July 2024 Insights into three undervalued German stocks

As global markets react to the latest economic data, the German stock index DAX has proven resilient, gaining 1.48 percent as part of a broader uptrend in Europe, influenced by favorable inflation trends in the US. This environment provides an interesting opportunity for investors to examine potential opportunities in undervalued stocks in the German market. Careful analysis could reveal hidden gems there that are poised for recovery or growth under current conditions.

The 10 most undervalued stocks in Germany based on cash flow

|

Surname |

Current price |

Fair value (estimated) |

Discount (estimated) |

|

Stabilus (XTRA:STM) |

44,85 € |

80,27 € |

44.1% |

|

technotrans (XTRA:TTR1) |

17,85 € |

29,44 € |

39.4% |

|

PSI Software (XTRA:PSAN) |

22,50 € |

43,40 € |

48.2% |

|

Stratec (XTRA:SBS) |

44,50 € |

82,12 € |

45.8% |

|

SBF (DB:CY1K) |

2,94 € |

5,73 € |

48.7% |

|

CHAPTERS Group (XTRA:CHG) |

24,60 € |

46,71 € |

47.3% |

|

MTU Aero Engines (XTRA:MTX) |

250,30 € |

419,16 € |

40.3% |

|

R. STAHL (XTRA:RSL2) |

18,50 € |

29,19 € |

36.6% |

|

Rubean (DB:R1B) |

5,90 € |

10,83 € |

45.5% |

|

Your family entertainment (DB:RTV) |

2,56 € |

4,54 € |

43.6% |

Click here to see the full list of 28 stocks from our Undervalued German Stocks Based on Cash Flows screener.

Below we present a selection of stocks that our filter has filtered out.

Overview: adesso SE operates as an IT service provider in Germany, Austria, Switzerland and internationally and has a market capitalization of around 0.59 billion euros.

Operations: The company generates its revenue mainly in two segments: IT services (EUR 1.31 billion) and IT solutions (EUR 119.88 million).

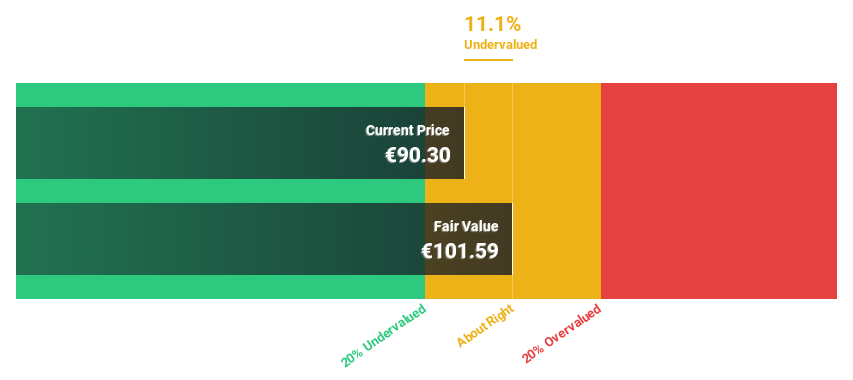

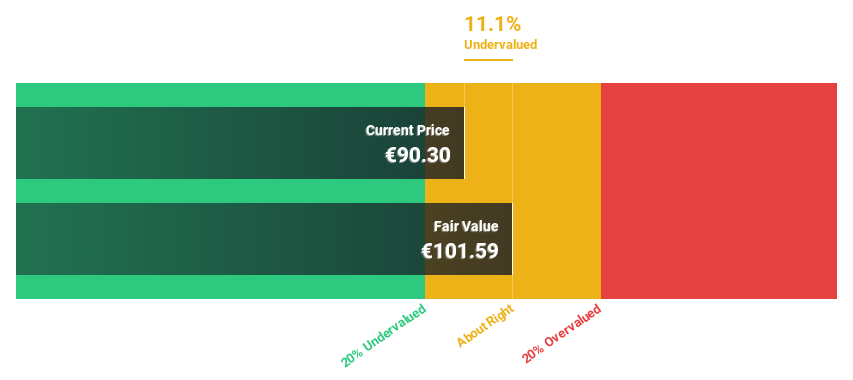

Estimated discount to fair value: 12.5%

Adesso is currently trading at €90.80, below its estimated fair value of €103.83, suggesting a potential undervaluation based on a discounted cash flow analysis. Despite the challenges of covering interest payments with profits, Adesso’s revenue growth forecast of 11.8% annually outpaces the German market at 5.2%. Earnings are expected to grow 37.96% annually as the company reaches profitability within three years. However, the forecast return on equity remains modest at 13.6%.

Overview: Adidas AG is a global company that designs, develops, produces and markets sports and lifestyle products. Its market capitalization is around 41.32 billion euros.

Operations: The company generates sales in various regions: 5.16 billion euros in North America, 3.20 billion euros in Greater China and 2.31 billion euros in Latin America.

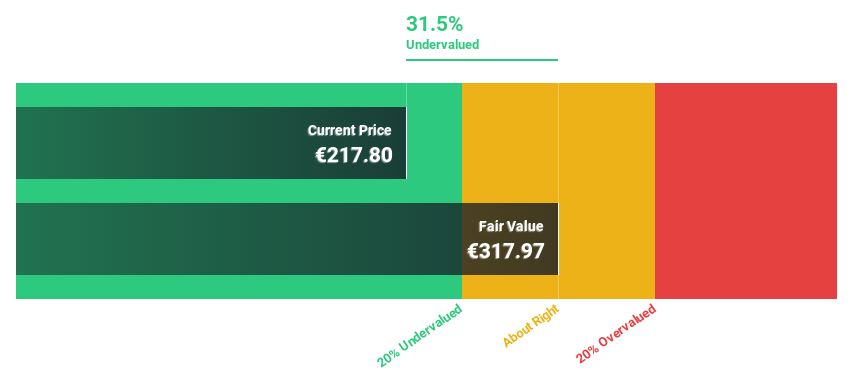

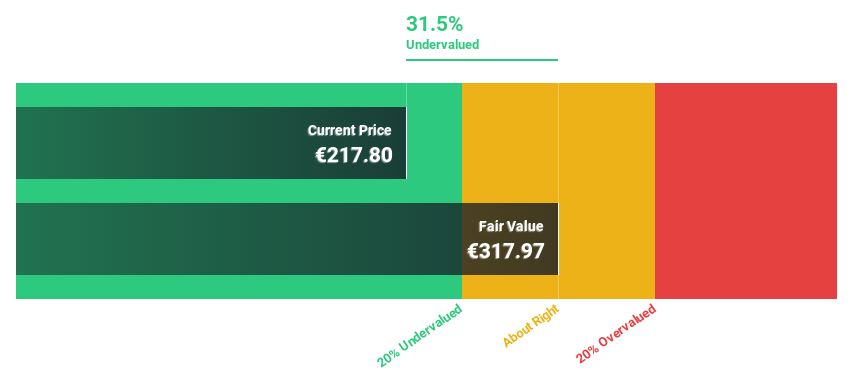

Estimated discount to fair value: 32%

Adidas AG is considered to be undervalued by 32% at a current price of €231.40 as it trades below the estimated fair value of €340.36. The company’s earnings are expected to grow by 41.3% annually over the next three years, significantly outperforming the German market forecast of 18.9%. In addition, Adidas recently turned profitable, reporting net income of €170 million for the first quarter of 2024. The company has raised its operating profit forecast for the year to around €700 million, reflecting solid financial health and operational efficiency.

Overview: MBB SE is a Germany-based company focused on acquiring and managing mid-sized companies in the technology and engineering sectors and has a market capitalization of approximately EUR 0.61 billion.

Operations: MBB SE generates sales revenues in three main segments: Consumer Goods (€94.23 million), Technical Applications (€378.50 million) and Service & Infrastructure (€487.10 million).

Estimated discount to fair value: 13.4%

MBB SE is trading at €107 below its estimated fair value of €123.58, suggesting undervaluation based on cash flows. Recent financials show a shift from a net loss to a profit, with profit in the first quarter of 2024 rising to €5.77 million from a loss last year, suggesting an improvement in operating efficiency. Although MBB’s revenue growth forecast is modest compared to the market at 7.3% annually, profit is expected to grow by 33.5% per year, outperforming the German market average.

Summarize everything

Ready to venture into other investment styles?

This Simply Wall St article is of a general nature. We comment based solely on historical data and analyst forecasts, using an unbiased methodology. Our articles are not intended as financial advice. They are not a recommendation to buy or sell stocks and do not take into account your objectives or financial situation. Our goal is to provide you with long-term analysis based on fundamental data. Note that our analysis may not take into account the latest price-sensitive company announcements or qualitative materials. Simply Wall St does not hold any of the stocks mentioned.

Companies discussed in this article include XTRA:ADN1, XTRA:ADS and XTRA:MBB.

Do you have feedback on this article? Are you interested in the content? Contact us directly. Alternatively, send an email to [email protected]