help individuals and companies plan their expenses and keep price increases low and stable, it says.

– Has anything become cheaper?

Yes, some items have fallen in price. Prices for clothing and shoes have fallen in June compared to May, with sales in stores helping to reduce costs. Some food prices have also fallen in the last month, such as fish, milk, cheese and eggs. Electricity prices have also fallen sharply compared to last year.

However, other things have become more expensive. In particular, prices for restaurants and hotels rose by 6.2 percent in June, and the cost of a hotel room rose by almost 9 percent.

Prices for package holidays also rose sharply last month, while prices for cinema, theatre and concerts continued to rise.

– Is it true that Taylor Swift’s tour is behind it?

Some economists suspect that the “Taylor Swift effect” caused hotels and restaurants to raise their prices more than usual during the month.

The singer toured sold-out arenas in cities across the UK in June – Cardiff, Edinburgh, Liverpool and London – which led to her fans spending more on overnight stays.

Sanjay Raja, Deutsche Bank’s chief UK economist, said it was “quite possible that some Taylor Swift effects were at play in the ‘stunning’ rise in hotel room prices.”

Laura Suter, director of personal finance at AJ Bell, said: “Bank of England policymakers may be cursing Taylor Swift as her fans’ spending on hotel rooms and restaurants during her Eras tour is likely to be a reason for price rises in June, meaning headline inflation stagnated at 2% rather than falling.”

However, due to the date on which the ONS collects its data – in this case on or around 11 June – it is difficult to determine how much influence individual events have on the monthly data.

– Does achieving the inflation target mean that the Bank of England can cut interest rates?

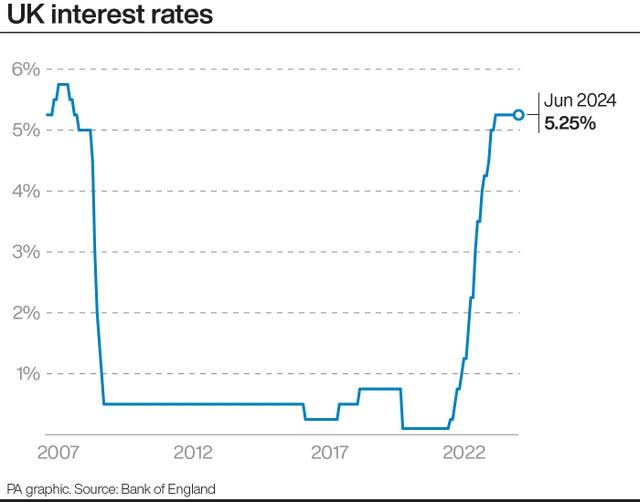

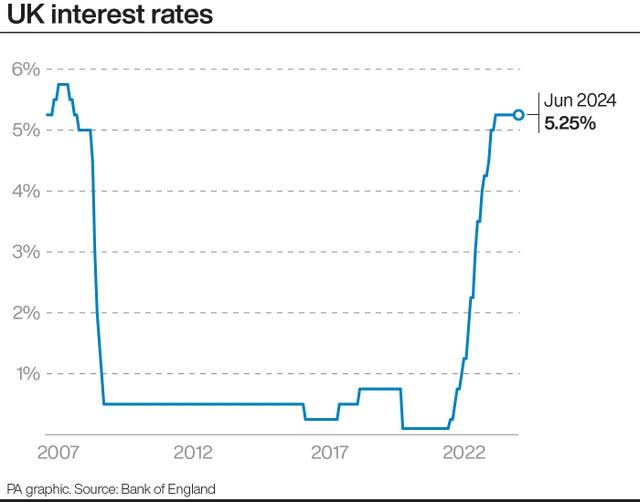

The Bank of England uses interest rates as a tool to control inflation.

Interest rates currently stand at 5.25% and have been maintained at this level since August last year.

The fact that the inflation rate has reached its target for two months in a row is good news for the Bank’s policymakers.

However, experts stressed that they would rather look at the finer details of the inflation data than the overall rate.

In particular, inflation in the services sector – which only includes service-related categories such as hospitality, culture and housing – remained higher than expected last month.

Ms Suter said: “This stubborn element of inflation is a major concern for the Bank and even a small decline in the right direction would have provided more confidence that now is the right time to cut interest rates.”

Luke Bartholomew, deputy chief economist at Abrdn, said the bank’s next decision in August was on a knife edge following the latest inflation data.