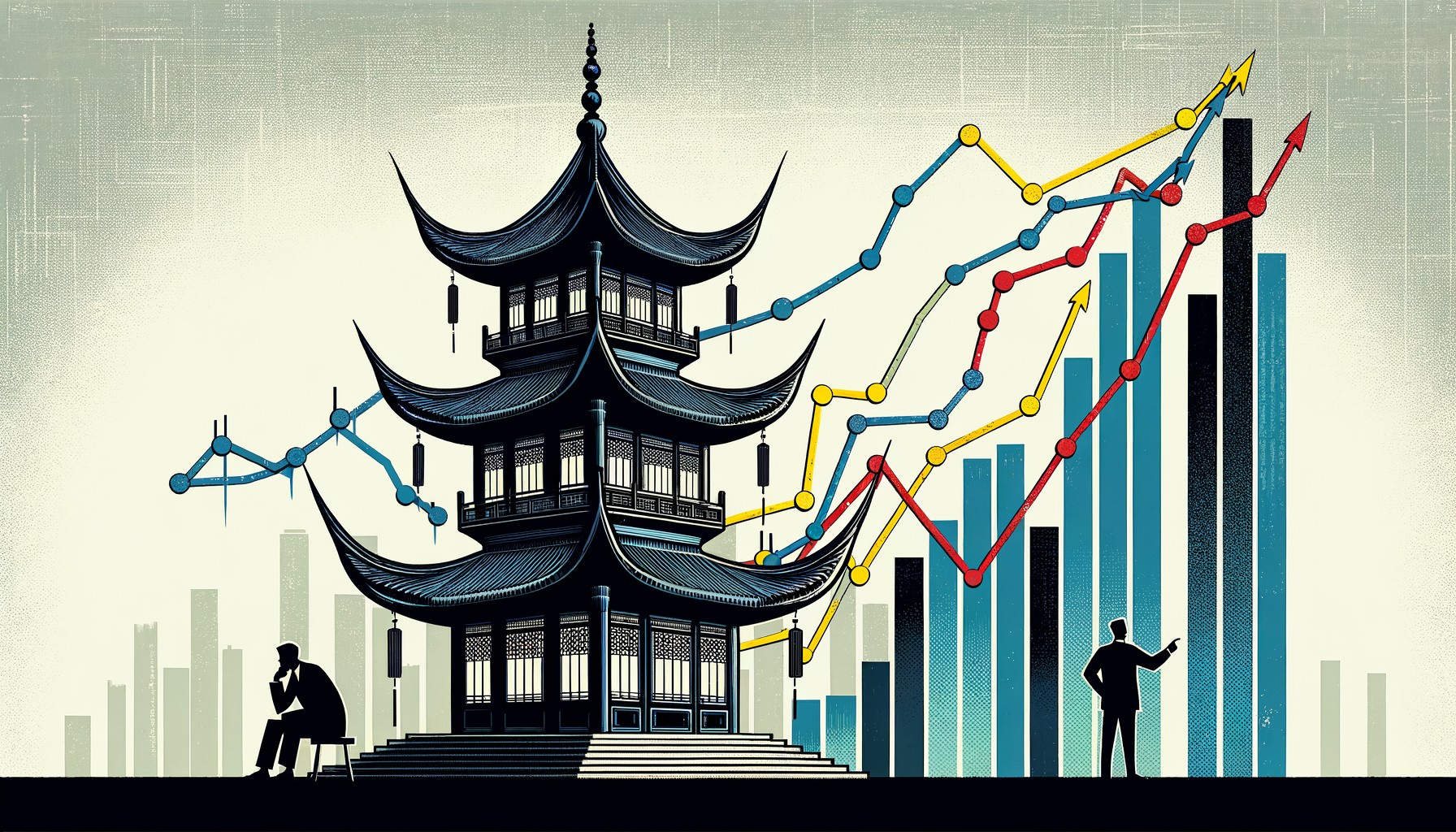

China’s economic recovery threatens to slow, investors look for value opportunities

What’s going on here?

China’s economic recovery is losing momentum, according to recent reports, with slower growth and cautious consumer despite market optimism.

What does that mean?

China’s growth figures for the second quarter fell short of forecasts, underscoring the country’s sluggish recovery. The real estate sector remains weak and consumer spending remains subdued, causing the economy to miss its targets. This uncertainty is reflected in the share Market that has seen only a modest increase of just over 1% this year. According to senior managing director of Rayliant Global Advisors, a value investing approach that encourages investment in undervalued stocks with high profit potential could be beneficial.

Why should I care?

For markets: In search of values in the fast lane.

Global indices such as the S&P 500, Nikkei and Sensex are trading higher price-to-earnings ratios, while Chinese equities appear to be undervalued, particularly in the technology and manufacturing sectors. The CSI300’s flat performance between 3,400 and 3,500 and the Shanghai Composite Index’s decline of over 6% from May highs show a market searching for direction. The North of South Capital EM Fund shows cautious optimism and focuses on undervaluation, but is conscious of macroeconomic and political risks.

The bigger picture: Slow and steady wins the race.

Geopolitical uncertainties and limited action by Chinese authorities point to a protracted recovery. Despite significant foreign investment via the Northbound Connect program, many investors remain cautious and await clearer signs of recovery. The price-to-book ratio of Chinese equities is 0.95, compared to 1.26 for the Asia-Pacific region as a whole, suggesting undervaluation and potential gains for patient investors.